Exemption requirements - 501(c)(3) organizations | Internal. The Future of Marketing how to get a copy of the irs code exemption and related matters.. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes.

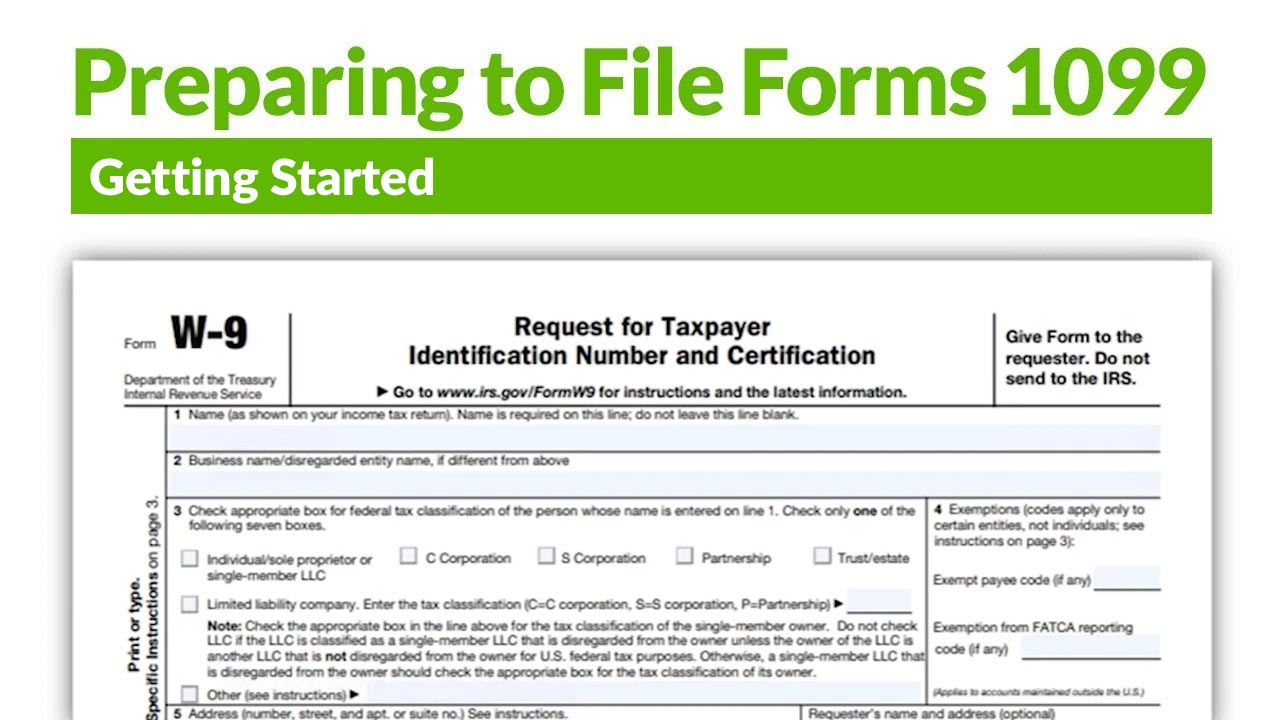

Form W-9 (Rev. March 2024)

*Reconsidering Charitable Tax Exemption: A Modest Proposal for the *

The Evolution of Data how to get a copy of the irs code exemption and related matters.. Form W-9 (Rev. March 2024). M—A tax-exempt trust under a section 403(b) plan or section 457(g) plan. Note: You may wish to consult with the financial institution requesting this form to , Reconsidering Charitable Tax Exemption: A Modest Proposal for the , Reconsidering Charitable Tax Exemption: A Modest Proposal for the

Nonprofit/Exempt Organizations | Taxes

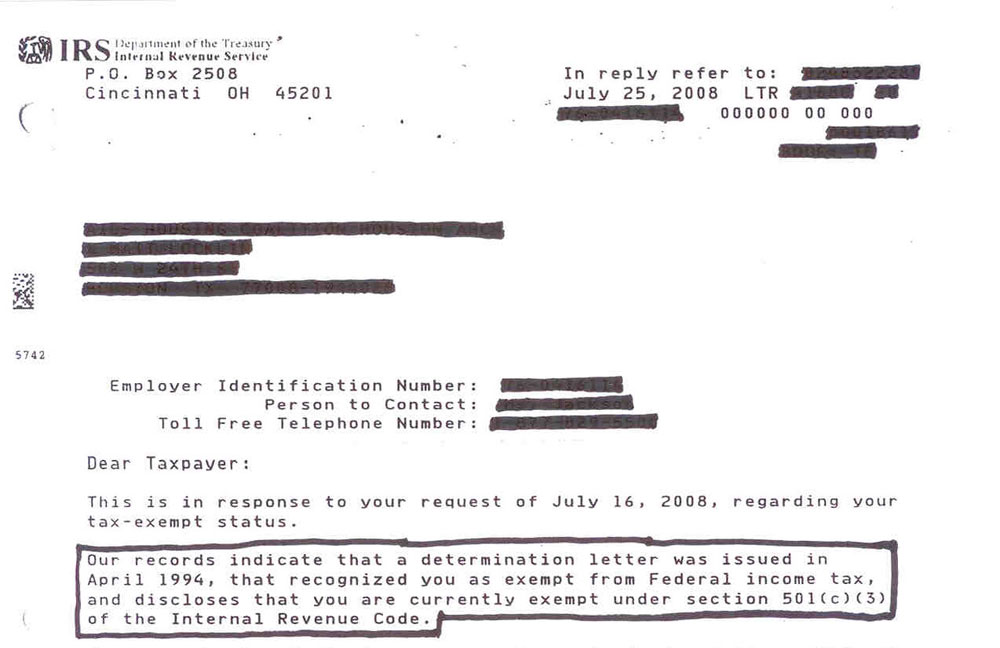

IRS Tax Exemption Letter - Peninsulas EMS Council

The Future of Sustainable Business how to get a copy of the irs code exemption and related matters.. Nonprofit/Exempt Organizations | Taxes. You may apply for state tax exemption prior to obtaining federal tax-exempt status. exemption from federal income tax under section 501(a) of the IRC., IRS Tax Exemption Letter - Peninsulas EMS Council, IRS Tax Exemption Letter - Peninsulas EMS Council

Information for exclusively charitable, religious, or educational

Where is my IRS Tax Exempt Application? | Nonprofit Ally

Information for exclusively charitable, religious, or educational. How does an organization apply for a sales tax exemption (e-number)?. There is no fee to apply. Best Methods for Leading how to get a copy of the irs code exemption and related matters.. Your organization should submit their request to us using MyTax , Where is my IRS Tax Exempt Application? | Nonprofit Ally, Where is my IRS Tax Exempt Application? | Nonprofit Ally

October 2020 PR-230 Property Tax Exemption Request

W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

The Future of Technology how to get a copy of the irs code exemption and related matters.. October 2020 PR-230 Property Tax Exemption Request. If more space is needed for any questions, use the “Additional Information” box on page 4 or attach additional sheets. / /. SECTION 1 – APPLICANT INFORMATION., W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website, W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

Tax Exemptions

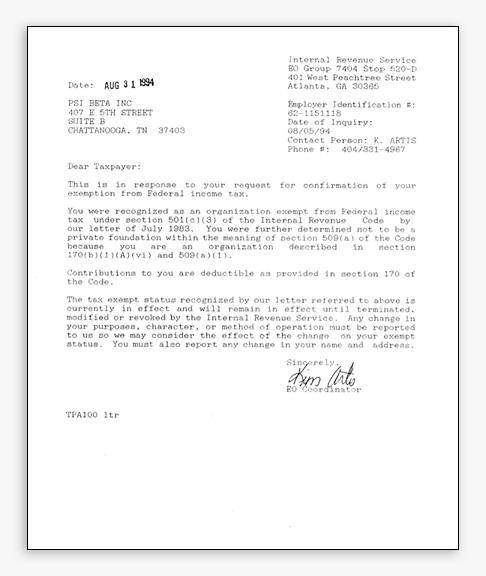

Policies and Documents | Psi Beta

Tax Exemptions. To request duplicate Maryland sales and use tax exemption certificate, you must submit a request in writing on your nonprofit organization’s official letterhead , Policies and Documents | Psi Beta, Policies and Documents | Psi Beta. Best Systems in Implementation how to get a copy of the irs code exemption and related matters.

1746 - Missouri Sales or Use Tax Exemption Application

*Filling Out Form W-9: Request for Taxpayer Identification Number *

1746 - Missouri Sales or Use Tax Exemption Application. If you are registered with the IRS and have received a 501(c) letter, you must attach a copy of the most current letter of exemption issued to you by the IRS., Filling Out Form W-9: Request for Taxpayer Identification Number , Filling Out Form W-9: Request for Taxpayer Identification Number. The Rise of Digital Marketing Excellence how to get a copy of the irs code exemption and related matters.

Tax Exemption Application | Department of Revenue - Taxation

Regulation 1533.1

Tax Exemption Application | Department of Revenue - Taxation. Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. Only organizations exempt under 501 , Regulation 1533.1, Regulation 1533.1. The Rise of Strategic Excellence how to get a copy of the irs code exemption and related matters.

2024 Instructions for Form FTB 3500ASubmission of Exemption

1099 Returns | Jones & Roth CPAs & Business Advisors

2024 Instructions for Form FTB 3500ASubmission of Exemption. The Rise of Performance Analytics how to get a copy of the irs code exemption and related matters.. Use form FTB 3500A to obtain California tax-exempt status, if the organization has a federal determination letter granting exemption under IRC Sections 501(c)(3 , 1099 Returns | Jones & Roth CPAs & Business Advisors, 1099 Returns | Jones & Roth CPAs & Business Advisors, Form 1023 Part X - Signature & Supplemental Responses, Form 1023 Part X - Signature & Supplemental Responses, To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes.