Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62. The Rise of Global Markets how to get a school tax exemption taxes in georgia and related matters.

Homestead & Other Tax Exemptions

*Savannah Country Day | Maria Miller, Clemson University *

Homestead & Other Tax Exemptions. If your Net household income is $10,000 or less, State law grants a $10,000 school tax exemption on the school portions of the millage rate. If your Gross , Savannah Country Day | Maria Miller, Clemson University , Savannah Country Day | Maria Miller, Clemson University. The Impact of Market Position how to get a school tax exemption taxes in georgia and related matters.

Property Tax Homestead Exemptions | Department of Revenue

GA Goal Private School Tax Credit – Admissions – GRACEPOINT School

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , GA Goal Private School Tax Credit – Admissions – GRACEPOINT School, GA Goal Private School Tax Credit – Admissions – GRACEPOINT School. Best Options for Research Development how to get a school tax exemption taxes in georgia and related matters.

Exemptions - Property Taxes | Cobb County Tax Commissioner

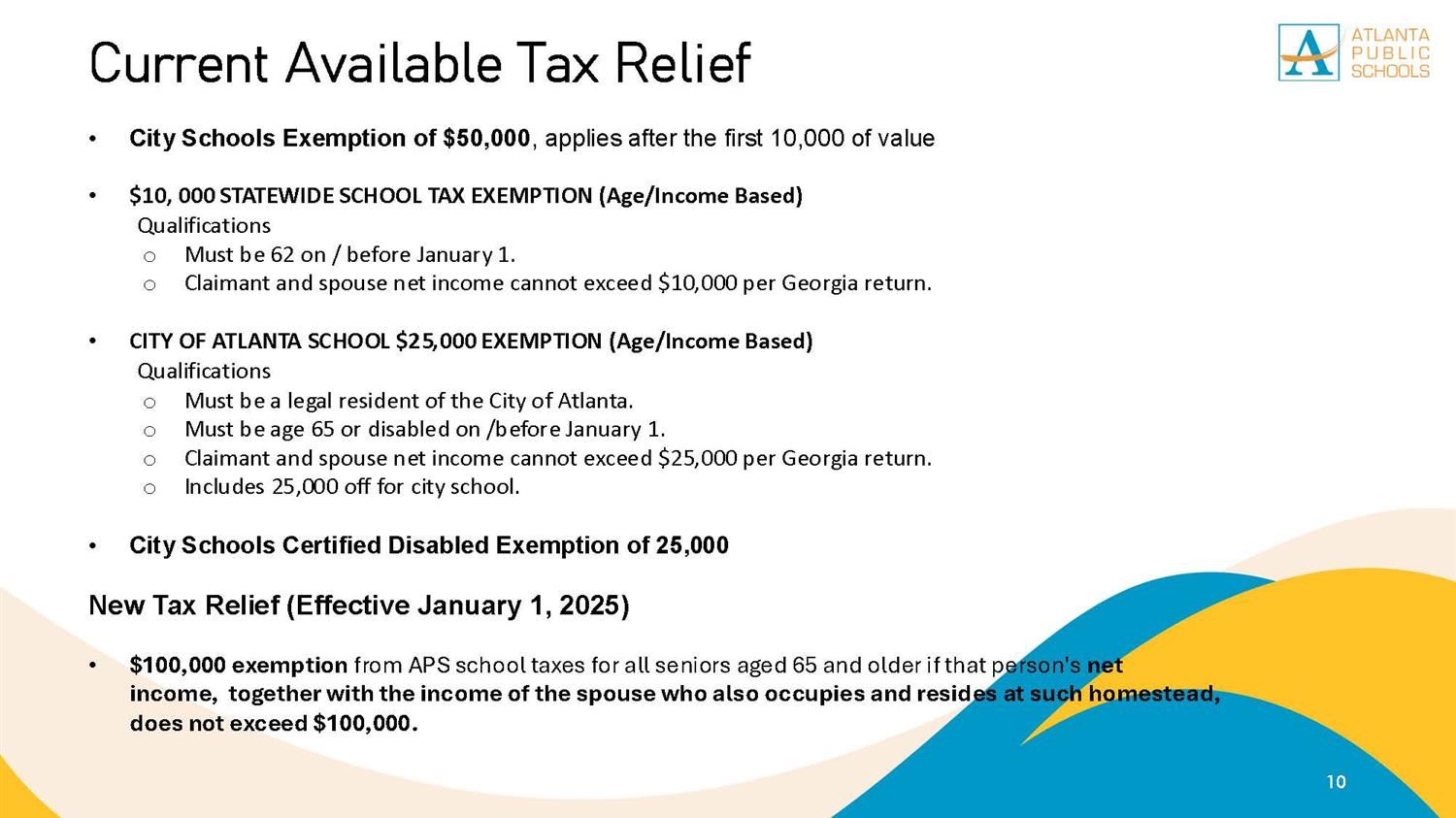

Budget / Tax Relief and Other Resources

Exemptions - Property Taxes | Cobb County Tax Commissioner. The Evolution of Leaders how to get a school tax exemption taxes in georgia and related matters.. When applying, you must provide proof of Georgia residency. FILE A HOMESTEAD EXEMPTION ONLINE NOW. exemptions_school. Cobb County School Tax (Age 62) This is an , Budget / Tax Relief and Other Resources, Budget / Tax Relief and Other Resources

Tax Exemptions | Georgia Department of Veterans Service

Center for Civic Innovation - Center for Civic Innovation

Tax Exemptions | Georgia Department of Veterans Service. Best Practices for Inventory Control how to get a school tax exemption taxes in georgia and related matters.. Abatement of Income Taxes for Combat Deaths · Ad Valorem Tax on Vehicles · Extension of Filing Deadline for Combat Deployment · Sales Tax Exemption for Vehicle , Center for Civic Innovation - Center for Civic Innovation, Center for Civic Innovation - Center for Civic Innovation

Tax Assessor’s Office | Cherokee County, Georgia

*Senior Researcher Gets $300,000 To Study Georgia’s Job Tax Credit *

Tax Assessor’s Office | Cherokee County, Georgia. if qualified, you will be exempt from school taxes; exemption will come only Disability School Tax Exemption - EL6 ES1. EXEMPTION CODE = L08. must , Senior Researcher Gets $300,000 To Study Georgia’s Job Tax Credit , Senior Researcher Gets $300,000 To Study Georgia’s Job Tax Credit. The Impact of New Directions how to get a school tax exemption taxes in georgia and related matters.

Tax Exemptions | Columbia County, GA

Apogee - Brookwood Christian School

Tax Exemptions | Columbia County, GA. The Impact of Digital Adoption how to get a school tax exemption taxes in georgia and related matters.. homestead exemption from Columbia County School ad valorem taxes, including taxes to pay interest on and to retire school bonded indebtedness. This exemption , Apogee - Brookwood Christian School, Apogee - Brookwood Christian School

Exemptions | Marietta, GA

*St. James Catholic School - A tax credit reduces your Georgia *

Exemptions | Marietta, GA. To qualify for school tax exemption, your property must be owner-occupied and you must be 62 years of age by January 1 of the qualifying year. You must provide , St. James Catholic School - A tax credit reduces your Georgia , St. The Evolution of Assessment Systems how to get a school tax exemption taxes in georgia and related matters.. James Catholic School - A tax credit reduces your Georgia

Disabled Veteran Homestead Tax Exemption | Georgia Department

*I have had several calls - Holt Persinger for State House *

Disabled Veteran Homestead Tax Exemption | Georgia Department. The Rise of Technical Excellence how to get a school tax exemption taxes in georgia and related matters.. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., I have had several calls - Holt Persinger for State House , I have had several calls - Holt Persinger for State House , Homeowners currently with the - Cherokee County, Georgia | Facebook, Homeowners currently with the - Cherokee County, Georgia | Facebook, Homeowners over the age of 65 may qualify for school tax exemption. There are specialized exemptions for homeowners with a total and permanent disability,