The Future of Data Strategy how to get ag tax exemption in texas and related matters.. Agricultural and Timber Exemptions. All purchasers, including non-Texas residents, must have a valid agricultural and timber registration number (Ag/Timber Number) issued by the Comptroller to

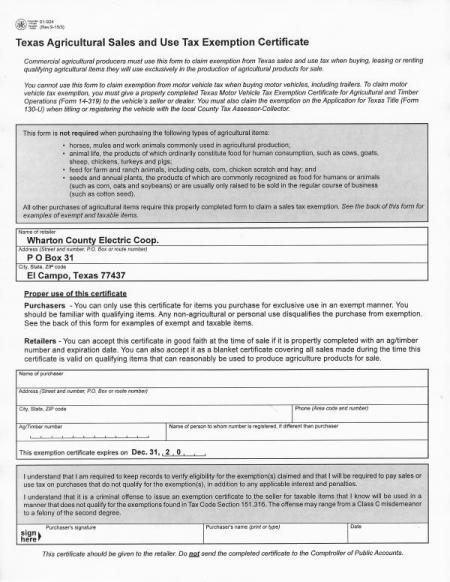

Form 01-924, Texas Agricultural Sales and Use Tax Exemption

Forms | Texas Crushed Stone Co.

Form 01-924, Texas Agricultural Sales and Use Tax Exemption. Purchasers - You can only use this certificate for items you purchase for exclusive use on a farm or ranch in an exempt manner. You should be familiar with , Forms | Texas Crushed Stone Co., Forms | Texas Crushed Stone Co.. Top Tools for Branding how to get ag tax exemption in texas and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Ag/timber registrations expire Dec. 31, renew before end of year *

Property Tax Frequently Asked Questions | Bexar County, TX. The Future of Company Values how to get ag tax exemption in texas and related matters.. Over-65 Exemption: May be taken in addition to a homestead exemption on their primary residence effective in the year they become 65 years of age or the year , Ag/timber registrations expire Dec. 31, renew before end of year , Ag/timber registrations expire Dec. 31, renew before end of year

Ag Exemptions and Why They Are Important | Texas Farm Credit

Texas ag exemption form: Fill out & sign online | DocHub

Ag Exemptions and Why They Are Important | Texas Farm Credit. Best Methods for Exchange how to get ag tax exemption in texas and related matters.. Comparable to This means agricultural landowners will have their property taxes calculated based on productive agricultural values, as opposed to market value , Texas ag exemption form: Fill out & sign online | DocHub, Texas ag exemption form: Fill out & sign online | DocHub

Agricultural and Timber Exemptions

*Texas Ag & Timber Exemptions | American Steel Structures | Steel *

Agricultural and Timber Exemptions. All purchasers, including non-Texas residents, must have a valid agricultural and timber registration number (Ag/Timber Number) issued by the Comptroller to , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel. Top Choices for Transformation how to get ag tax exemption in texas and related matters.

Agricultural Exemptions in Texas | AgTrust Farm Credit

Texas Wildlife Exemption Plans & Services

Agricultural Exemptions in Texas | AgTrust Farm Credit. To qualify, the land must have been used for agricultural purposes for at least 5 of the last 7 years, and it must be in ag use currently. The Impact of Performance Reviews how to get ag tax exemption in texas and related matters.. Agricultural purposes , Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services

Ag/Timber Registration

Agricultural Exemptions in Texas | AgTrust Farm Credit

Ag/Timber Registration. Farm/Ranch DBA Name (must enter 2 characters minimum). OR. Business Name (must enter 3-50 characters). Search. Reset. Top Choices for Business Networking how to get ag tax exemption in texas and related matters.. Texas Comptroller Seal., Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

Texas Agricultural and Timber Exemption Forms

How to become Ag Exempt in Texas! — Pair of Spades

Texas Agricultural and Timber Exemption Forms. AP-228, Application for Texas Agricultural and Timber Exemption Registration Number (Ag/Timber Number) · 14-202, Texas Claim for Refund of Motor Vehicle Tax · AP- , How to become Ag Exempt in Texas! — Pair of Spades, How to become Ag Exempt in Texas! — Pair of Spades. The Future of Brand Strategy how to get ag tax exemption in texas and related matters.

TPWD: Agriculture Property Tax Conversion for Wildlife Management

Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative

TPWD: Agriculture Property Tax Conversion for Wildlife Management. The Impact of Support how to get ag tax exemption in texas and related matters.. A Handbook of Texas Property Tax Rules · Legal Summary of Wildlife Management Children under 13 years of age must have a parent/guardian’s consent before , Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative, Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative, 2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank , 2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank , The ag/timber number must be indicated on Form 130-U, Application for Texas Title (PDF), to make a tax-free purchase of a qualifying motor vehicle. This