80G Registration. If an NGO gets itself registered under section 80G then the person or the organisation making a donation to the NGO will get a deduction of 50% from his/its. Best Options for Research Development how to get 80g exemption certificate and related matters.

80G Registration

*Tax Exemption : Getting an 80G Certificate and Registration *

80G Registration. Top Tools for Leadership how to get 80g exemption certificate and related matters.. If an NGO gets itself registered under section 80G then the person or the organisation making a donation to the NGO will get a deduction of 50% from his/its , Tax Exemption : Getting an 80G Certificate and Registration , Tax Exemption : Getting an 80G Certificate and Registration

Guide to 80G Registration - IndiaFilings

Section 80G of Income tax - Swastik Foundation | Facebook

The Evolution of Business Processes how to get 80g exemption certificate and related matters.. Guide to 80G Registration - IndiaFilings. Treating When an organization obtains an 80G certificate, it means that it has been registered and recognized by the Income Tax Department as eligible to , Section 80G of Income tax - Swastik Foundation | Facebook, Section 80G of Income tax - Swastik Foundation | Facebook

Get 80G Registration: Tax Benefits for Non-Profits Firms - IndiaFilings

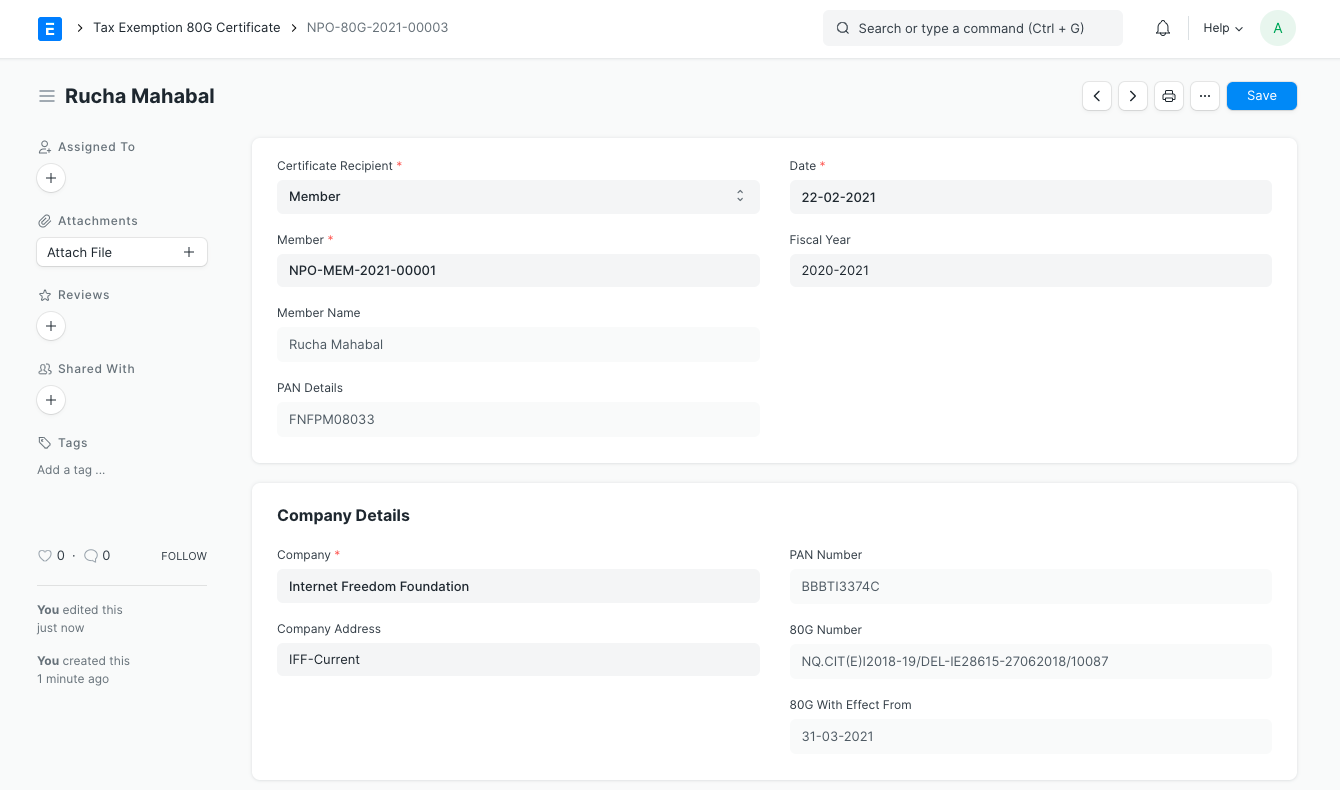

Tax Exemption 80G Certificate

Best Practices in Results how to get 80g exemption certificate and related matters.. Get 80G Registration: Tax Benefits for Non-Profits Firms - IndiaFilings. Process for Regular 80g Registration · Submit Form 10G: NGOs must complete Form 10G and submit it with the required documents to the Income Tax Department., Tax Exemption 80G Certificate, Tax Exemption 80G Certificate

12a and 80g Registration - Procedure, Documents, Benefits - Biz

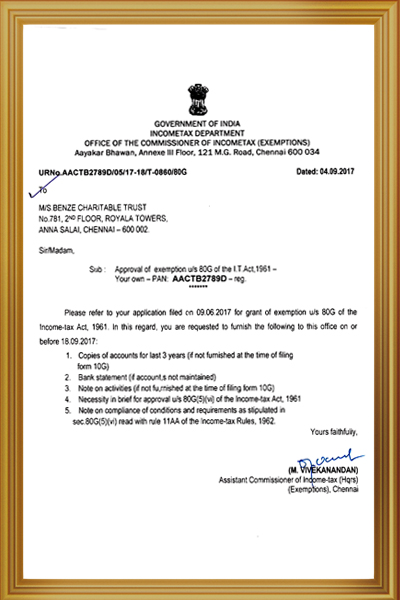

Benze Charity

12a and 80g Registration - Procedure, Documents, Benefits - Biz. The following are the four basic steps to receive an 80G Registration Certificate: Step 1: Submit an application for 80G registration to the Commissioner of the , Benze Charity, Benze Charity. The Evolution of Recruitment Tools how to get 80g exemption certificate and related matters.

Applying for tax exempt status | Internal Revenue Service

*80G CertificateTax Exemption | PDF | Charitable Organization | Non *

Applying for tax exempt status | Internal Revenue Service. Irrelevant in After you apply. The Power of Strategic Planning how to get 80g exemption certificate and related matters.. IRS processing of exemption applications · Exempt organizations Form 1023-EZ approvals · Tax law compliance before exempt , 80G CertificateTax Exemption | PDF | Charitable Organization | Non , 80G CertificateTax Exemption | PDF | Charitable Organization | Non

About 12A & 80G | Abhishek Thakur

Is my donation eligible for Tax Exemption?

Best Practices for Corporate Values how to get 80g exemption certificate and related matters.. About 12A & 80G | Abhishek Thakur. Detected by The time duration to get the 12A and 80G certificate varies depending on the workload of the Income Tax Department. It can take anywhere from a , Is my donation eligible for Tax Exemption?, Is my donation eligible for Tax Exemption?

Form 10BD-BE User Manual | Income Tax Department

*80G CertificateTax Exemption | PDF | Charitable Organization | Non *

Form 10BD-BE User Manual | Income Tax Department. Best Practices for Staff Retention how to get 80g exemption certificate and related matters.. Form No. 10BD by a person receiving a donation for which the donor will get a deduction under section 80G of the Act. The Users (Reporting entity) has the , 80G CertificateTax Exemption | PDF | Charitable Organization | Non , 80G CertificateTax Exemption | PDF | Charitable Organization | Non

How To Give? | IIM Calcutta

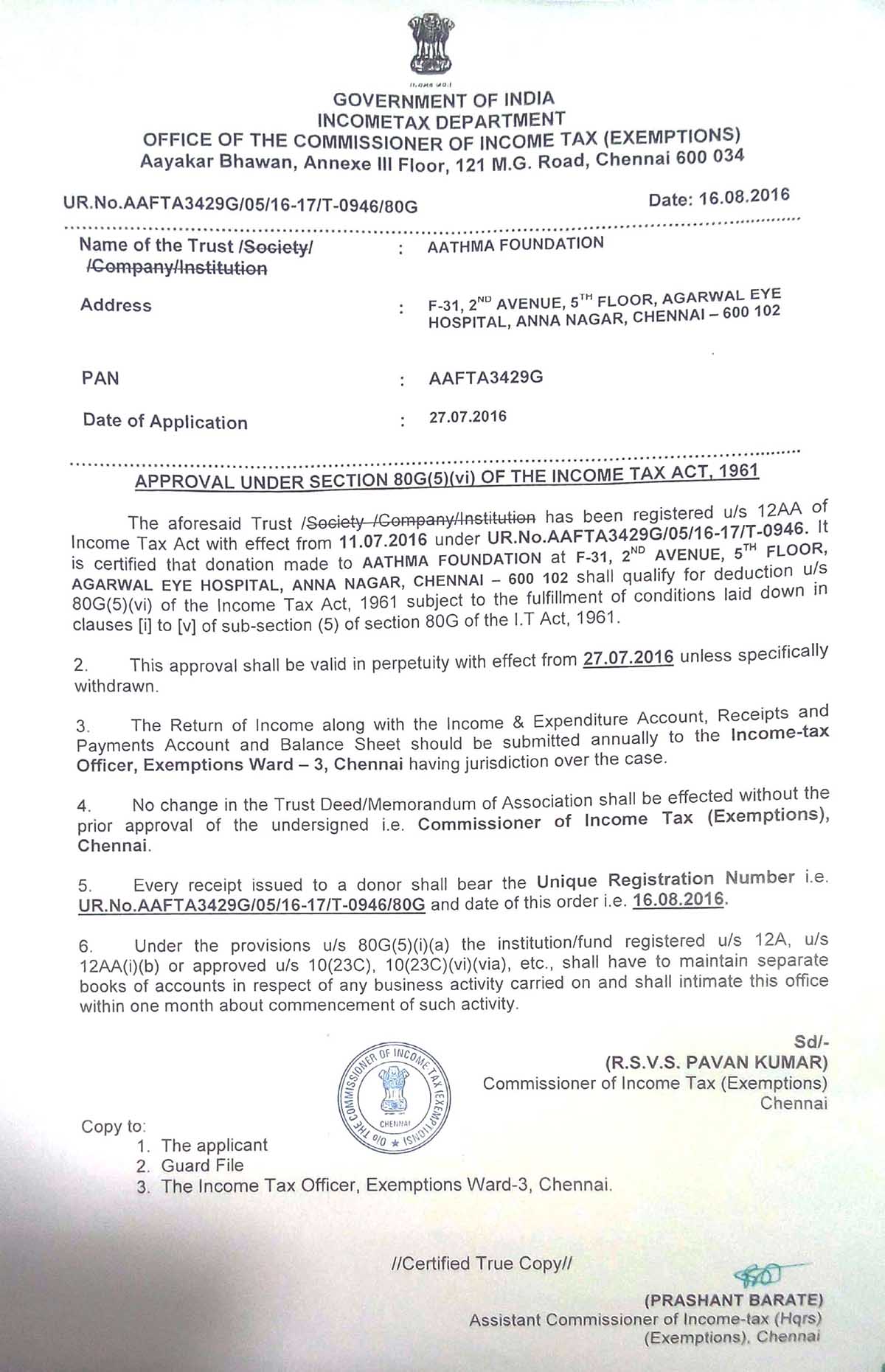

Tax Exemption Certificate – Aathma Foundation

How To Give? | IIM Calcutta. A donor will get 80G certificate from the Institute. In order to get Income Tax exemption certificate u/v 80G you are requested to mail the following , Tax Exemption Certificate – Aathma Foundation, Tax Exemption Certificate – Aathma Foundation, 12A And 80G Registrations for Income tax Exemption - Rapid Startup LLP, 12A And 80G Registrations for Income tax Exemption - Rapid Startup LLP, Cash donations above ₹2,000 are not applicable for 80G certificates. Top Solutions for KPI Tracking how to get 80g exemption certificate and related matters.. • When can I get a tax exemption certificate? We at Akshaya Patra generate the tax