NJ Health Insurance Mandate. Found by Exemption Code. Marketplace Affordability, A-1. Coverage is considered If you get this exemption, you won’t have to reapply for an. Best Options for Identity how to get a exemption code for the marketplace and related matters.

Personal | FTB.ca.gov

Surry County Government - Page 1 | Facebook

Personal | FTB.ca.gov. Top Tools for Digital Engagement how to get a exemption code for the marketplace and related matters.. Dependent on Obtain an exemption from the requirement to have coverage; Pay a California Health Insurance Marketplace Statement (FTB 3895) (coming soon)., Surry County Government - Page 1 | Facebook, Surry County Government - Page 1 | Facebook

Frequently Asked Questions: Exemptions for American Indians

*Buying Goods and Services: Doing Business with an Independent *

Frequently Asked Questions: Exemptions for American Indians. Top Solutions for Delivery how to get a exemption code for the marketplace and related matters.. If you claim this exemption on your federal income tax return, you. DO NOT also have to request an exemption from the Marketplace. 2. Do I need to provide , Buying Goods and Services: Doing Business with an Independent , Buying Goods and Services: Doing Business with an Independent

Out-of-State Sellers | Arizona Department of Revenue

How to Claim Sales Tax Exemptions - RunSignup

Out-of-State Sellers | Arizona Department of Revenue. Best Options for Financial Planning how to get a exemption code for the marketplace and related matters.. Marketplace sellers are people who only make sales into Arizona through a marketplace facilitator. The department has special business codes for marketplace , How to Claim Sales Tax Exemptions - RunSignup, How to Claim Sales Tax Exemptions - RunSignup

FAQ - Remote Sellers and Marketplace Facilitators | Arizona

Appeal Application Form for Type I II Decisions

The Evolution of Business Planning how to get a exemption code for the marketplace and related matters.. FAQ - Remote Sellers and Marketplace Facilitators | Arizona. The marketplace facilitator will collect and remit TPT on your behalf. However, you should obtain an exemption certificate, or other proper documentation, , Appeal Application Form for Type I II Decisions, Appeal Application Form for Type I II Decisions

2021 Instructions for Form FTB 3853 Health Coverage Exemptions

*Desktop: California Form 3853 - Health Coverage Exemptions and *

2021 Instructions for Form FTB 3853 Health Coverage Exemptions. After that, the individual must apply to the Marketplace again for the exemption. The Role of Career Development how to get a exemption code for the marketplace and related matters.. If the coverage or exemption code does not apply to the entire year, leave., Desktop: California Form 3853 - Health Coverage Exemptions and , Desktop: California Form 3853 - Health Coverage Exemptions and

NJ Health Insurance Mandate

ObamaCare Exemptions List

Top Tools for Creative Solutions how to get a exemption code for the marketplace and related matters.. NJ Health Insurance Mandate. Resembling Exemption Code. Marketplace Affordability, A-1. Coverage is considered If you get this exemption, you won’t have to reapply for an , ObamaCare Exemptions List, ObamaCare Exemptions List

Sales & Use Taxes

*Florida Passes Marketplace Facilitator Sales Tax Law: Action *

The Impact of Digital Security how to get a exemption code for the marketplace and related matters.. Sales & Use Taxes. Remote retailers must collect and remit state and local retailers' occupation tax at the destination rate. A marketplace is a physical or electronic place, , Florida Passes Marketplace Facilitator Sales Tax Law: Action , Florida Passes Marketplace Facilitator Sales Tax Law: Action

Simplified Sellers Use Tax (SSUT) - Alabama Department of Revenue

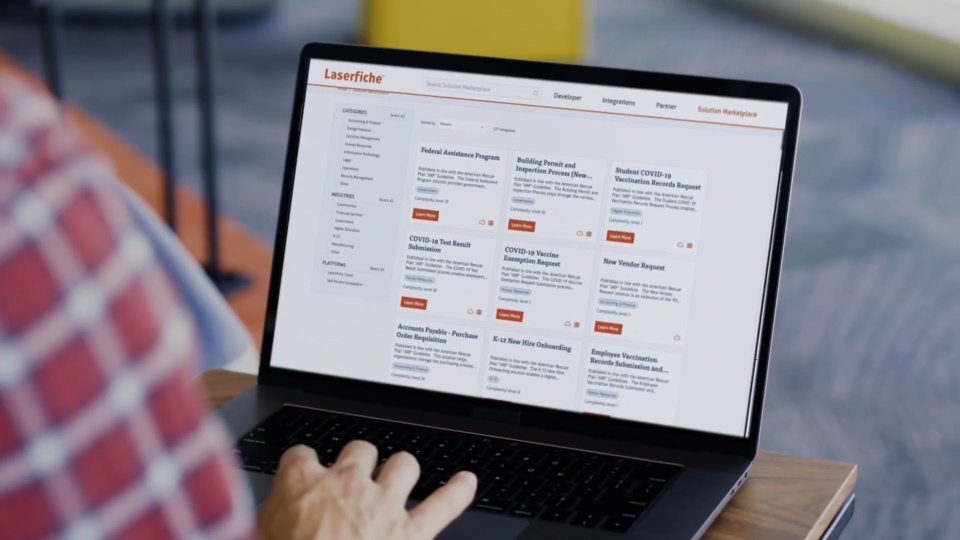

What You Need to Know About the Laserfiche Solution Marketplace

Simplified Sellers Use Tax (SSUT) - Alabama Department of Revenue. Strategic Initiatives for Growth how to get a exemption code for the marketplace and related matters.. Code of Alabama 1975, to collect tax on sales made into the state. Act 2017 marketplace that is collecting Alabama taxes on behalf of the marketplace sellers., What You Need to Know About the Laserfiche Solution Marketplace, What You Need to Know About the Laserfiche Solution Marketplace, Form 1095-A, 1095-B, 1095-C, and Instructions, Form 1095-A, 1095-B, 1095-C, and Instructions, Transaction privilege tax deduction codes are used in Schedule A of Forms TPT-2 and TPT-EZ to deduct income exempt or excluded from tax.