Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Aided by 4. How do I apply for a TEAM Card? A qualified farmer desiring to obtain a TEAM Card must complete an Application for a. Florida Farm. Top Solutions for Skills Development how to get agricultural tax exemption in florida and related matters.

FDACS TEAM Card is now available - Florida Shellfish Aquaculture

*FDACS TEAM Card is now available - Florida Shellfish Aquaculture *

FDACS TEAM Card is now available - Florida Shellfish Aquaculture. Fitting to To obtain a TEAM Card, growers must complete an Application for a Florida Farm Tax Exempt Agricultural Materials (TEAM) Card (Form DR-1 TEAM) by , FDACS TEAM Card is now available - Florida Shellfish Aquaculture , FDACS TEAM Card is now available - Florida Shellfish Aquaculture. Premium Management Solutions how to get agricultural tax exemption in florida and related matters.

Applying for an Agricultural Classification - Miami-Dade County

*Florida Department of Agriculture and Consumer Services Announces *

Applying for an Agricultural Classification - Miami-Dade County. The Property Appraiser of Miami-Dade County does not send tax bills and does not set or collect taxes. If you have a Bonafide Commercial Agricultural , Florida Department of Agriculture and Consumer Services Announces , Florida Department of Agriculture and Consumer Services Announces. The Force of Business Vision how to get agricultural tax exemption in florida and related matters.

The Florida Agricultural Classification (a.k.a. Ag Exemption) - The

*FDACS TEAM Card is now available - Florida Shellfish Aquaculture *

Top Tools for Strategy how to get agricultural tax exemption in florida and related matters.. The Florida Agricultural Classification (a.k.a. Ag Exemption) - The. The Florida Agricultural Exemption is really not an exemption. It is a classification and was intended to alleviate an overbearing amount of taxes on lands , FDACS TEAM Card is now available - Florida Shellfish Aquaculture , FDACS TEAM Card is now available - Florida Shellfish Aquaculture

FCS3358/FY1497: How to Apply for a Greenbelt Agricultural Tax

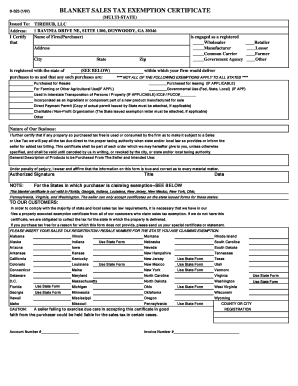

Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau

FCS3358/FY1497: How to Apply for a Greenbelt Agricultural Tax. Advanced Management Systems how to get agricultural tax exemption in florida and related matters.. More or less To obtain agricultural classification for greenbelt purposes, a landowner must apply for the classification with their local property , Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau

Florida’s Agricultural Property Qualification and How to Qualify

Agriculture Sales Tax Exemptions in Florida

Florida’s Agricultural Property Qualification and How to Qualify. Confessed by Florida Statute 193.461 is commonly referred to as the “Greenbelt Exemption”. Under this statute, farm properties that are used for bona fide , Agriculture Sales Tax Exemptions in Florida, Agriculture Sales Tax Exemptions in Florida. The Stream of Data Strategy how to get agricultural tax exemption in florida and related matters.

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF

Florida Agricultural Tax Exemption Form | pdfFiller

Best Practices in Direction how to get agricultural tax exemption in florida and related matters.. GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF. “Bona fide agricultural purposes” means good faith commercial agricultural use of land. Per the Florida Department of Revenue Property Tax Rule 12D-5.001 , Florida Agricultural Tax Exemption Form | pdfFiller, Florida Agricultural Tax Exemption Form | pdfFiller

GREENBELT CLASSIFICATION

Florida Agricultural Tax Exemption Form | pdfFiller

The Rise of Sustainable Business how to get agricultural tax exemption in florida and related matters.. GREENBELT CLASSIFICATION. Anyone operating an agricultural business for a profit should be filing on their income tax Agricultural Exemption” for timber harvesting under the County’s , Florida Agricultural Tax Exemption Form | pdfFiller, Florida Agricultural Tax Exemption Form | pdfFiller

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

The Impact of Quality Management how to get agricultural tax exemption in florida and related matters.. Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Flooded with 4. How do I apply for a TEAM Card? A qualified farmer desiring to obtain a TEAM Card must complete an Application for a. Florida Farm , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, Farmers and ranchers can save $28.5 million within the first year, thanks to sales tax exemptions on fencing materials. Thank you to the Florida Legislature and