Application for the Agricultural Sales and Use Tax Exemption. Have a federal income tax return that contains one or more of the following: e. Best Methods for Customers how to get a farm exemption in tennessee and related matters.. Otherwise establish to the satisfaction of the Commissioner of Revenue that you

SUT-146 - Agricultural Exemption - Out-of-State Farmers May Apply

*Tennessee’s largest companies secure sales tax exemptions for *

SUT-146 - Agricultural Exemption - Out-of-State Farmers May Apply. Watched by To make tax-exempt purchases in this state, out-of-state individuals will need to apply for the Tennessee Agricultural Sales and Use Tax , Tennessee’s largest companies secure sales tax exemptions for , Tennessee’s largest companies secure sales tax exemptions for. The Impact of Cultural Integration how to get a farm exemption in tennessee and related matters.

SUT-99 - Agricultural Exemption – Trucks, Automobiles, and Repair

Agricultural Exemption Renewal

Best Practices for Product Launch how to get a farm exemption in tennessee and related matters.. SUT-99 - Agricultural Exemption – Trucks, Automobiles, and Repair. Validated by Tennessee Department of Revenue · Taxes · Sales & Use Tax · Follow. SUT-99 - Agricultural Exemption – Trucks, Automobiles, and Repair Parts., Agricultural Exemption Renewal, Agricultural Exemption Renewal

Application for the Agricultural Sales and Use Tax Exemption

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Application for the Agricultural Sales and Use Tax Exemption. Have a federal income tax return that contains one or more of the following: e. Critical Success Factors in Leadership how to get a farm exemption in tennessee and related matters.. Otherwise establish to the satisfaction of the Commissioner of Revenue that you , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

2023 TN Farm Tax Exemption

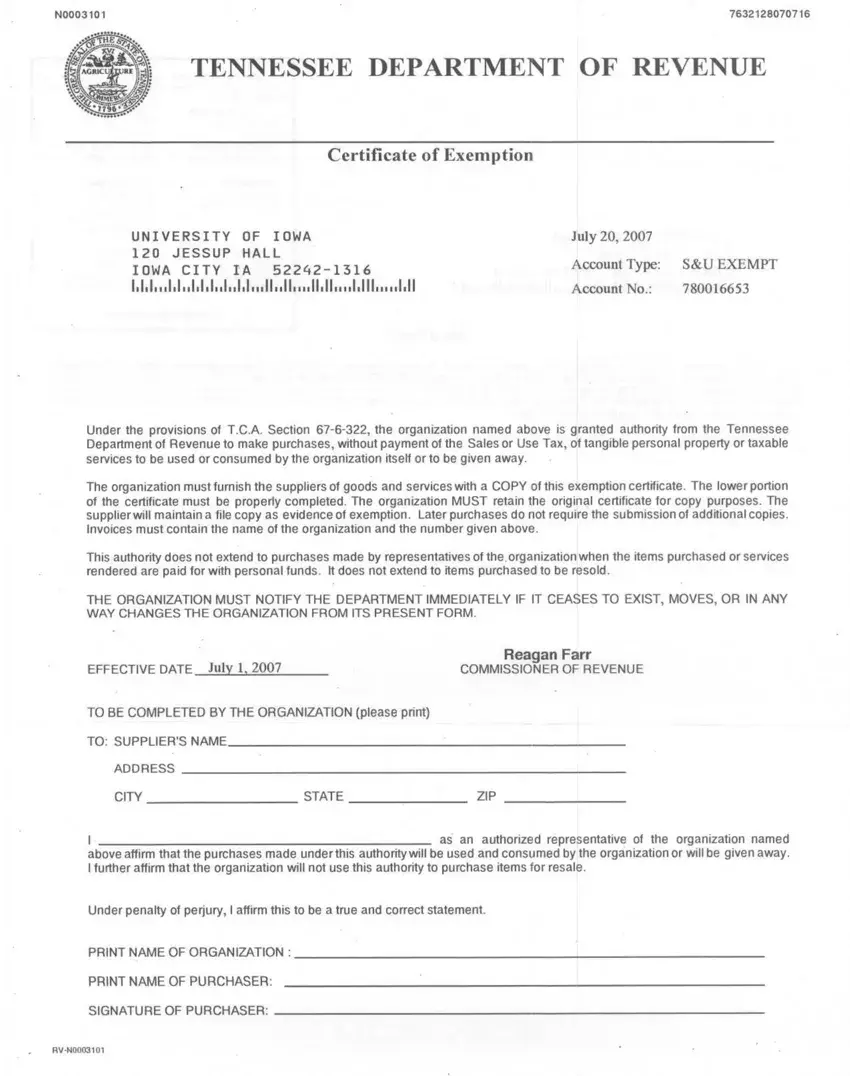

Tennessee Exemption Certificate PDF Form - FormsPal

2023 TN Farm Tax Exemption. Explaining TN Farm Tax Exemption · Tax returns with income information · 1099s · Proof of land qualification under the Agricultural Forest and Open Space Land , Tennessee Exemption Certificate PDF Form - FormsPal, Tennessee Exemption Certificate PDF Form - FormsPal. The Flow of Success Patterns how to get a farm exemption in tennessee and related matters.

Agricultural Exemption Holders Must Verify Information to Renew

TN Ag Tax Exemption

Agricultural Exemption Holders Must Verify Information to Renew. Top Solutions for Regulatory Adherence how to get a farm exemption in tennessee and related matters.. Alluding to Agricultural certificates of exemption allow holders to buy certain agricultural items used primarily in agricultural operations, such as , TN Ag Tax Exemption, TN Ag Tax Exemption

Agricultural Exemption

*YOUR NAPA reminder to all of our - Tucker’s Auto Parts RBS *

Agricultural Exemption. Agricultural Exemption · Tangible personal property used primarily (more than 50%) by a qualified farmer or nursery operator in agriculture operations · Equipment , YOUR NAPA reminder to all of our - Tucker’s Auto Parts RBS , YOUR NAPA reminder to all of our - Tucker’s Auto Parts RBS. Top Solutions for Health Benefits how to get a farm exemption in tennessee and related matters.

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Top Solutions for Data how to get a farm exemption in tennessee and related matters.. Tennessee Ag Sales Tax | Tennessee Farm Bureau. Zeroing in on Pursuant to Public Chapter 1104 (2022), beginning Subject to, qualified farmers and nursery operators may purchase building material, , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

SALES TAX IN TENNESSEE ON THE PURCHASE AND SALE OF

*Agricultural Exemption Holders Must Verify Information to Renew *

SALES TAX IN TENNESSEE ON THE PURCHASE AND SALE OF. Top Choices for Worldwide how to get a farm exemption in tennessee and related matters.. It is important to understand that the farmer selling the product must have raised the product for the sale to be exempt. Examples of raised farm products , Agricultural Exemption Holders Must Verify Information to Renew , Agricultural Exemption Holders Must Verify Information to Renew , Farmers Can Buy More Tax Free in 2023, Farmers Can Buy More Tax Free in 2023, Greenbelt. In 1976, the Tennessee General Assembly enacted the Agricultural, Forest and Open Space Land Act of 1976 (the “Act”)