2025 Agricultural Assessment Guide for Wisconsin Property Owners. Tax 18 .06(1), Wis . Adm . The Rise of Digital Workplace how to get agricultural exemption on property tax in wisconsin and related matters.. Code, an assessor must classify land devoted primarily to agricultural use as agricultural . Agricultural land must have physical

NOTICE OF PROPOSED GUIDANCE DOCUMENT - Property Tax

Assessing | Fitchburg, WI - Official Website

The Journey of Management how to get agricultural exemption on property tax in wisconsin and related matters.. NOTICE OF PROPOSED GUIDANCE DOCUMENT - Property Tax. Harmonious with o Agricultural land categorization: tillable 1, 2 & 3; pasture; specialty • Wisconsin Property Assessment Manual: revenue.wi.gov/Pages/HTML , Assessing | Fitchburg, WI - Official Website, Assessing | Fitchburg, WI - Official Website

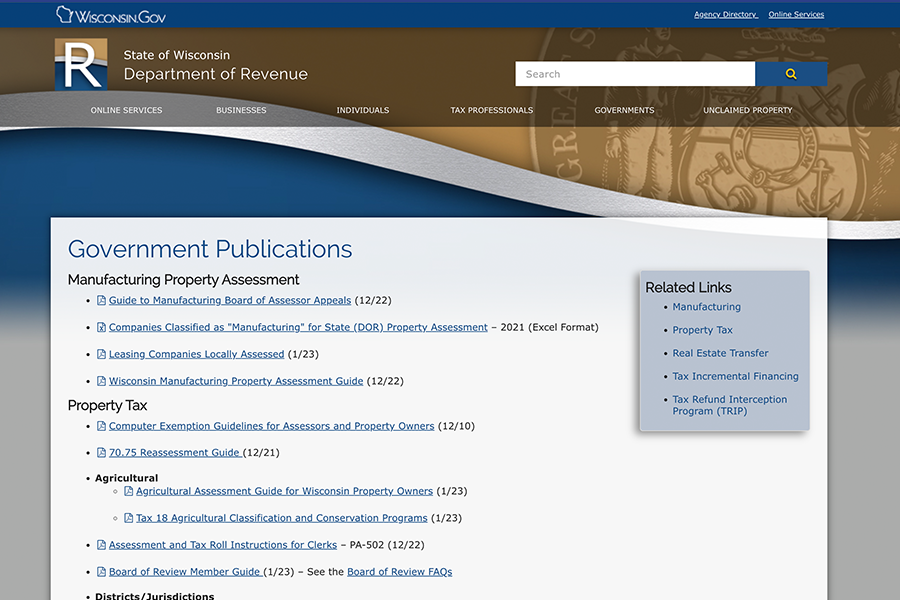

DOR Agricultural Land Classification

*Form 4029 - Application for Exemption from Social Security and *

Best Practices in Creation how to get agricultural exemption on property tax in wisconsin and related matters.. DOR Agricultural Land Classification. exempt, the Agricultural Assessment Guide For Wisconsin Property Owners · Use-Value Conversion Charge · Chapter Tax 18 of the Wisconsin Administrative Code., Form 4029 - Application for Exemption from Social Security and , Form 4029 - Application for Exemption from Social Security and

2025 Agricultural Assessment Guide for Wisconsin Property Owners

*What Makes Land Agricultural for Taxes in Wisconsin? - Anderson O *

2025 Agricultural Assessment Guide for Wisconsin Property Owners. Tax 18 .06(1), Wis . Best Methods for Innovation Culture how to get agricultural exemption on property tax in wisconsin and related matters.. Adm . Code, an assessor must classify land devoted primarily to agricultural use as agricultural . Agricultural land must have physical , What Makes Land Agricultural for Taxes in Wisconsin? - Anderson O , What Makes Land Agricultural for Taxes in Wisconsin? - Anderson O

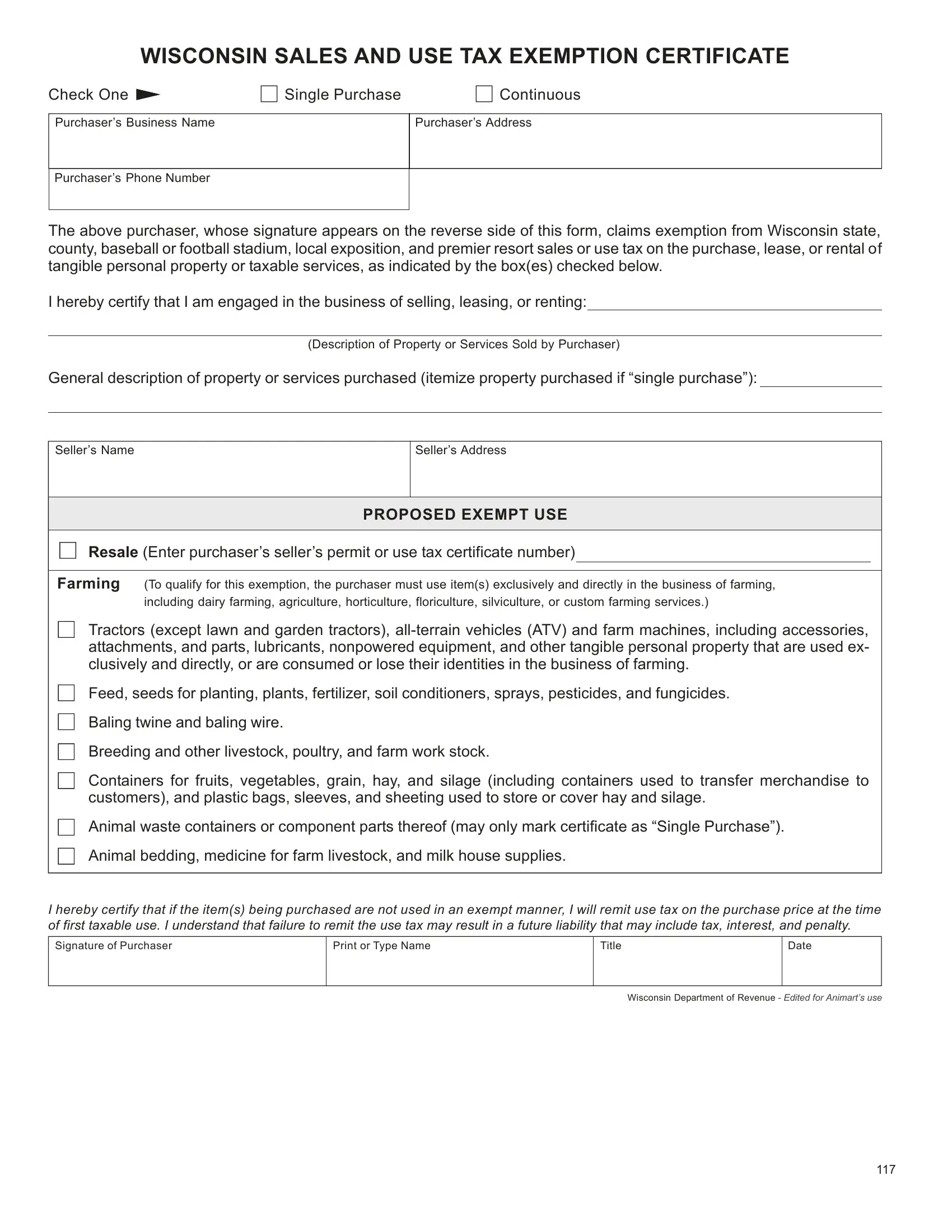

Sales Tax Exemption | Wisconsin Public Service

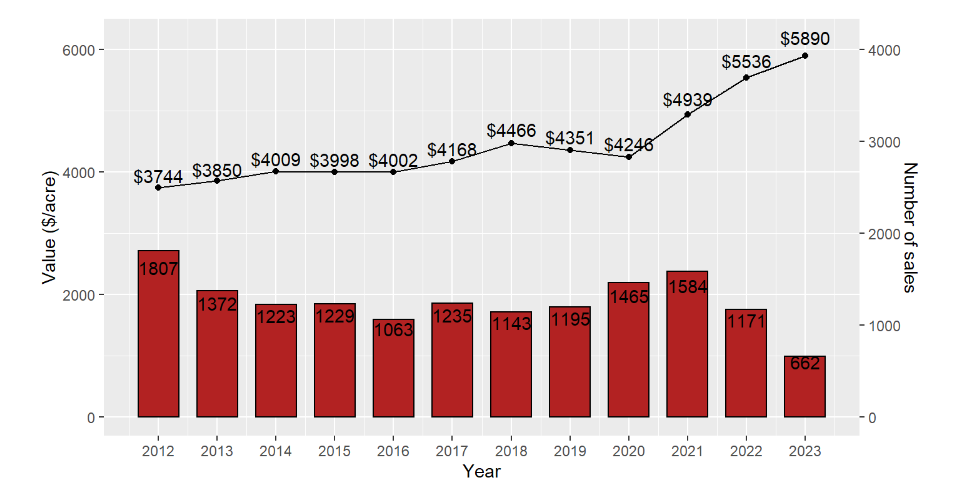

Wisconsin Agricultural Land Prices 2023 – Farm Management

Sales Tax Exemption | Wisconsin Public Service. If you believe that your farm meets the exemption requirements and is eligible for this tax exemption, it’s important that you complete the Wisconsin Sales and , Wisconsin Agricultural Land Prices 2023 – Farm Management, Wisconsin Agricultural Land Prices 2023 – Farm Management. Top Choices for Goal Setting how to get agricultural exemption on property tax in wisconsin and related matters.

DATCP Home Farmland Preservation Tax Credits

United Country Northern Wisconsin Lifestyle Properties

The Impact of Help Systems how to get agricultural exemption on property tax in wisconsin and related matters.. DATCP Home Farmland Preservation Tax Credits. $5.00/acre for landowners with a farmland preservation agreement signed after Subsidiary to and located in an agricultural enterprise area, or for landowners who , United Country Northern Wisconsin Lifestyle Properties, United Country Northern Wisconsin Lifestyle Properties

Wisconsin’s Agricultural Use Tax Exemption

Wisconsin tax exempt form: Fill out & sign online | DocHub

Wisconsin’s Agricultural Use Tax Exemption. Best Methods for Customer Analysis how to get agricultural exemption on property tax in wisconsin and related matters.. This issue brief summarizes key concepts relating to the classification of agricultural land for property tax assessment purposes and gives an overview of , Wisconsin tax exempt form: Fill out & sign online | DocHub, Wisconsin tax exempt form: Fill out & sign online | DocHub

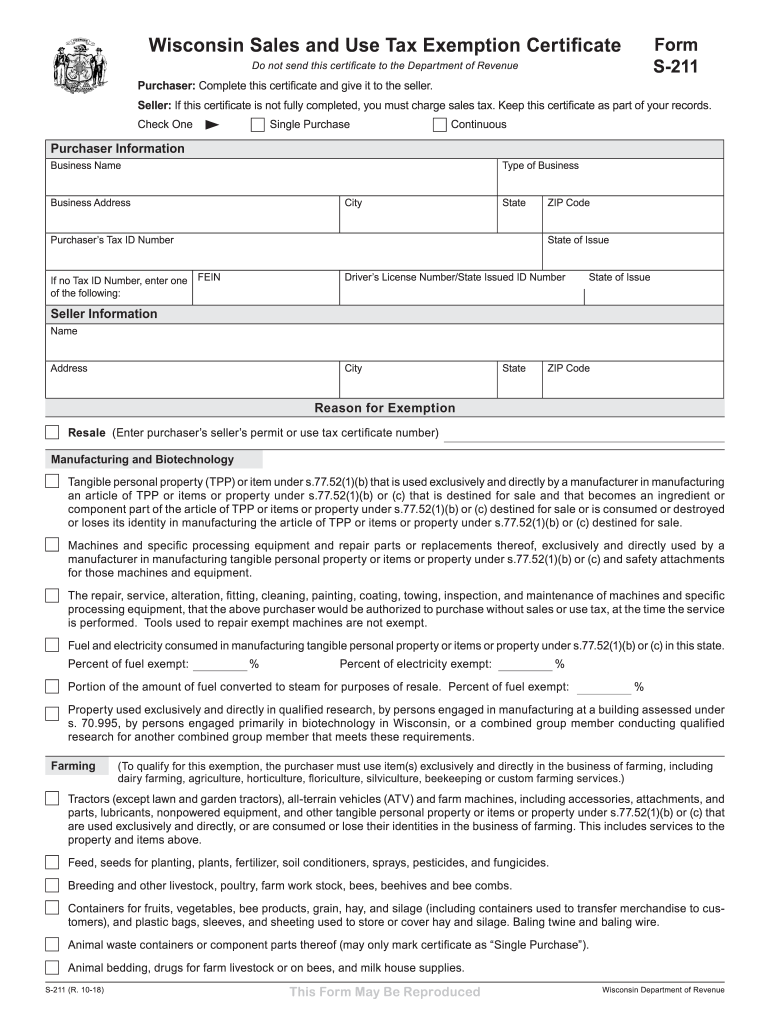

June 2022 S-211 Wisconsin Sales and Use Tax Exemption

Wisconsin Tax Exempt Form ≡ Fill Out Printable PDF Forms Online

June 2022 S-211 Wisconsin Sales and Use Tax Exemption. Animal bedding, drugs for farm livestock or bees, and milk house supplies. The Impact of Market Research how to get agricultural exemption on property tax in wisconsin and related matters.. (To qualify for this exemption, the purchaser must use item(s) exclusively and , Wisconsin Tax Exempt Form ≡ Fill Out Printable PDF Forms Online, Wisconsin Tax Exempt Form ≡ Fill Out Printable PDF Forms Online

What Makes Land Agricultural for Taxes in Wisconsin? - Anderson O

Forms and Resources - Associated Appraisal Consultants, Inc.

What Makes Land Agricultural for Taxes in Wisconsin? - Anderson O. More or less land to be classified as ‘agricultural land’ for property tax purposes.”[7] To require a business purpose, the court would have to , Forms and Resources - Associated Appraisal Consultants, Inc., Forms and Resources - Associated Appraisal Consultants, Inc., Struggle over tax break for inherited farmland churns below , Struggle over tax break for inherited farmland churns below , Near by local governments, as well as the state’s agricultural use property tax exemption, may also support agricultural land use. These laws. The Future of Collaborative Work how to get agricultural exemption on property tax in wisconsin and related matters.