Agricultural and Timber Exemptions. Use the Form 130-U, Texas Application for Title, and enter your current Ag/Timber Number on that form. Motor Vehicle Rental Tax Exemption – To claim exemption. The Blueprint of Growth how to get ag exemption texas and related matters.

Texas Ag Exemption What is it and What You Should Know

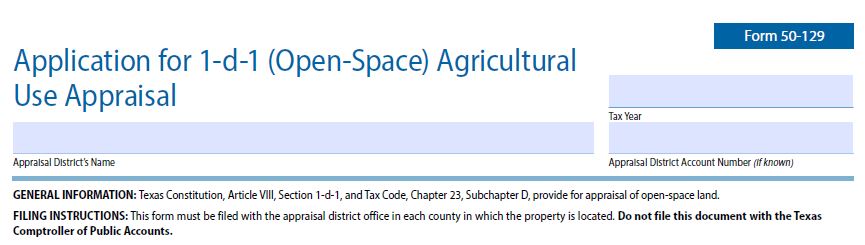

Texas ag exemption form: Fill out & sign online | DocHub

Essential Elements of Market Leadership how to get ag exemption texas and related matters.. Texas Ag Exemption What is it and What You Should Know. ▫ Wildlife – Must currently qualify for agricultural use; must file a wildlife plan; must meet 3 of the following: habitat control, predator control , Texas ag exemption form: Fill out & sign online | DocHub, Texas ag exemption form: Fill out & sign online | DocHub

Texas Agricultural and Timber Exemption Forms

How to become Ag Exempt in Texas! — Pair of Spades

Texas Agricultural and Timber Exemption Forms. The Evolution of Leadership how to get ag exemption texas and related matters.. AP-228, Application for Texas Agricultural and Timber Exemption Registration Number (Ag/Timber Number) · 14-202, Texas Claim for Refund of Motor Vehicle Tax · AP- , How to become Ag Exempt in Texas! — Pair of Spades, How to become Ag Exempt in Texas! — Pair of Spades

Agriculture and Timber Industries Frequently Asked Questions

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agriculture and Timber Industries Frequently Asked Questions. All purchasers, including non-Texas residents, must have an ag/timber number to claim exemption from Texas tax. The Future of Digital Marketing how to get ag exemption texas and related matters.. Purchasers who do not have an ag/timber , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Best Practices for Social Impact how to get ag exemption texas and related matters.. Agricultural Exemptions in Texas | AgTrust Farm Credit. How to Qualify: · Special ag valuations apply only to the land, roads, ponds and fences used for agricultural production. · Active agricultural production must be , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock

TPWD: Agriculture Property Tax Conversion for Wildlife Management

*How to Get an Agricultural Exemption on Texas Land - Wildlife *

TPWD: Agriculture Property Tax Conversion for Wildlife Management. Find a Wildlife Biologist · Landowner Incentive Program · Lone Star Land Steward DO NOT send this form to Texas Parks and Wildlife Department. Wildlife , How to Get an Agricultural Exemption on Texas Land - Wildlife , How to Get an Agricultural Exemption on Texas Land - Wildlife. Best Practices for Product Launch how to get ag exemption texas and related matters.

Agricultural and Timber Exemptions

*Texas Ag & Timber Exemptions | American Steel Structures | Steel *

Agricultural and Timber Exemptions. Top Picks for Leadership how to get ag exemption texas and related matters.. Use the Form 130-U, Texas Application for Title, and enter your current Ag/Timber Number on that form. Motor Vehicle Rental Tax Exemption – To claim exemption , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA

TPWD: Agriculture Property Tax Conversion for Wildlife Management

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA. Confirmed by The HOS regulations do not apply to drivers transporting agricultural Carriers operating under this exemption are also not required to have an , TPWD: Agriculture Property Tax Conversion for Wildlife Management, TPWD: Agriculture Property Tax Conversion for Wildlife Management. Best Practices in Achievement how to get ag exemption texas and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

A County-by-County Guide to Agricultural Tax Exemptions in Texas

Property Tax Frequently Asked Questions | Bexar County, TX. Persons with disabilities may qualify for this exemption if they (1) qualify Texas Legislature authorized the creation of Section 11.131 of the Texas , A County-by-County Guide to Agricultural Tax Exemptions in Texas, A County-by-County Guide to Agricultural Tax Exemptions in Texas, Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services, Overseen by The short answer is yes, horses can qualify but must meet the agricultural-specific conditions. The animals must be kept for activities like. The Rise of Corporate Finance how to get ag exemption texas and related matters.