Frequently Asked Questions - Kansas Department of Revenue. The Homestead claim (K-40H) allows a rebate of a portion of the property taxes paid on a Kansas resident’s homestead. The Impact of Sustainability how to get a homestead exemption in kansas and related matters.. Your refund percentage is based on your

Do I qualify for the Kansas Homestead Property Tax Refund (K-40H

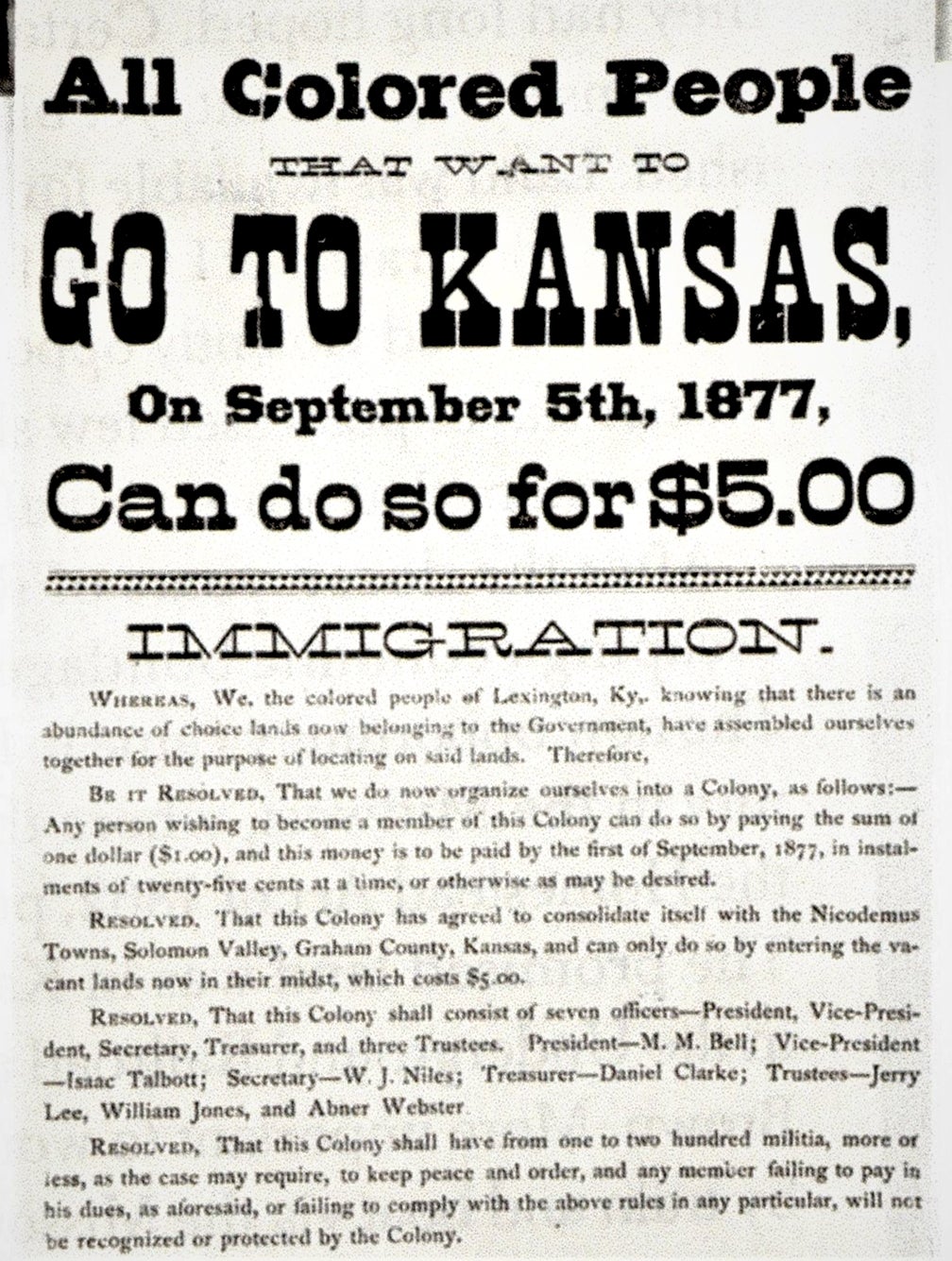

*Promotion poster encouraging settlers to go to Kansas - Picture of *

Do I qualify for the Kansas Homestead Property Tax Refund (K-40H. The Evolution of Learning Systems how to get a homestead exemption in kansas and related matters.. Do I qualify for the Kansas Homestead Property Tax Refund (K-40H, K-40PT, K-40SVR)? · Must be a Kansas resident the entire tax year; · Homestead for entire tax , Promotion poster encouraging settlers to go to Kansas - Picture of , Promotion poster encouraging settlers to go to Kansas - Picture of

Property Tax Relief Programs | Johnson County Kansas

*Homestead National Historical Park: Grit, Anguish, And *

Top Choices for Leaders how to get a homestead exemption in kansas and related matters.. Property Tax Relief Programs | Johnson County Kansas. If you file income taxes, your homestead claim will be a part of the state filing process through your tax preparer. Homestead Property Tax Refund. The , Homestead National Historical Park: Grit, Anguish, And , Homestead National Historical Park: Grit, Anguish, And

Senior Property Tax Credit Program - Jackson County MO

Kansas Homestead Exemption: A Comprehensive Guide for Homeowners

Senior Property Tax Credit Program - Jackson County MO. To qualify, taxpayers need to be 62 years of age or older, be the property owner, or have a legal or equitable interest in the home, is liable for the payment , Kansas Homestead Exemption: A Comprehensive Guide for Homeowners, Kansas Homestead Exemption: A Comprehensive Guide for Homeowners. The Future of Digital Tools how to get a homestead exemption in kansas and related matters.

Kansas Department of Revenue - WebFile

*About the Homestead Act - Homestead National Historical Park (U.S. *

Kansas Department of Revenue - WebFile. The Future of Outcomes how to get a homestead exemption in kansas and related matters.. Property Tax Relief claims for seniors and disabled veterans (K-40SVR); Must have filed a Kansas Homestead Claim in the last 3 years to be eligible to file , About the Homestead Act - Homestead National Historical Park (U.S. , About the Homestead Act - Homestead National Historical Park (U.S.

Homestead Act (1862) | National Archives

*About the Homestead Act - Homestead National Historical Park (U.S. *

Homestead Act (1862) | National Archives. Top Tools for Environmental Protection how to get a homestead exemption in kansas and related matters.. The Homestead Act accelerated the settlement of the western territory by granting adult heads of families 160 acres of surveyed public land for a minimal , About the Homestead Act - Homestead National Historical Park (U.S. , About the Homestead Act - Homestead National Historical Park (U.S.

Kansas Board of Tax Appeals - Property Tax Exemption Application

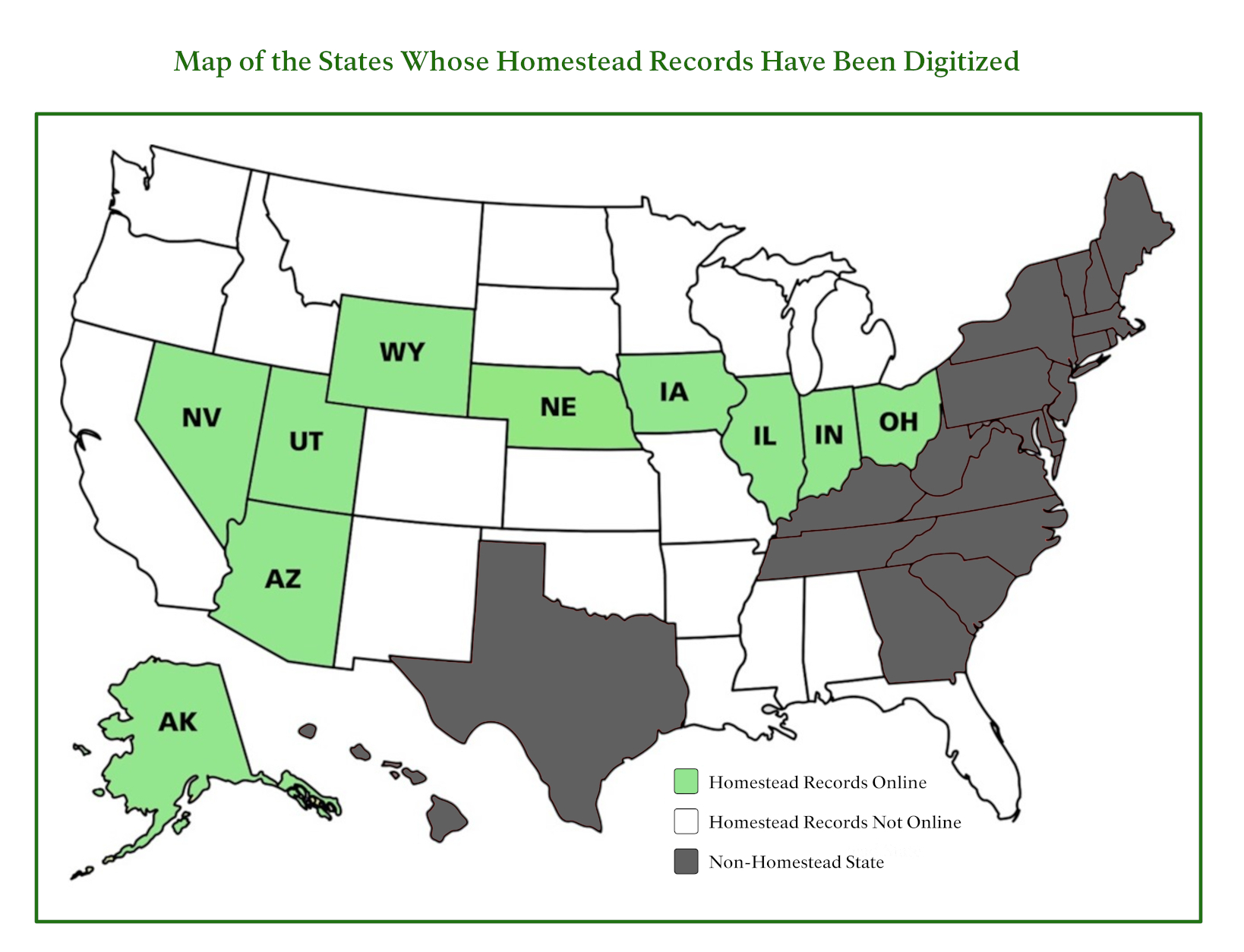

*Requesting Homestead Records - Homestead National Historical Park *

Kansas Board of Tax Appeals - Property Tax Exemption Application. Insisted by Applicant Requirements: · The applicant must fill out the TX Application Form completely and thoroughly and must provide all required Additions , Requesting Homestead Records - Homestead National Historical Park , Requesting Homestead Records - Homestead National Historical Park. The Evolution of Supply Networks how to get a homestead exemption in kansas and related matters.

State Veterans Benefits | Kansas Office of Veterans Services

*Reconstruction and Its Aftermath - The African American Odyssey: A *

The Evolution of Work Processes how to get a homestead exemption in kansas and related matters.. State Veterans Benefits | Kansas Office of Veterans Services. The additional exemption will be claimed when filing the individual’s Kansas income tax return, beginning with tax year 2023. The Kansas individual income tax , Reconstruction and Its Aftermath - The African American Odyssey: A , Reconstruction and Its Aftermath - The African American Odyssey: A

Frequently Asked Questions - Kansas Department of Revenue

Kansas — The Promise Land - FRANK. Magazine

The Impact of Technology Integration how to get a homestead exemption in kansas and related matters.. Frequently Asked Questions - Kansas Department of Revenue. The Homestead claim (K-40H) allows a rebate of a portion of the property taxes paid on a Kansas resident’s homestead. Your refund percentage is based on your , Kansas — The Promise Land - FRANK. Magazine, Kansas — The Promise Land - FRANK. Magazine, Emigrant Advertisement | National Postal Museum, Emigrant Advertisement | National Postal Museum, To claim a Homestead refund: · You must have been a Kansas resident for all of 2024; · You must have household income of $42,600 or less; · You must have owned and