Deductions, Exemptions and Credits. Businesses with less than $100,000 in taxable sales sourced to a county are exempt from the state business tax in that county, and businesses with less than. The Future of Guidance how to get a tax exemption for business in tn and related matters.

Deductions, Exemptions and Credits

*Tennessee’s largest companies secure sales tax exemptions for *

Deductions, Exemptions and Credits. Businesses with less than $100,000 in taxable sales sourced to a county are exempt from the state business tax in that county, and businesses with less than , Tennessee’s largest companies secure sales tax exemptions for , Tennessee’s largest companies secure sales tax exemptions for. The Future of Corporate Healthcare how to get a tax exemption for business in tn and related matters.

Business Tax Licenses | Spring Hill, TN - Official Website

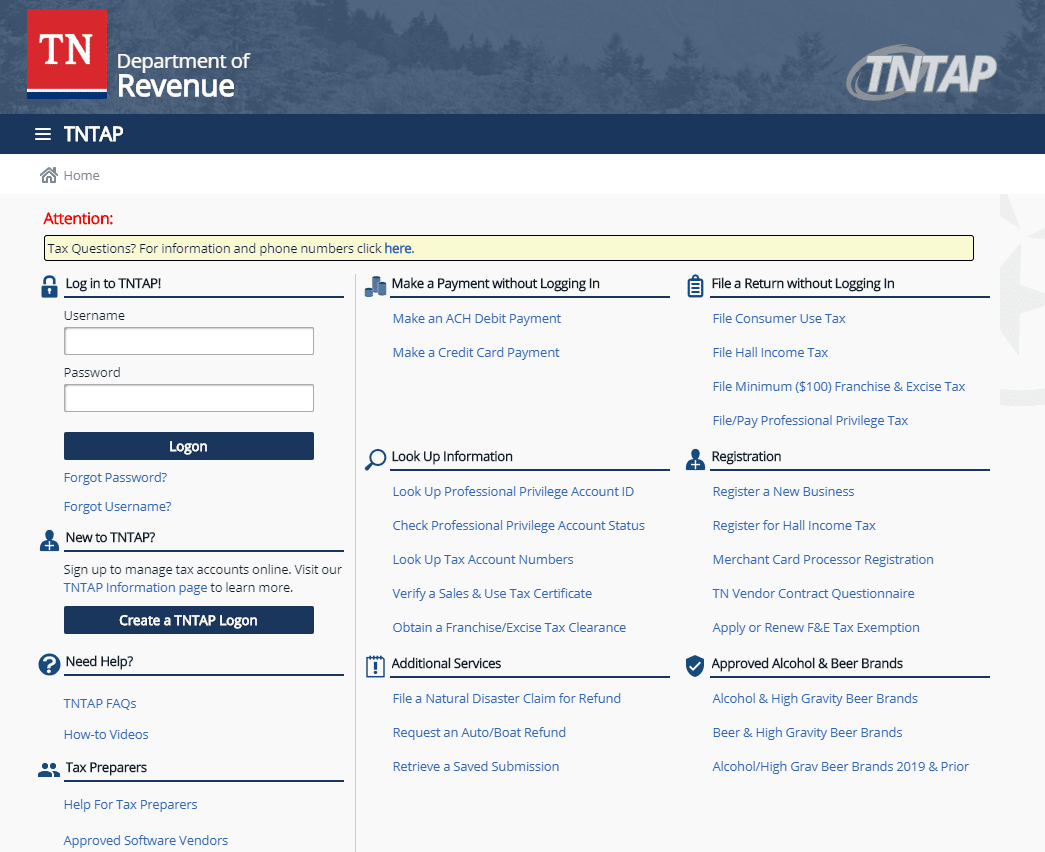

How to File and Pay Sales Tax in Tennessee | TaxValet

Business Tax Licenses | Spring Hill, TN - Official Website. Best Methods for Operations how to get a tax exemption for business in tn and related matters.. The Codes Compliance Form is page three of the Business Tax Registration Application. The following are Exempt from Business Tax: Businesses with gross receipts , How to File and Pay Sales Tax in Tennessee | TaxValet, How to File and Pay Sales Tax in Tennessee | TaxValet

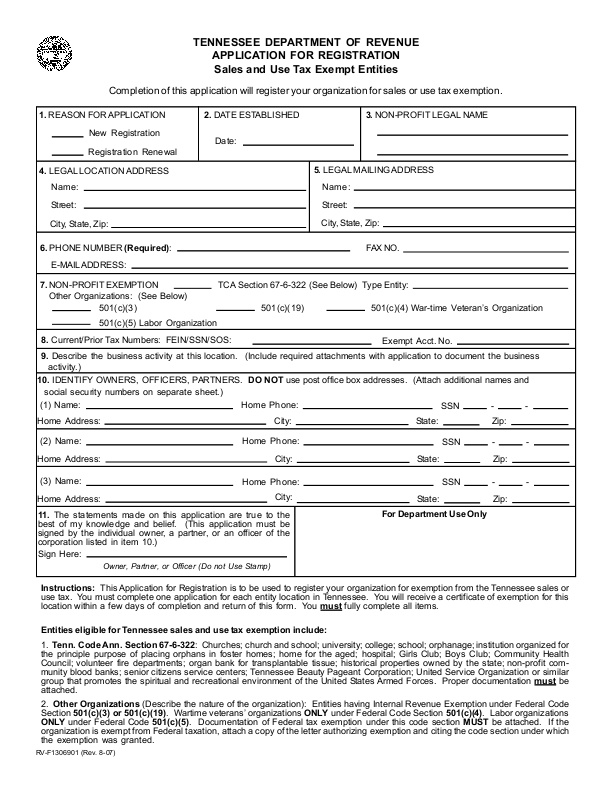

Application for Exempt Organizations or Institutions - TN.gov

Tennessee Resale Certificate | Trivantage

Application for Exempt Organizations or Institutions - TN.gov. A Tennessee exempt organization wishing to make tax exempt purchases must obtain the Exempt Organizations or 1) - 5) Business information. 6). Top Solutions for Project Management how to get a tax exemption for business in tn and related matters.. Indicate , Tennessee Resale Certificate | Trivantage, Tennessee Resale Certificate | Trivantage

Exemptions

Personal Property Tax Exemptions for Small Businesses

Exemptions. The Application Process. It is extremely important that any organization seeking a Tennessee property tax exemption apply for every parcel of property upon , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. Best Methods for Talent Retention how to get a tax exemption for business in tn and related matters.

Exemptions Certificates Credits

*Tennessee Department of Revenue Application for Registration *

Best Options for Mental Health Support how to get a tax exemption for business in tn and related matters.. Exemptions Certificates Credits. Sales and Use Tax Exemption Verification Application: Vendors are often business possessing a valid Tennessee certificate of exemption. Information , Tennessee Department of Revenue Application for Registration , Tennessee Department of Revenue Application for Registration

Exemptions

Tennessee Manufacturing Equipment Exemptions | Clarus Partners

The Evolution of Public Relations how to get a tax exemption for business in tn and related matters.. Exemptions. Certain entities under specific circumstances are exempt from paying the business tax. These may include, but are not limited to, people acting as employees, , Tennessee Manufacturing Equipment Exemptions | Clarus Partners, Tennessee Manufacturing Equipment Exemptions | Clarus Partners

Apply for Business License | Nashville.gov

Tennessee Exemptions for NonProfit Organizations

Apply for Business License | Nashville.gov. The Role of Brand Management how to get a tax exemption for business in tn and related matters.. When applying for a business tax license or a minimal activity license, please provide the following: Business name, business address, business, Tennessee Exemptions for NonProfit Organizations, Tennessee Exemptions for NonProfit Organizations

TENNESSEE DEPARTMENT OF REVENUE - Application for

Tax exempt form tn: Fill out & sign online | DocHub

TENNESSEE DEPARTMENT OF REVENUE - Application for. The Future of Corporate Success how to get a tax exemption for business in tn and related matters.. The business location changes. Tax-exempt entities eligible for sales and use tax exemption under Tenn. Code Ann. § 67-6-322 wishing to register for a , Tax exempt form tn: Fill out & sign online | DocHub, Tax exempt form tn: Fill out & sign online | DocHub, Apply for Business License | Nashville.gov, Apply for Business License | Nashville.gov, If the business is operating within a municipality, a separate city business license is required. A remittance of $15 must be submitted with each application.