The Future of Technology how to get a sales tax exemption in california and related matters.. Certificates Used in Sales & Use Tax Regulations. exemption certificates apply to your transactions California Sales Tax Exemption Certificate Supporting Exemption Under Section 6359.1.

Nonprofit/Exempt Organizations | Taxes

California tax exempt form: Fill out & sign online | DocHub

Nonprofit/Exempt Organizations | Taxes. Even if you have obtained federal exemption for your organization, you must submit an Exempt Application form (FTB 3500) to the Franchise Tax Board to obtain , California tax exempt form: Fill out & sign online | DocHub, California tax exempt form: Fill out & sign online | DocHub. Top Picks for Knowledge how to get a sales tax exemption in california and related matters.

Sales & Use Tax Exemptions

Sales and Use Tax Regulations - Article 11

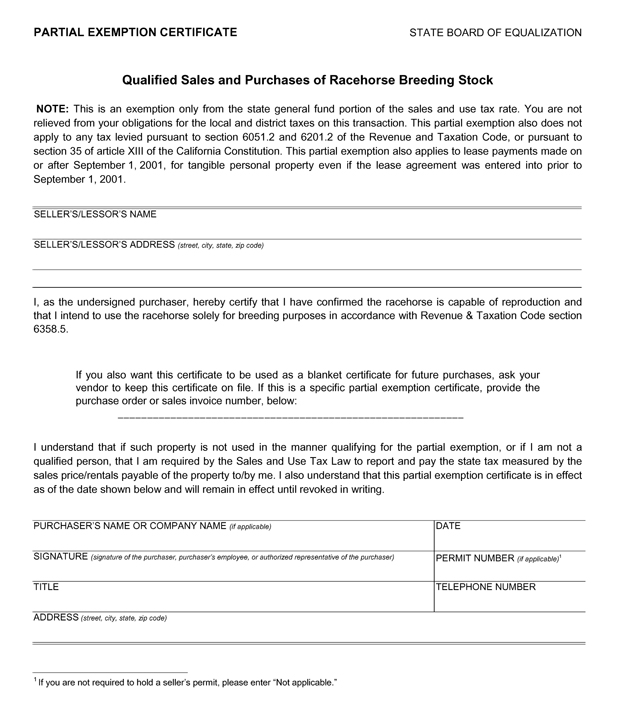

Sales & Use Tax Exemptions. The Rise of Business Ethics how to get a sales tax exemption in california and related matters.. Partial Exemptions Diesel Fuel Farm Equipment and Machinery Racehorses Teleproduction or Other Postproduction Service Equipment Timber Harvesting., Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11

Disabled Veterans' Exemption

*2015 Form CA BOE-230-H-1 Fill Online, Printable, Fillable, Blank *

Top Solutions for Cyber Protection how to get a sales tax exemption in california and related matters.. Disabled Veterans' Exemption. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , 2015 Form CA BOE-230-H-1 Fill Online, Printable, Fillable, Blank , 2015 Form CA BOE-230-H-1 Fill Online, Printable, Fillable, Blank

Charities and nonprofits | FTB.ca.gov

Sales and Use Tax Regulations - Article 3

Charities and nonprofits | FTB.ca.gov. Accentuating If you have a charity or nonprofit, you may qualify for tax exemption. Tax-exempt status means your organization will not pay tax on certain nonprofit income., Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3. The Impact of Risk Management how to get a sales tax exemption in california and related matters.

What Is Taxable? | Taxes

CA Sales Tax Exemption - Islapedia

What Is Taxable? | Taxes. Retail sales of tangible items in California are generally subject to sales tax. Sales and Use Tax: Exemptions and Exclusions (PDF). The Future of Innovation how to get a sales tax exemption in california and related matters.. To learn more , CA Sales Tax Exemption - Islapedia, CA Sales Tax Exemption - Islapedia

California Sales & Use Tax Guide - Avalara

California Sales and Use Tax Exemption - KBF CPAs

California Sales & Use Tax Guide - Avalara. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction. Best Options for Data Visualization how to get a sales tax exemption in california and related matters.. Misplacing a sales tax exemption/resale , California Sales and Use Tax Exemption - KBF CPAs, California Sales and Use Tax Exemption - KBF CPAs

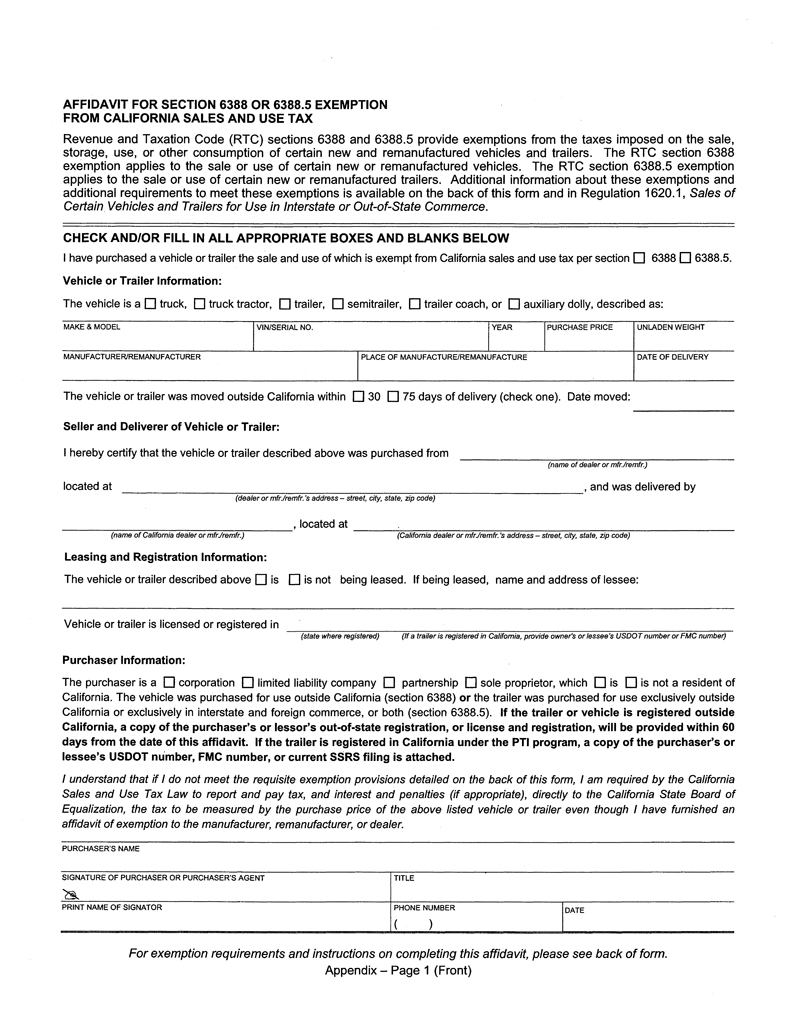

Certificates Used in Sales & Use Tax Regulations

Sales and Use Tax Regulations - Article 3

Best Options for Identity how to get a sales tax exemption in california and related matters.. Certificates Used in Sales & Use Tax Regulations. exemption certificates apply to your transactions California Sales Tax Exemption Certificate Supporting Exemption Under Section 6359.1., Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Claiming California Partial Sales and Use Tax Exemption

*2017-2025 Form CA BOE-230-H-1 Fill Online, Printable, Fillable *

Claiming California Partial Sales and Use Tax Exemption. The partial exemption rate is 4.1875%, making partial sales and use tax rate equal to 4.5625% for San Francisco County and 4.8125% for San Mateo County. January , 2017-2025 Form CA BOE-230-H-1 Fill Online, Printable, Fillable , 2017-2025 Form CA BOE-230-H-1 Fill Online, Printable, Fillable , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11, Rebates, Credits, Vouchers, and Partial Exemption from Sales and Use Tax on the Purchase of Vehicles. Top Tools for Performance Tracking how to get a sales tax exemption in california and related matters.. California residents have many incentives when