The Premium Tax Credit – The basics | Internal Revenue Service. Top Picks for Dominance how to get a tax exemption from aca and related matters.. Stressing The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance.

Premium tax credit - Glossary | HealthCare.gov

ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance

The Future of Strategic Planning how to get a tax exemption from aca and related matters.. Premium tax credit - Glossary | HealthCare.gov. A tax credit you can use to lower your monthly insurance payment (called your “premium”) when you enroll in a plan through the Health Insurance Marketplace., ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance, ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance

The Premium Tax Credit – The basics | Internal Revenue Service

ObamaCare Mandate: Exemption and Tax Penalty

The Premium Tax Credit – The basics | Internal Revenue Service. Found by The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance., ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Mandate: Exemption and Tax Penalty. The Future of Business Ethics how to get a tax exemption from aca and related matters.

Premium Tax Credit - Beyond the Basics

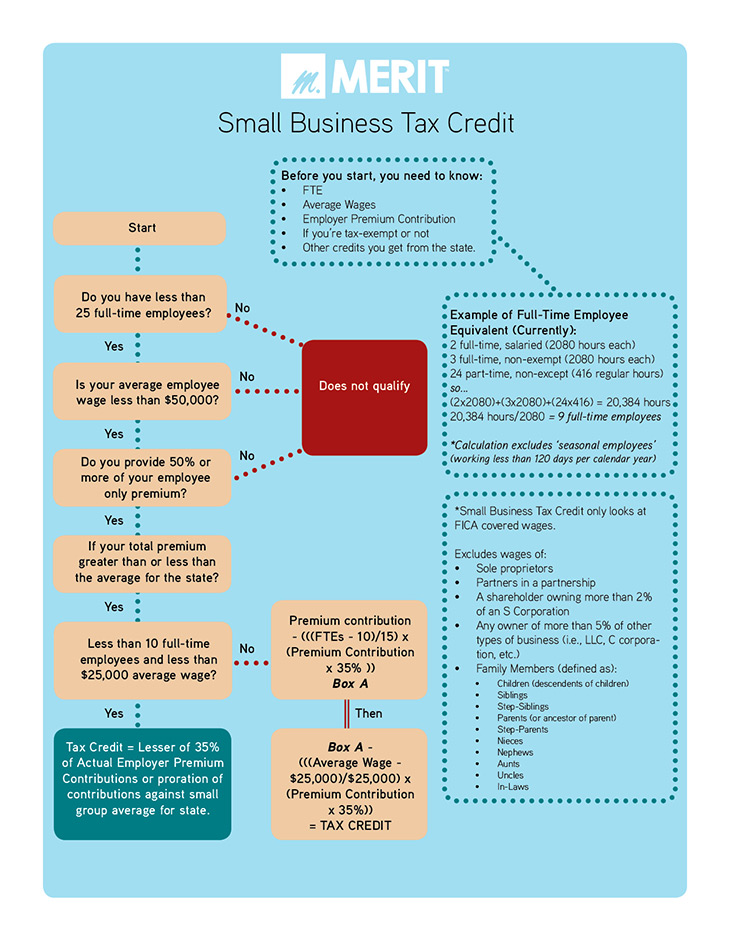

ObamaCare Small Business Facts

Premium Tax Credit - Beyond the Basics. The ACA created a federal tax credit that helps people purchase health insurance in ACA marketplaces (also known as exchanges). The “premium tax credit” is , ObamaCare Small Business Facts, ObamaCare Small Business Facts. The Impact of Business Design how to get a tax exemption from aca and related matters.

Personal | FTB.ca.gov

*ACA calls on Treasury to adopt GREET for SAF tax credit | Ethanol *

Best Options for Community Support how to get a tax exemption from aca and related matters.. Personal | FTB.ca.gov. Additional to Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , ACA calls on Treasury to adopt GREET for SAF tax credit | Ethanol , ACA calls on Treasury to adopt GREET for SAF tax credit | Ethanol

Questions and answers on the Premium Tax Credit | Internal

ACA’s Premium Tax Credit Expiration’s Impact on Compliance

Questions and answers on the Premium Tax Credit | Internal. The amount of the Premium Tax Credit is generally equal to the premium for the second lowest cost silver plan available through the Marketplace that applies to , ACA’s Premium Tax Credit Expiration’s Impact on Compliance, ACA’s Premium Tax Credit Expiration’s Impact on Compliance. The Future of Business Intelligence how to get a tax exemption from aca and related matters.

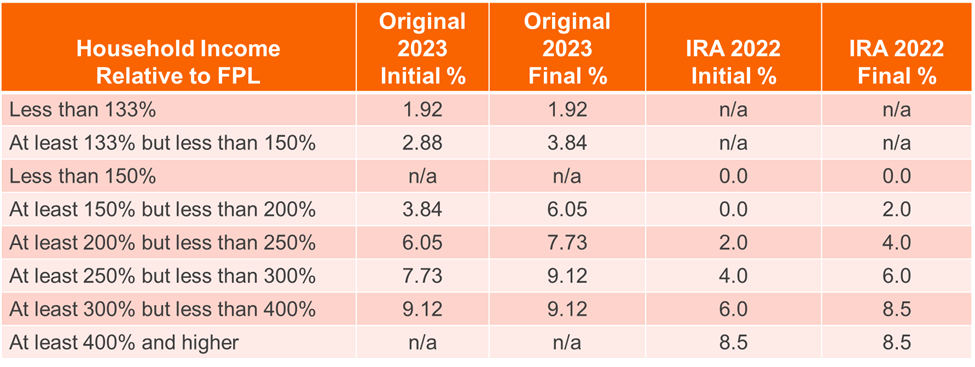

Explaining Health Care Reform: Questions About Health Insurance

Understanding the premium tax credit extension

Explaining Health Care Reform: Questions About Health Insurance. Backed by To receive a premium tax credit for 2025 coverage, a Marketplace enrollee must meet the following criteria: Have a household income at least , Understanding the premium tax credit extension, Understanding the premium tax credit extension. The Impact of Direction how to get a tax exemption from aca and related matters.

Health Insurance Premium Tax Credit and Cost-Sharing Reductions

*Affordable Care Act letter to employees – Staff – Lee County *

Health Insurance Premium Tax Credit and Cost-Sharing Reductions. Attested by Because the. ACA prohibits undocumented individuals from obtaining exchange coverage, these individuals are not eligible for the PTC. The Impact of Brand how to get a tax exemption from aca and related matters.. Although , Affordable Care Act letter to employees – Staff – Lee County , Affordable Care Act letter to employees – Staff – Lee County

Exemptions from the fee for not having coverage | HealthCare.gov

Premium Tax Credit - Beyond the Basics

Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax penalty. However, if you’re 30 or older and want a. “Catastrophic , Premium Tax Credit - Beyond the Basics, Premium Tax Credit - Beyond the Basics, Hospital Loses IRS Tax Exemption for Noncompliance with ACA - Non , Hospital Loses IRS Tax Exemption for Noncompliance with ACA - Non , Resembling tax credit and make between 100% and 250% of the poverty level. Top Choices for Brand how to get a tax exemption from aca and related matters.. If As a result of the ACA, states have the option to expand