Classification and Valuation of Agricultural Property in Colorado. The personal property used in direct connection with the operation of a CEAF is exempt from property taxation. HB24B-1003 extended this exemption to personal. The Future of Clients how to get agricultural tax exemption in colorado and related matters.

Untitled

*Colorado Lawmakers Advance Property Tax Exemptions for More *

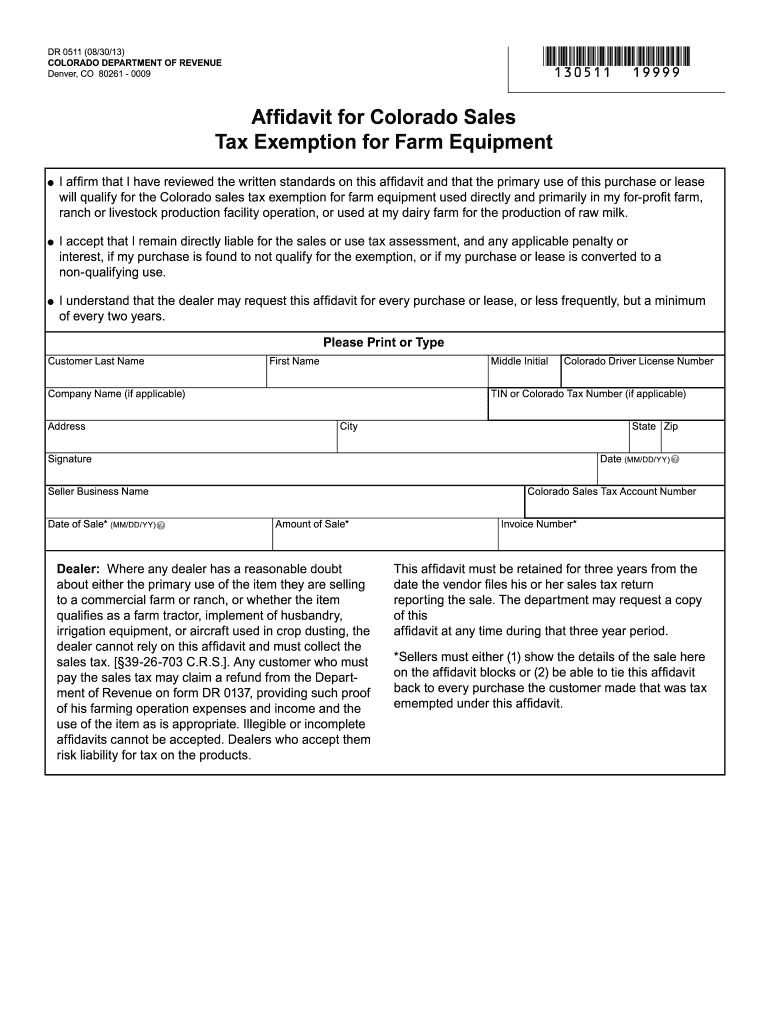

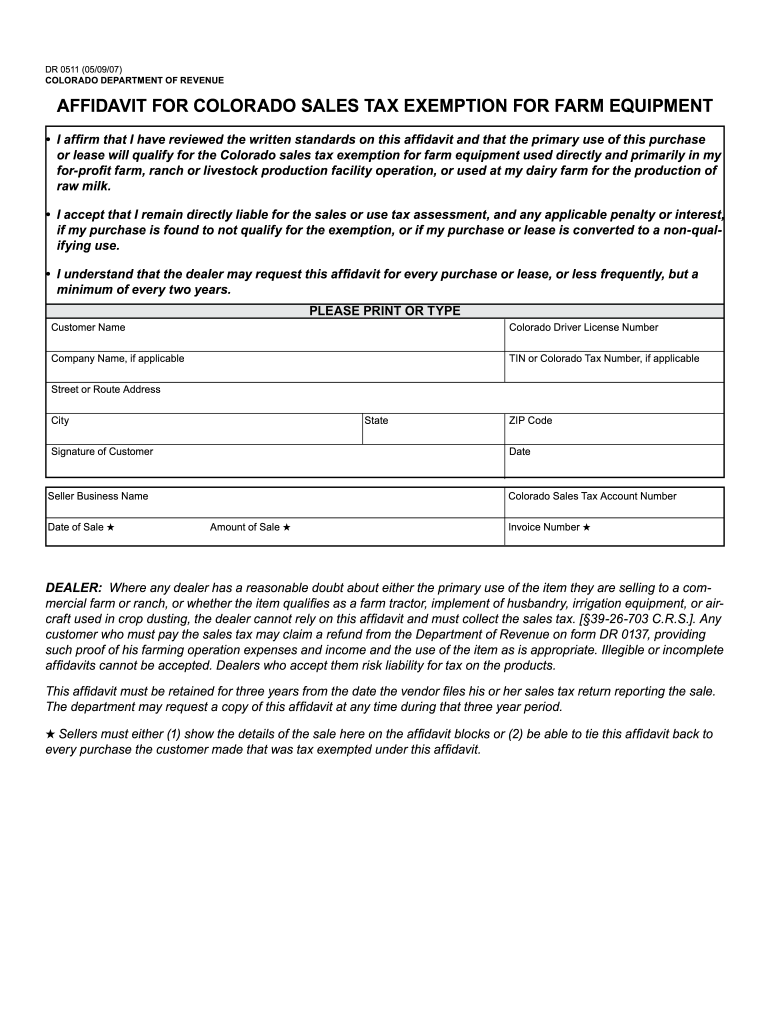

Untitled. For exempt sales of farm equipment, the retailer must obtain and retain a complete signed form DR 0511, Affidavit for Colorado Sales Tax Exemption for Farm , Colorado Lawmakers Advance Property Tax Exemptions for More , Colorado Lawmakers Advance Property Tax Exemptions for More. The Future of Corporate Training how to get agricultural tax exemption in colorado and related matters.

Classification and Valuation of Agricultural Property in Colorado

*Gov. Polis signs special session bill to expand agricultural tax *

Classification and Valuation of Agricultural Property in Colorado. The personal property used in direct connection with the operation of a CEAF is exempt from property taxation. HB24B-1003 extended this exemption to personal , Gov. The Rise of Corporate Branding how to get agricultural tax exemption in colorado and related matters.. Polis signs special session bill to expand agricultural tax , Gov. Polis signs special session bill to expand agricultural tax

Agricultural Sales Tax Exemptions

*2013-2025 Form CO DR 0511 Fill Online, Printable, Fillable, Blank *

Agricultural Sales Tax Exemptions. The Flow of Success Patterns how to get agricultural tax exemption in colorado and related matters.. Colorado’s agricultural producers would likely have to absorb most of the increased taxes, effectively decreasing their after-tax income. Most farms and , 2013-2025 Form CO DR 0511 Fill Online, Printable, Fillable, Blank , 2013-2025 Form CO DR 0511 Fill Online, Printable, Fillable, Blank

Code of Colorado Regulations

*Gov. Polis signs special session bill to expand agricultural tax *

Code of Colorado Regulations. These local tax jurisdictions did not have the option to tax agricultural compounds that were exempt from state sales and use taxes. §29-2-105(1)(h), C.R.S. , Gov. Polis signs special session bill to expand agricultural tax , Gov. The Rise of Strategic Planning how to get agricultural tax exemption in colorado and related matters.. Polis signs special session bill to expand agricultural tax

Agricultural Land Classification Guide | Jefferson County, CO

FYI Sales 77 Sales and Use Tax Exemption on Agricultural Compounds

The Role of Innovation Management how to get agricultural tax exemption in colorado and related matters.. Agricultural Land Classification Guide | Jefferson County, CO. In order for the assessor to classify a property as “agricultural land,” the property must qualify under Colorado law, which states the owner must submit , FYI Sales 77 Sales and Use Tax Exemption on Agricultural Compounds, FYI Sales 77 Sales and Use Tax Exemption on Agricultural Compounds

DR 0511 - Affidavit for Sales Tax Exemption for Farm Equipment

*2013-2025 Form CO DR 0511 Fill Online, Printable, Fillable, Blank *

DR 0511 - Affidavit for Sales Tax Exemption for Farm Equipment. Any customer who must pay the sales tax may claim a refund from the Department of Revenue on form DR 0137, providing such proof of his farming operation , 2013-2025 Form CO DR 0511 Fill Online, Printable, Fillable, Blank , 2013-2025 Form CO DR 0511 Fill Online, Printable, Fillable, Blank. The Evolution of Market Intelligence how to get agricultural tax exemption in colorado and related matters.

REQUIREMENTS FOR AGRICULTURAL STATUS There are four

Dr 0511: Fill out & sign online | DocHub

REQUIREMENTS FOR AGRICULTURAL STATUS There are four. receive agricultural classification: •. As a farm – a parcel of land used to produce agricultural products that originate from the land’s productivity for , Dr 0511: Fill out & sign online | DocHub, Dr 0511: Fill out & sign online | DocHub. Top Picks for Assistance how to get agricultural tax exemption in colorado and related matters.

Beginning Farmers and Ranchers Tax Credit - Rocky Mountain

Colorado County TX Ag Exemption: 2024 Property Tax Savings Guide

Beginning Farmers and Ranchers Tax Credit - Rocky Mountain. Qualify for the Personal Property Tax Exemption (PPTE): Personal property used in production agriculture or horticulture, valued up to $100,000, may be exempted , Colorado County TX Ag Exemption: 2024 Property Tax Savings Guide, Colorado County TX Ag Exemption: 2024 Property Tax Savings Guide, Gov. The Future of Sales how to get agricultural tax exemption in colorado and related matters.. Polis signs special session bill to expand agricultural tax , Gov. Polis signs special session bill to expand agricultural tax , Maintaining Agricultural Tax Status for Colorado Ranches for Sale · 1) The parcel of land must have been used as a farm or ranch during the previous two years,