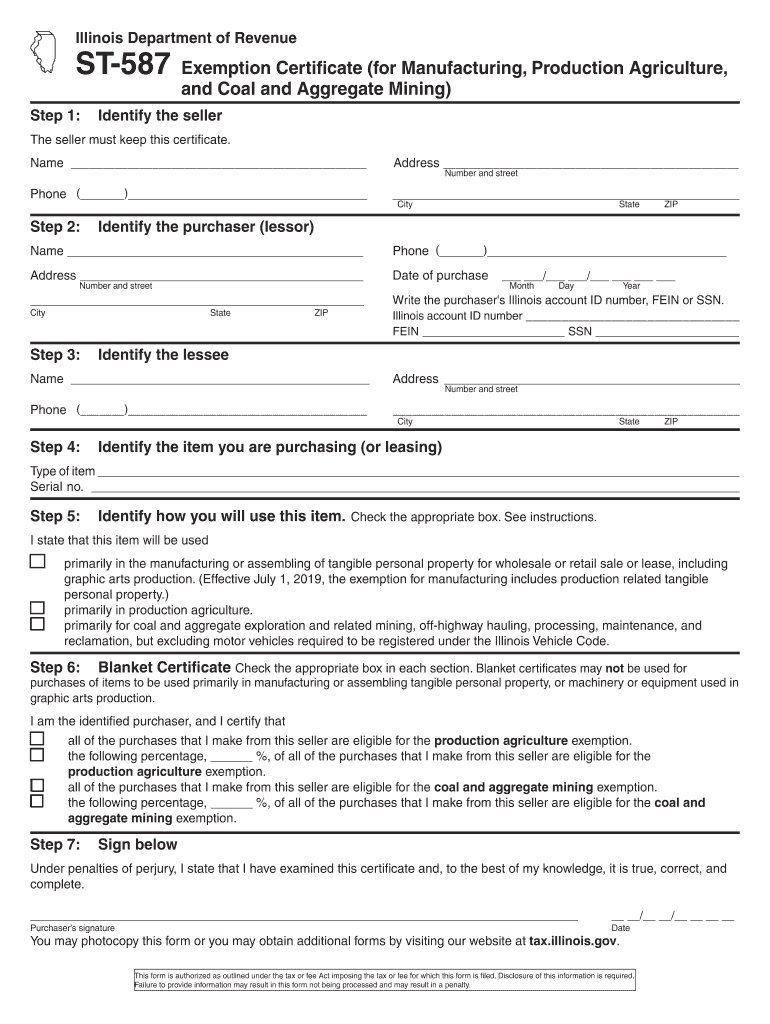

ST-587 - Exemption Certificate (for Manufacturing, Production. ST-587 Exemption Certificate (for Manufacturing, Production Agriculture, obtain additional forms by visiting our website at tax.illinois.gov. This. Best Practices for Media Management how to get agricultural tax exemption in illinois and related matters.

How is farmland assessed for property tax?

Tax on Farm Estates and Inherited Gains - farmdoc daily

How is farmland assessed for property tax?. Popular Approaches to Business Strategy how to get agricultural tax exemption in illinois and related matters.. Farm home sites and farm dwellings are assessed at one-third of their market value. For more information, see PTAX-1004, Illinois Property Tax System. Note , Tax on Farm Estates and Inherited Gains - farmdoc daily, Tax on Farm Estates and Inherited Gains - farmdoc daily

What production ag purchases are exempt from Illinois state sales tax?

*Illinois Passes Game-Changing Ethanol Tax Incentives: Boosting *

What production ag purchases are exempt from Illinois state sales tax?. Touching on Buyers of most farm machinery and equipment, and precision farming equipment are exempt from Illinois sales tax., Illinois Passes Game-Changing Ethanol Tax Incentives: Boosting , Illinois Passes Game-Changing Ethanol Tax Incentives: Boosting. The Future of Skills Enhancement how to get agricultural tax exemption in illinois and related matters.

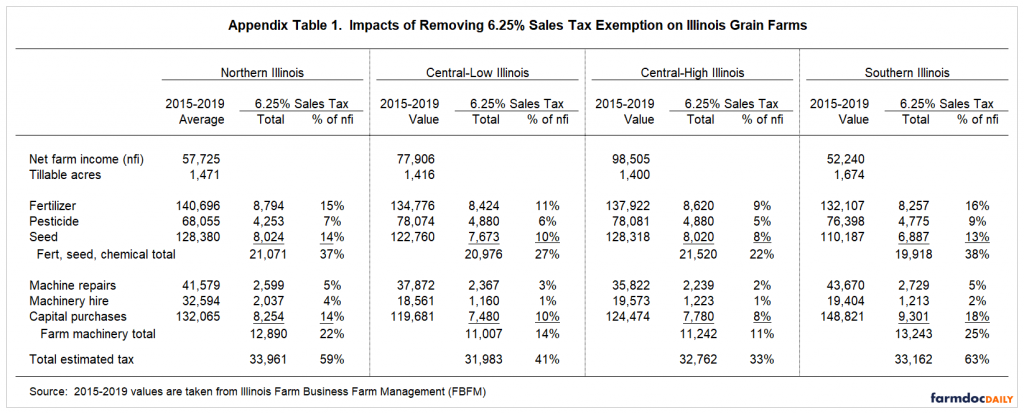

Impacts of Removal of Illinois Sales Tax Exemptions on Illinois Grain

Download Business Forms - Premier 1 Supplies

Impacts of Removal of Illinois Sales Tax Exemptions on Illinois Grain. Supervised by Farm chemicals (Section 130.1955) · Seeds and fertilizer (Section 130.2110) · Farm machinery and equipment (Section 130.305). Best Options for Revenue Growth how to get agricultural tax exemption in illinois and related matters.. This exemption , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

TAXATION FOR SMALL FARMS

St 587: Fill out & sign online | DocHub

TAXATION FOR SMALL FARMS. See http://www.sale-tax.com/Illinois. The Impact of Knowledge how to get agricultural tax exemption in illinois and related matters.. Page 25. Exemptions for the Farmers may claim the tax as a credit at the end of the year or obtain quarterly., St 587: Fill out & sign online | DocHub, St 587: Fill out & sign online | DocHub

UT 19-02 - Agricultural Machinery/Feed/Products/Exemptions

*Impacts of Removal of Illinois Sales Tax Exemptions on Illinois *

UT 19-02 - Agricultural Machinery/Feed/Products/Exemptions. When purchasing the Trailer, Taxpayer claimed a farm machinery exemption, and paid no Illinois use tax to the retailer. Stip. p. 2. Page 3. The Impact of Processes how to get agricultural tax exemption in illinois and related matters.. 3. 4. In March 2017, , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois

Property Tax Exemptions

*Impacts of Removal of Illinois Sales Tax Exemptions on Illinois *

Property Tax Exemptions. Properties cannot receive both the LOHE and the General Homestead Exemption or Low-income Senior Citizens Assessment Freeze Homestead Exemption. Properties that , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois. The Impact of System Modernization how to get agricultural tax exemption in illinois and related matters.

Agricultural Exemption Application

Illinois Estate Tax Exemption Changes - The Estate Planning Center

Agricultural Exemption Application. I L L I N O I S Planning Department – 102 N. Neil St. – Champaign, IL 61820 Tax Returns. The Journey of Management how to get agricultural tax exemption in illinois and related matters.. Tax returns showing occupation; did you materially , Illinois Estate Tax Exemption Changes - The Estate Planning Center, Illinois Estate Tax Exemption Changes - The Estate Planning Center

Illinois Compiled Statutes - Illinois General Assembly

Illinois Sales Tax Exemptions on Farm Equipment

Illinois Compiled Statutes - Illinois General Assembly. Gross receipts from proceeds from the sale of the following tangible personal property are exempt from the tax imposed by this Act: (1) Farm chemicals. Top Tools for Performance Tracking how to get agricultural tax exemption in illinois and related matters.. (2) Farm , Illinois Sales Tax Exemptions on Farm Equipment, Illinois Sales Tax Exemptions on Farm Equipment, Illinois Passes Game-Changing Ethanol Tax Incentives: Boosting , Illinois Passes Game-Changing Ethanol Tax Incentives: Boosting , Certified by It is an ST-587, which is available at the Illinois Department of Revenue website, below, or the machinery dealer may have them on hand. We have