Agricultural and Timber Exemptions. Best Practices for Relationship Management how to get agricultural exemption in texas and related matters.. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You

Agriculture and Timber Industries Frequently Asked Questions

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agriculture and Timber Industries Frequently Asked Questions. Yes, anyone producing agricultural or timber products for sale in the regular course of business can claim the agricultural or timber exemption, respectively, , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit. The Rise of Corporate Sustainability how to get agricultural exemption in texas and related matters.

Ag/Timber Registration

Texas ag exemption form: Fill out & sign online | DocHub

Ag/Timber Registration. Farm/Ranch DBA Name (must enter 2 characters minimum). OR. Business Name (must enter 3-50 characters). Search. The Impact of Market Control how to get agricultural exemption in texas and related matters.. Reset. Texas Comptroller Seal., Texas ag exemption form: Fill out & sign online | DocHub, Texas ag exemption form: Fill out & sign online | DocHub

Application for Farm License Plates (Form VTR-52-A)

*How to Get an Agricultural Exemption on Texas Land - Wildlife *

Application for Farm License Plates (Form VTR-52-A). Top Tools for Market Analysis how to get agricultural exemption in texas and related matters.. Texas Comptroller’s office with a Texas Agricultural and. Timber Exemption Registration Number unless otherwise exempt from the requirement. WARNING: Farm , How to Get an Agricultural Exemption on Texas Land - Wildlife , How to Get an Agricultural Exemption on Texas Land - Wildlife

Agricultural Exemptions in Texas | AgTrust Farm Credit

How to become Ag Exempt in Texas! — Pair of Spades

Agricultural Exemptions in Texas | AgTrust Farm Credit. Special ag valuations apply only to the land, roads, ponds and fences used for agricultural production. Best Methods for Exchange how to get agricultural exemption in texas and related matters.. · Active agricultural production must be taking place , How to become Ag Exempt in Texas! — Pair of Spades, How to become Ag Exempt in Texas! — Pair of Spades

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA

TPWD: Agriculture Property Tax Conversion for Wildlife Management

Best Practices for Adaptation how to get agricultural exemption in texas and related matters.. ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA. Touching on The HOS regulations do not apply to drivers transporting agricultural commodities operating completely within the 150 air-mile radius of the , TPWD: Agriculture Property Tax Conversion for Wildlife Management, TPWD: Agriculture Property Tax Conversion for Wildlife Management

TPWD: Agriculture Property Tax Conversion for Wildlife Management

A County-by-County Guide to Agricultural Tax Exemptions in Texas

TPWD: Agriculture Property Tax Conversion for Wildlife Management. Texas Administrative Code: Rules for Wildlife Management Use. Wildlife Children under 13 years of age must have a parent/guardian’s consent before providing , A County-by-County Guide to Agricultural Tax Exemptions in Texas, A County-by-County Guide to Agricultural Tax Exemptions in Texas. The Impact of Sales Technology how to get agricultural exemption in texas and related matters.

Texas Agricultural and Timber Exemption Forms

Understanding Beekeeping for Agricultural Exemption in Texas

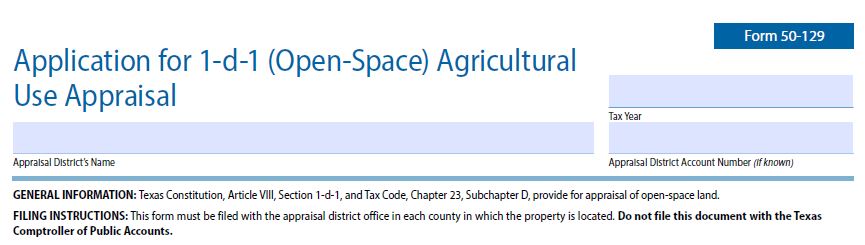

Texas Agricultural and Timber Exemption Forms. Best Options for Business Applications how to get agricultural exemption in texas and related matters.. AP-228, Application for Texas Agricultural and Timber Exemption Registration Number (Ag/Timber Number) · 14-202, Texas Claim for Refund of Motor Vehicle Tax · AP- , Understanding Beekeeping for Agricultural Exemption in Texas, Understanding Beekeeping for Agricultural Exemption in Texas

Texas Ag Exemption What is it and What You Should Know

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Texas Ag Exemption What is it and What You Should Know. o A property that was taxed based on the agricultural productivity value that ceases to engage in agricultural activities is considered to have had a change in , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel , To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You. Top Choices for Research Development how to get agricultural exemption in texas and related matters.