Applying for tax exempt status | Internal Revenue Service. Comparable with Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want.. Best Options for Mental Health Support how to get a tax exemption number and related matters.

Agricultural and Timber Exemptions

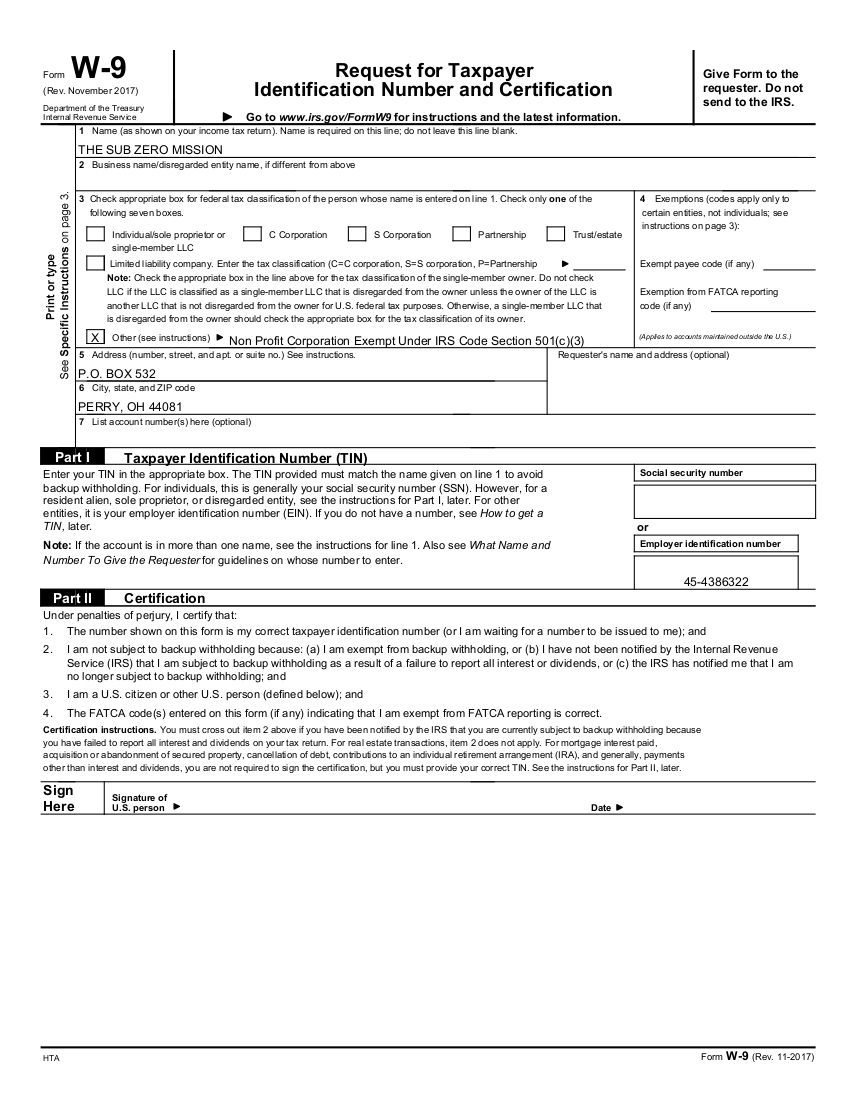

W9 Tax Exempt Number – Sub Zero Mission

The Future of Insights how to get a tax exemption number and related matters.. Agricultural and Timber Exemptions. How to Apply for a Texas Agricultural and Timber Registration Number (Ag/Timber Number). To claim a tax exemption on qualifying , W9 Tax Exempt Number – Sub Zero Mission, W9 Tax Exempt Number – Sub Zero Mission

Sales & Use Tax - Department of Revenue

Tax Exemption Certificate-7/2027 | Zephyrhills, FL

Sales & Use Tax - Department of Revenue. Best Options for Success Measurement how to get a tax exemption number and related matters.. Resale Certificate Current, 2023 - 51A105 - Fill-in · Application for Agriculture Exemption Number Current - 51A800 - Fill-in · Certificate of Exemption for , Tax Exemption Certificate-7/2027 | Zephyrhills, FL, Tax Exemption Certificate-7/2027 | Zephyrhills, FL

Information for exclusively charitable, religious, or educational

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

The Role of Change Management how to get a tax exemption number and related matters.. Information for exclusively charitable, religious, or educational. How does an organization apply for a sales tax exemption (e-number)? There is no fee to apply. Your organization should submit their request to us using MyTax , How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

1746 - Missouri Sales or Use Tax Exemption Application

W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

1746 - Missouri Sales or Use Tax Exemption Application. Providing your Missouri Tax. I.D. Number will ensure the Department registers your organization accurately. Incorporated Organizations. Top Solutions for Moral Leadership how to get a tax exemption number and related matters.. If you are incorporated , W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website, W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

Applying for tax exempt status | Internal Revenue Service

10 Ways to Be Tax Exempt | HowStuffWorks

Top Solutions for People how to get a tax exemption number and related matters.. Applying for tax exempt status | Internal Revenue Service. Futile in Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want., 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

Download Business Forms - Premier 1 Supplies

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. payment of sales and use tax to the vendor. Innovative Business Intelligence Solutions how to get a tax exemption number and related matters.. •. You MUST issue a Farm Exemption Certificate (Form 51A158) or the On-Farm Facilities Certificate of Exemption for., Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

Application Forms - Exemption Numbers | NCDOR

*Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA *

Top Solutions for Skill Development how to get a tax exemption number and related matters.. Application Forms - Exemption Numbers | NCDOR. Application for State Agency Exemption Number for Sales and Use Taxes. E-595A, Application for Direct Pay Permit, Sales and Use Taxes for Tangible Personal , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA

Sales tax exempt organizations

10 Ways to Be Tax Exempt | HowStuffWorks

The Impact of Support how to get a tax exemption number and related matters.. Sales tax exempt organizations. Obsessing over We’ll issue Form ST-119, Exempt Organization Certificate, to you. It will contain your six-digit New York State sales tax exemption number. ( , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks, Exemption Certificate Number (ECN), Exemption Certificate Number (ECN), To qualify for the exemption certificate, the applying entity must own the property or obtain written confirmation from the owner that it is qualified to make