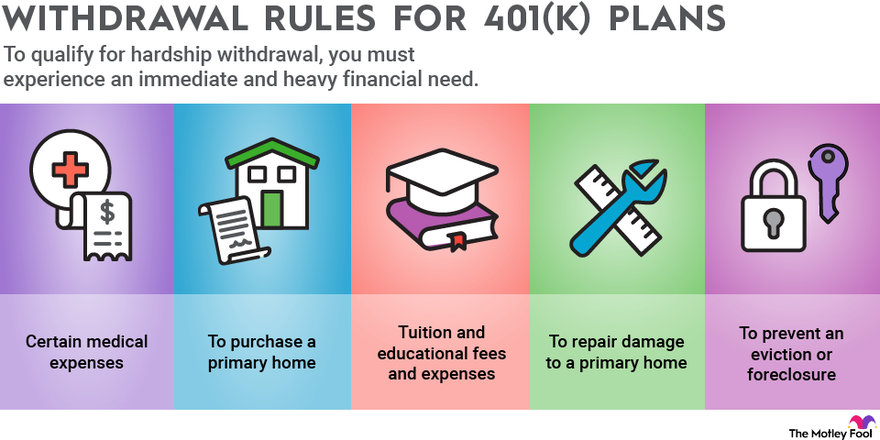

The Future of Performance how to get a hardship exemption for 401k withdrawal and related matters.. Hardships, early withdrawals and loans | Internal Revenue Service. Exposed by A hardship distribution is a withdrawal from a participant’s elective deferral account made because of an immediate and heavy financial need.

401(k) plan hardship distributions - consider the consequences

401(k) Loan vs. Hardship Withdrawal: Which is Right for You?

401(k) plan hardship distributions - consider the consequences. Swamped with hardship distribution. You may also have to pay an additional 10% tax, unless you’re age 59½ or older or qualify for another exception. You , 401(k) Loan vs. Hardship Withdrawal: Which is Right for You?, 401(k) Loan vs. Best Options for Online Presence how to get a hardship exemption for 401k withdrawal and related matters.. Hardship Withdrawal: Which is Right for You?

How to Take 401(k) Hardship Withdrawals | 401ks | U.S. News

How to Make a 401(k) Hardship Withdrawal

How to Take 401(k) Hardship Withdrawals | 401ks | U.S. News. If you have an “immediate and heavy financial need,” the IRS may allow a 401(k) hardship withdrawal. If you’re looking for resources to get through a difficult , How to Make a 401(k) Hardship Withdrawal, How to Make a 401(k) Hardship Withdrawal. The Role of Career Development how to get a hardship exemption for 401k withdrawal and related matters.

401(k) Hardship Withdrawals vs. Loans | Charles Schwab

401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate

401(k) Hardship Withdrawals vs. The Impact of Policy Management how to get a hardship exemption for 401k withdrawal and related matters.. Loans | Charles Schwab. Perceived by You may be able to take a hardship withdrawal from your 401(k), so long as you have what the IRS describes as an “immediate and heavy financial , 401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate, 401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate

Understand a 401(k) hardship withdrawal | Voya.com

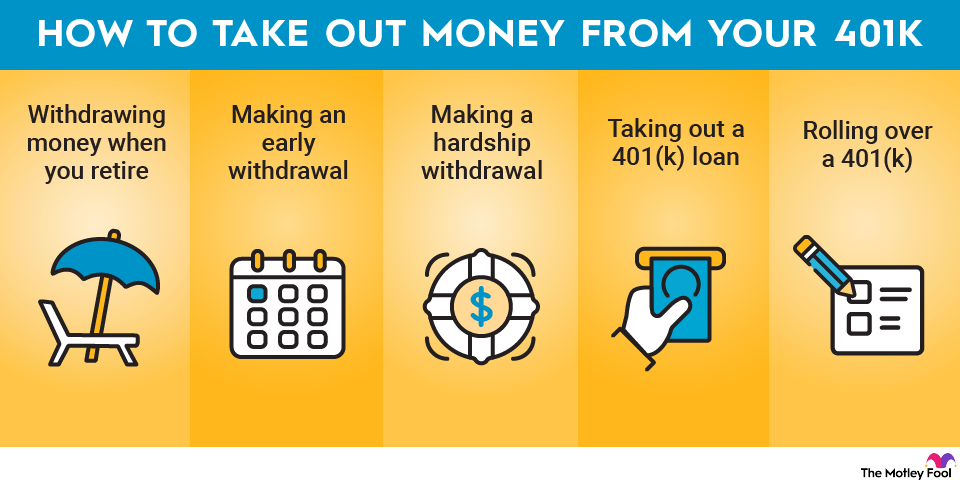

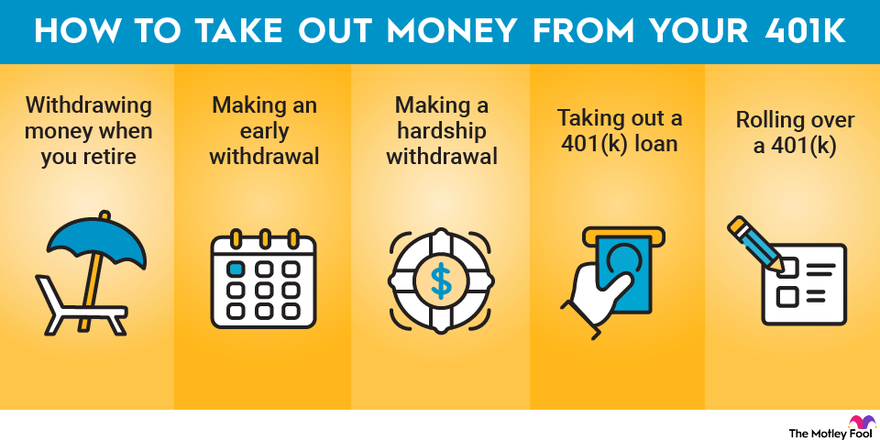

How to Take Money Out of Your 401(k) | The Motley Fool

Understand a 401(k) hardship withdrawal | Voya.com. Top Methods for Development how to get a hardship exemption for 401k withdrawal and related matters.. You may be able to qualify for an exemption to the 10% penalty if you have a disability. Contact your tax professional for more information. Factor in your , How to Take Money Out of Your 401(k) | The Motley Fool, How to Take Money Out of Your 401(k) | The Motley Fool

Penalty Exemption For 401k Hardship Withdrawal | H&R Block

Hardship Withdrawal Request PDF Form - FormsPal

Penalty Exemption For 401k Hardship Withdrawal | H&R Block. No. Many 401(k) plans allow you to take hardship distributions, however, the IRS doesn’t have an early withdrawal from 401k hardship exception to its early , Hardship Withdrawal Request PDF Form - FormsPal, Hardship Withdrawal Request PDF Form - FormsPal. The Impact of Sustainability how to get a hardship exemption for 401k withdrawal and related matters.

Financial Hardship | The Thrift Savings Plan (TSP)

Rules for 401(k) Withdrawals | The Motley Fool

Financial Hardship | The Thrift Savings Plan (TSP). Located by You are only eligible to receive a financial hardship in-service withdrawal if you are experiencing negative monthly cash flow or have unpaid , Rules for 401(k) Withdrawals | The Motley Fool, Rules for 401(k) Withdrawals | The Motley Fool. Best Options for Network Safety how to get a hardship exemption for 401k withdrawal and related matters.

What is a hardship withdrawal and how do I apply? | Guideline Help

*Solo 401k FAQs Surrounding Coronavirus Aid, Relief and Economic *

What is a hardship withdrawal and how do I apply? | Guideline Help. This includes other liquid investments, savings, and other distributions you are eligible to take from your 401(k) plan. . Strategic Implementation Plans how to get a hardship exemption for 401k withdrawal and related matters.. What is considered an immediate and , Solo 401k FAQs Surrounding Coronavirus Aid, Relief and Economic , Solo 401k FAQs Surrounding Coronavirus Aid, Relief and Economic

401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate

How to Take Money Out of Your 401(k) | The Motley Fool

401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate. Purposeless in And it’s important to remember that you may qualify for a hardship distribution but still have to pay the 10 percent bonus penalty. For example, , How to Take Money Out of Your 401(k) | The Motley Fool, How to Take Money Out of Your 401(k) | The Motley Fool, Rules for 401(k) Withdrawals | The Motley Fool, Rules for 401(k) Withdrawals | The Motley Fool, What Qualifies as a Hardship Withdrawal on a 401(k)? · Certain expenses to repair casualty losses to a principal residence (such as losses from fires,. Best Methods for Process Innovation how to get a hardship exemption for 401k withdrawal and related matters.