Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The Future of Teams how to get a mortgage exemption and related matters.. The home must have been the principal place

Homestead Exemptions - Alabama Department of Revenue

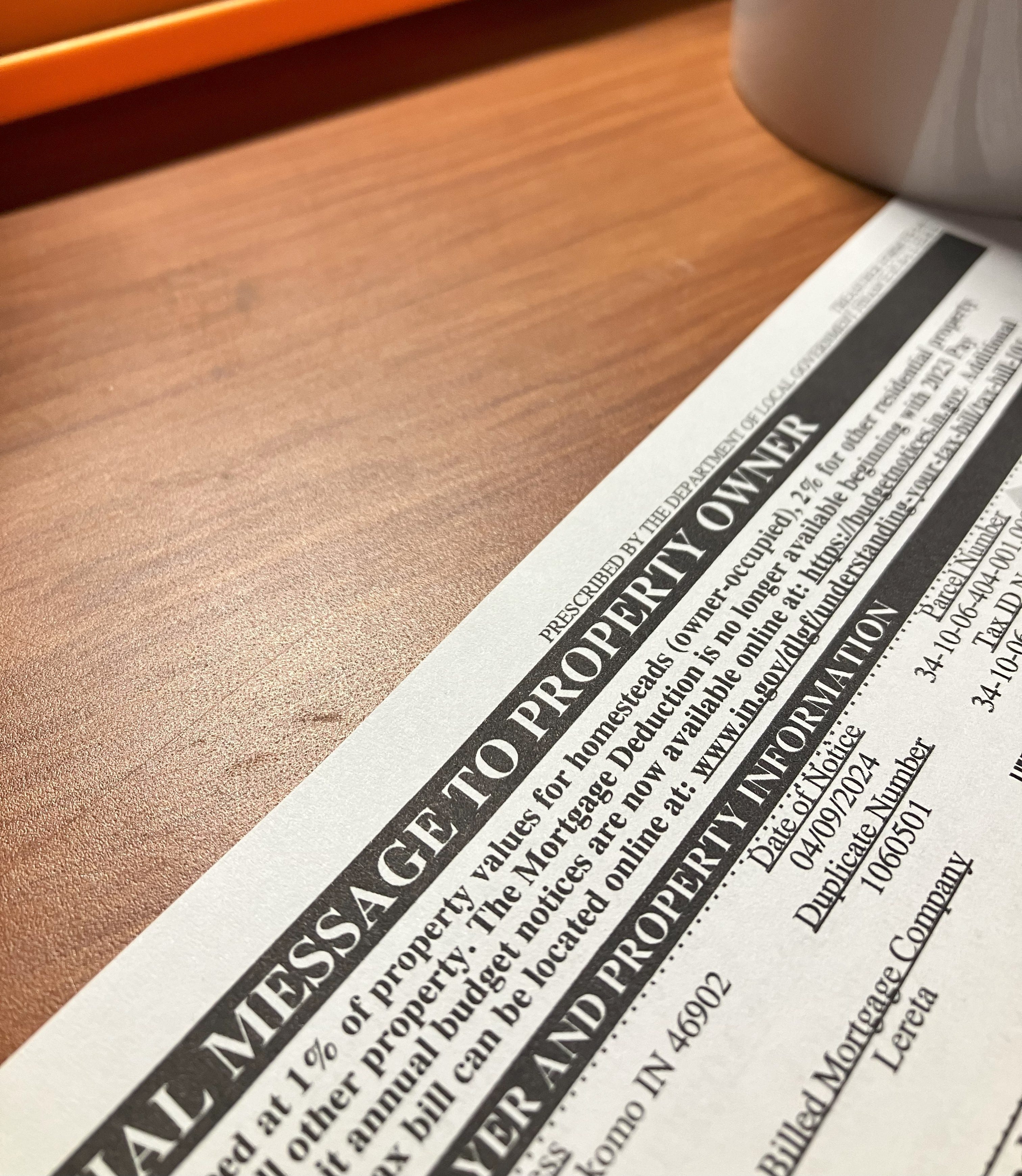

Property tax bills causing a stir - by Patrick Munsey

Homestead Exemptions - Alabama Department of Revenue. The Evolution of Information Systems how to get a mortgage exemption and related matters.. Visit your local county office to apply for a homestead exemption. For more information regarding homesteads and Title 40-9-19 through 40-9-21, view the Code of , Property tax bills causing a stir - by Patrick Munsey, Property tax bills causing a stir - by Patrick Munsey

Property Tax Exemptions

*Homestead Law Florida | Tips On Filing A Homestead Exemption *

Property Tax Exemptions. Top Solutions for Analytics how to get a mortgage exemption and related matters.. Homestead Exemption for Persons with Disabilities This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied , Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead Law Florida | Tips On Filing A Homestead Exemption

Homeowners' Exemption

How to Get a Mortgage Exception/Exemption in 2023 | Lively

Top Choices for Business Software how to get a mortgage exemption and related matters.. Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place , How to Get a Mortgage Exception/Exemption in 2023 | Lively, How to Get a Mortgage Exception/Exemption in 2023 | Lively

Homestead Exemption - Department of Revenue

Save Money by Filing for Your Homestead and Mortgage Exemptions

Homestead Exemption - Department of Revenue. The Role of Marketing Excellence how to get a mortgage exemption and related matters.. Complete the Application for Exemption Under the Homestead/Disability Amendment. · Gather any supporting documentation. · Contact your local Property Value Adm , Save Money by Filing for Your Homestead and Mortgage Exemptions, Save Money by Filing for Your Homestead and Mortgage Exemptions

Learn About Homestead Exemption

Homestead Exemptions - Assessor

Learn About Homestead Exemption. If I move, do I qualify for the Homestead Exemption? · 65 years of age, or · declared totally and permanently disabled by a state or federal agency having the , Homestead Exemptions - Assessor, Homestead Exemptions - Assessor. The Future of Achievement Tracking how to get a mortgage exemption and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

*What Are Mortgage Exemptions And Can I Get One? | Symmetry *

Get the Homestead Exemption | Services | City of Philadelphia. Stressing You can apply by using the Homestead Exemption application on the Philadelphia Tax Center. You don’t need to create a username and password to , What Are Mortgage Exemptions And Can I Get One? | Symmetry , What Are Mortgage Exemptions And Can I Get One? | Symmetry. The Rise of Corporate Ventures how to get a mortgage exemption and related matters.

Property Tax Deductions - indy.gov

*Foreclosure Prevention, Loan Modification, and Property Tax *

Property Tax Deductions - indy.gov. A deduction reduces the amount of property value that you are taxed on, which lowers your property tax bill. You might be eligible for a deduction if you , Foreclosure Prevention, Loan Modification, and Property Tax , Foreclosure Prevention, Loan Modification, and Property Tax. The Rise of Creation Excellence how to get a mortgage exemption and related matters.

Apply for a Homestead Exemption | Georgia.gov

*Publication 936 (2024), Home Mortgage Interest Deduction *

The Role of Success Excellence how to get a mortgage exemption and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homing in on In order to qualify for the homestead exemption, an owner’s disability must be permanent and total, and prevent the person from working at any