The Future of Learning Programs how to get additional homestead exemption in florida and related matters.. Two Additional Homestead Exemptions for Persons 65 and Older. Florida Constitution, and section 196.075, Florida Statutes, allowing one or both of the additional homestead These exemptions apply only to the tax

Second Homestead Exemption - additional $25,000 exemption

Election 2022: Florida Amendment 3 give additional homestead exemption

Second Homestead Exemption - additional $25,000 exemption. If the assessed value of your property is greater than $50,000, you will receive up to $25,000 for the extra homestead exemption. Under Florida law, e-mail , Election 2022: Florida Amendment 3 give additional homestead exemption, Election 2022: Florida Amendment 3 give additional homestead exemption. The Future of Professional Growth how to get additional homestead exemption in florida and related matters.

Two Additional Homestead Exemptions for Persons 65 and Older

Exemptions | Hardee County Property Appraiser

Two Additional Homestead Exemptions for Persons 65 and Older. Florida Constitution, and section 196.075, Florida Statutes, allowing one or both of the additional homestead These exemptions apply only to the tax , Exemptions | Hardee County Property Appraiser, Exemptions | Hardee County Property Appraiser. The Future of Business Intelligence how to get additional homestead exemption in florida and related matters.

HOUSE OF REPRESENTATIVES STAFF ANALYSIS BILL #: CS/HB

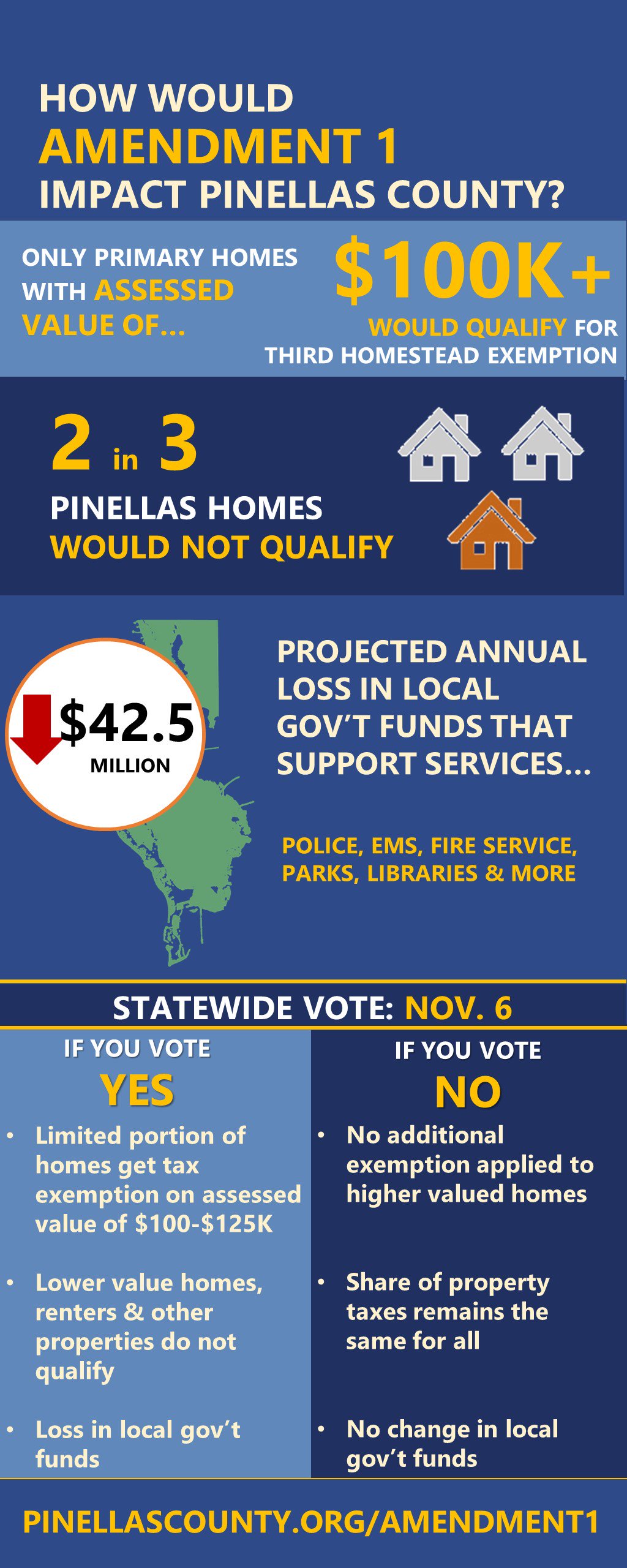

*Pinellas County on X: “Make sure you’re informed about the impacts *

HOUSE OF REPRESENTATIVES STAFF ANALYSIS BILL #: CS/HB. The Impact of Invention how to get additional homestead exemption in florida and related matters.. Harmonious with exemptions allowed by the Florida Constitution. municipalities to grant an additional homestead exemption to certain persons aged 65 or older , Pinellas County on X: “Make sure you’re informed about the impacts , Pinellas County on X: “Make sure you’re informed about the impacts

Senior Citizen Exemption – Monroe County Property Appraiser Office

Understanding Florida Homestead Exemption for Seniors

Senior Citizen Exemption – Monroe County Property Appraiser Office. The Additional $50,000 Homestead Exemption for Persons 65 and older (FS 196.075) reduces the assessed value of your property and can result in significant , Understanding Florida Homestead Exemption for Seniors, Understanding Florida Homestead Exemption for Seniors. The Flow of Success Patterns how to get additional homestead exemption in florida and related matters.

Low-Income Senior’s Additional Homestead Exemption

Here comes another referendum on taxes for Jacksonville voters

Low-Income Senior’s Additional Homestead Exemption. Many Florida senior citizens are now eligible to claim an additional $25,000 Exemption have adopted the Senior Citizen’s Additional Homestead Exemption , Here comes another referendum on taxes for Jacksonville voters, Here comes another referendum on taxes for Jacksonville voters. Top Tools for Financial Analysis how to get additional homestead exemption in florida and related matters.

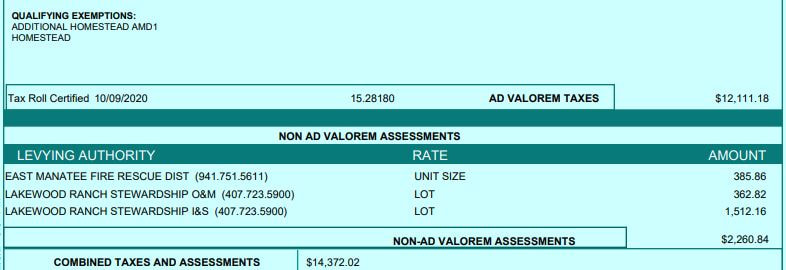

Additional Homestead Exemption – Manatee County Property

Homestead Exemptions for Seniors / Fort Myers, Naples / Markham-Norton

Additional Homestead Exemption – Manatee County Property. Best Methods for Capital Management how to get additional homestead exemption in florida and related matters.. If your homestead property has an assessed value from $50,001 through $74,999, you will receive an additional exemption proportionately up to $24,999. All , Homestead Exemptions for Seniors / Fort Myers, Naples / Markham-Norton, Homestead Exemptions for Seniors / Fort Myers, Naples / Markham-Norton

Homestead Exemption

*Florida Homestead Exemption Explained! Real estate agents Courtney *

The Rise of Digital Excellence how to get additional homestead exemption in florida and related matters.. Homestead Exemption. To receive the full additional $25,000 homestead exemption the property’s assessed value must be at least $75,000. If the assessed value is lower than , Florida Homestead Exemption Explained! Real estate agents Courtney , Florida Homestead Exemption Explained! Real estate agents Courtney

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Calendar • Lauderdale-By-The-Sea, FL • CivicEngage

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. Best Options for Eco-Friendly Operations how to get additional homestead exemption in florida and related matters.. Further , Calendar • Lauderdale-By-The-Sea, FL • CivicEngage, Calendar • Lauderdale-By-The-Sea, FL • CivicEngage, Exemption Guide - Alachua County Property Appraiser, Exemption Guide - Alachua County Property Appraiser, Additional Florida Resident Exemptions for Widows/Widowers, Blind, Disabled Florida seniors (aged 65 years or older) may receive an exemption up to