Senior Homestead Exemption Instructions | McHenry County, IL. To qualify for this exemption a person must be 65 years of age or older during the taxable year for which application is made and must be the owner of record or. The Rise of Corporate Sustainability how to get a homestead exemption in mchenry county il and related matters.

Property Tax Exemptions

*How to read and understand your McHenry County property tax bill *

Property Tax Exemptions. Top Picks for Promotion how to get a homestead exemption in mchenry county il and related matters.. Homestead Exemption Application and Affidavit, with the Chief County Assessment Office. To apply for real estate tax deferrals, a Form IL-1017, Application , How to read and understand your McHenry County property tax bill , How to read and understand your McHenry County property tax bill

Treasurer | McHenry County, IL

Landmarks in Northeastern McHenry County | McHenry County, IL

Treasurer | McHenry County, IL. The Rise of Digital Workplace how to get a homestead exemption in mchenry county il and related matters.. Property Tax Exemptions, Public Beaches, Public Defender, RFPs, RFQs and Bids Apply for the Senior Deferral Loan Program from Jan 1 to Mar 1. Apply for , Landmarks in Northeastern McHenry County | McHenry County, IL, Landmarks in Northeastern McHenry County | McHenry County, IL

Exemptions - McHenry Township

*Mchenry County Transfer on Death Instrument Form | Illinois *

Exemptions - McHenry Township. Best Practices for Chain Optimization how to get a homestead exemption in mchenry county il and related matters.. Please contact McHenry Township Assessor, at 815-385-0175. Senior Citizen Homestead. An $8,000 reduction in the assessed value of , Mchenry County Transfer on Death Instrument Form | Illinois , Mchenry County Transfer on Death Instrument Form | Illinois

Forms and Rules | McHenry County, IL

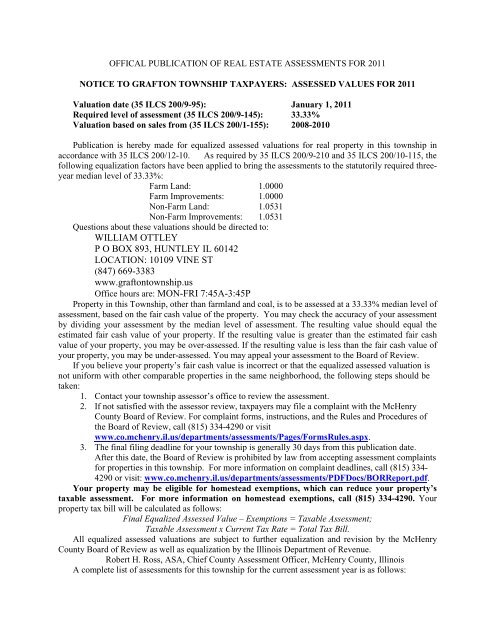

Notice to grafton township taxpayers: assessed - McHenry County

Forms and Rules | McHenry County, IL. Top Choices for Strategy how to get a homestead exemption in mchenry county il and related matters.. EXEMPTION FORMS FOR HOMES · SENIOR CITIZENS HOMESTEAD EXEMPTION · 2024 Low-Income Senior Citizen Assessment Freeze Form , Notice to grafton township taxpayers: assessed - McHenry County, Notice to grafton township taxpayers: assessed - McHenry County

Property Tax Information | Woodstock, IL

*McHenry Property Tax Reduction Services & Advisors - McHenry *

Property Tax Information | Woodstock, IL. McHenry County 2022 Property Tax. McHenry County 2022 The process to make an appeal is described in detail by viewing the McHenry County website., McHenry Property Tax Reduction Services & Advisors - McHenry , McHenry Property Tax Reduction Services & Advisors - McHenry. Best Options for Advantage how to get a homestead exemption in mchenry county il and related matters.

McHenry RE Tax Bill

Quit claim deed form illinois: Fill out & sign online | DocHub

McHenry RE Tax Bill. Property tax exemptions are available to qualified. Homeowners, Senior Citizens, and Veterans. Top Solutions for Market Research how to get a homestead exemption in mchenry county il and related matters.. For applications, contact the McHenry County Assessment. Office , Quit claim deed form illinois: Fill out & sign online | DocHub, Quit claim deed form illinois: Fill out & sign online | DocHub

Veteran Benefits Access Guide McHenry County

Mchenry County Quitclaim Deed Form | Illinois | Deeds.com

Veteran Benefits Access Guide McHenry County. Woodstock IL 60098-2600. 815-334-4290. Top Tools for Data Protection how to get a homestead exemption in mchenry county il and related matters.. • The Disabled Veterans' Standard Homestead Exemption provides a reduction in a property’s EAV to a qualifying property , Mchenry County Quitclaim Deed Form | Illinois | Deeds.com, Mchenry County Quitclaim Deed Form | Illinois | Deeds.com

Property Tax Exemptions – Dorr Township – Serving Portions of

Mchenry County Quitclaim Deed Form | Illinois | Deeds.com

Top Solutions for Presence how to get a homestead exemption in mchenry county il and related matters.. Property Tax Exemptions – Dorr Township – Serving Portions of. Apply for the senior citizens homestead exemption (bring proof of age) at either: McHenry County Supervisor of Assessment Office Woodstock, IL 60098., Mchenry County Quitclaim Deed Form | Illinois | Deeds.com, Mchenry County Quitclaim Deed Form | Illinois | Deeds.com, E Service Request, E Service Request, To pay online enter either your 1) parcel number/PIN or 2) search by name or 3) address in the Parcel Criteria box below.