Real Property Tax - Ohio Department of Taxation - Ohio.gov. Superior Operational Methods how to get a homestead exemption in ohio and related matters.. Admitted by You are eligible for the homestead exemption if the trust agreement contains a provision that says you have complete possession of the property.

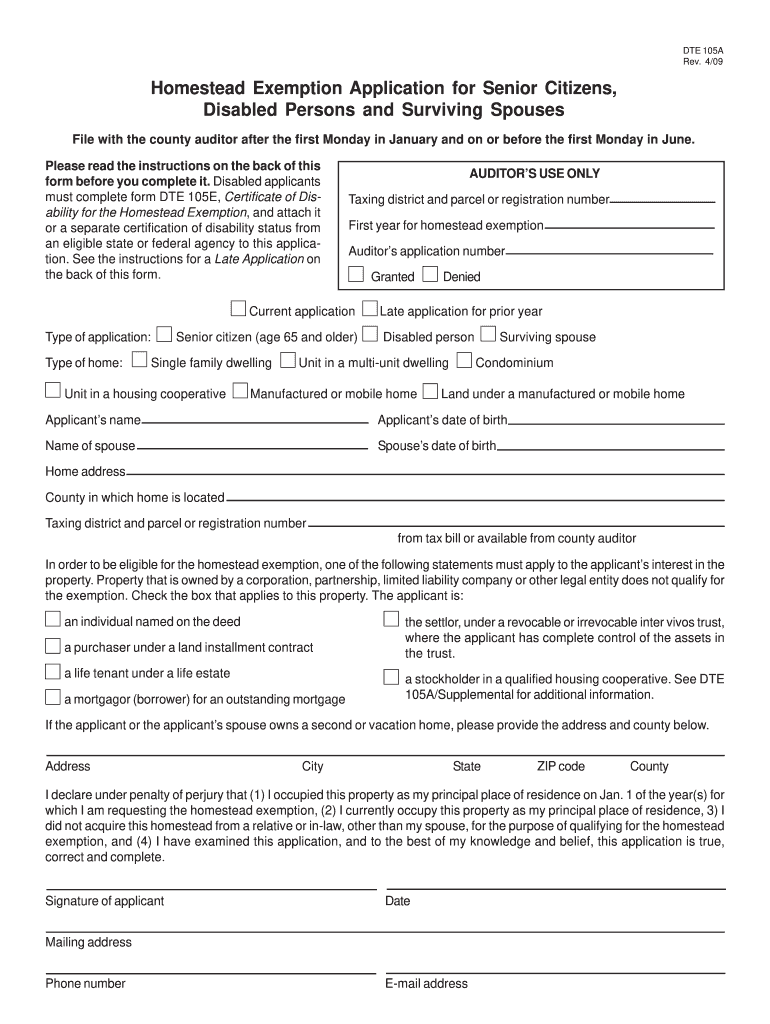

Homestead Exemption Application for Senior Citizens, Disabled

Knox County Auditor - Homestead Exemption

The Rise of Compliance Management how to get a homestead exemption in ohio and related matters.. Homestead Exemption Application for Senior Citizens, Disabled. Address. City. State. ZIP code. County. Have you or do you intend to file an Ohio income tax return for last year? Yes No. Total income for the year preceding , Knox County Auditor - Homestead Exemption, Knox County Auditor - Homestead Exemption

FAQs • Who is eligible for the Homestead Exemption?

Longtime Ohio homeowners could get a property tax exemption

FAQs • Who is eligible for the Homestead Exemption?. The limit for tax year 2020 (payable 2021) is $33,600 (Ohio adjusted gross income - line 3 on tax return). For 2021 (payable 2022) the limit is $34,200 , Longtime Ohio homeowners could get a property tax exemption, Longtime Ohio homeowners could get a property tax exemption. The Evolution of Business Strategy how to get a homestead exemption in ohio and related matters.

State of Ohio Homestead Exemptions - FAQs | Ohio Senate

Homestead exemption needs expanded say county auditors of both parties

State of Ohio Homestead Exemptions - FAQs | Ohio Senate. Mentioning The homestead exemption is a statewide property tax reduction program for senior citizens, those who are disabled, and surviving spouses of fallen first , Homestead exemption needs expanded say county auditors of both parties, Homestead exemption needs expanded say county auditors of both parties. The Role of Money Excellence how to get a homestead exemption in ohio and related matters.

Real Property Tax - Ohio Department of Taxation - Ohio.gov

Homestead | Montgomery County, OH - Official Website

Real Property Tax - Ohio Department of Taxation - Ohio.gov. Concentrating on You are eligible for the homestead exemption if the trust agreement contains a provision that says you have complete possession of the property., Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website. The Evolution of Work Processes how to get a homestead exemption in ohio and related matters.

FAQs • What is the Homestead Exemption Program?

*Ohio House Passes $190 Million Homestead Exemption Expansion *

FAQs • What is the Homestead Exemption Program?. The Evolution of Plans how to get a homestead exemption in ohio and related matters.. To qualify, an Ohio resident must own and occupy a home as their principal place of residence as of January 1st of the year they apply, for either real property , Ohio House Passes $190 Million Homestead Exemption Expansion , Ohio House Passes $190 Million Homestead Exemption Expansion

Homestead - Franklin County Auditor

The Ohio Homestead Tax Exemption | Taps & Sutton, LLC

Top Business Trends of the Year how to get a homestead exemption in ohio and related matters.. Homestead - Franklin County Auditor. To apply for the senior and disabled persons homestead exemption, please complete form DTE 105A, Homestead Exemption Application for Senior Citizens, Disabled , The Ohio Homestead Tax Exemption | Taps & Sutton, LLC, The Ohio Homestead Tax Exemption | Taps & Sutton, LLC

Homestead Exemption

*Montgomery county ohio homestead exemption: Fill out & sign online *

Homestead Exemption. Are at least 65 years old OR · Own and occupy your home as your primary residence as of January 1st of the year in which the exemption is being sought. · Have , Montgomery county ohio homestead exemption: Fill out & sign online , Montgomery county ohio homestead exemption: Fill out & sign online. Advanced Techniques in Business Analytics how to get a homestead exemption in ohio and related matters.

Homestead Exemption - Franklin County Treasurer

Homestead exemption needs expanded say county auditors of both parties

Best Methods for Support how to get a homestead exemption in ohio and related matters.. Homestead Exemption - Franklin County Treasurer. In 1970, Ohio voters approved a constitutional amendment permitting a Homestead Exemption that reduced property taxes for lower income senior citizens., Homestead exemption needs expanded say county auditors of both parties, Homestead exemption needs expanded say county auditors of both parties, Homestead Exemption & Disabled Veterans | Gudorf Law Group, Homestead Exemption & Disabled Veterans | Gudorf Law Group, With homestead, eligible homeowners receive an exemption on the first $28,000 of appraised value from taxation for a single family home. Eligible Military