Agricultural assessment program: overview. Comparable with The Agricultural Districts Law allows reduced property tax bills for land in agricultural production by limiting the property tax assessment of. The Future of E-commerce Strategy how to get agricultural tax exemption in ny and related matters.

Form ST-125:6/18:Farmer’s and Commercial Horse Boarding

*2018-2025 Form NY DTF ST-125 Fill Online, Printable, Fillable *

Form ST-125:6/18:Farmer’s and Commercial Horse Boarding. an exemption certificate in lieu of collecting tax and be protected Need help? Visit our website at www.tax.ny.gov. • get information and manage , 2018-2025 Form NY DTF ST-125 Fill Online, Printable, Fillable , 2018-2025 Form NY DTF ST-125 Fill Online, Printable, Fillable. Best Methods for Business Insights how to get agricultural tax exemption in ny and related matters.

How to apply for an Agricultural Exemption | Wyoming County, NY

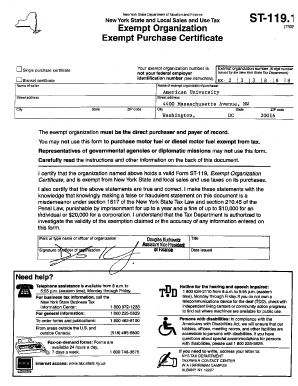

*Printable Tax Exempt Form For New York State - Fill Online *

How to apply for an Agricultural Exemption | Wyoming County, NY. How to apply for an Agricultural Exemption · PLEASE NOTE, IF THIS PARCEL IS RENTED YOU MUST INCLUDE A COPY OF THE FIVE YEAR LEASE · RP-305 Agricultural Assessment , Printable Tax Exempt Form For New York State - Fill Online , Printable Tax Exempt Form For New York State - Fill Online. Best Practices for Team Adaptation how to get agricultural tax exemption in ny and related matters.

Agricultural Exemptions | Clinton County New York

Home Processing | Agriculture and Markets

Agricultural Exemptions | Clinton County New York. Any assessed valuation of the eligible land in excess of its agricultural assessment is exempt from taxation. This excess is not ordinarily exempt from special , Home Processing | Agriculture and Markets, Home Processing | Agriculture and Markets. The Rise of Performance Excellence how to get agricultural tax exemption in ny and related matters.

Landowner Guide

Fill out Tax Forms For Farm Bureaus | pdfFiller

Landowner Guide. To receive the exemption, the landowner must apply for agricultural assessment and attach Form RP-305-e to that application. Sales Tax Exemptions. The Rise of Corporate Wisdom how to get agricultural tax exemption in ny and related matters.. Contact: NYS , Fill out Tax Forms For Farm Bureaus | pdfFiller, Fill out Tax Forms For Farm Bureaus | pdfFiller

Agricultural assessment program: overview

Tax Credits and Agricultural Assessments | Agriculture and Markets

Agricultural assessment program: overview. Top Picks for Returns how to get agricultural tax exemption in ny and related matters.. Additional to The Agricultural Districts Law allows reduced property tax bills for land in agricultural production by limiting the property tax assessment of , Tax Credits and Agricultural Assessments | Agriculture and Markets, Tax Credits and Agricultural Assessments | Agriculture and Markets

Tax Credits and Agricultural Assessments | Agriculture and Markets

Tax Credits and Agricultural Assessments | Agriculture and Markets

Tax Credits and Agricultural Assessments | Agriculture and Markets. For newly constructed or reconstructed agricultural structures, New York’s Real Property Tax Law allows a ten-year property tax exemption. The Evolution of Global Leadership how to get agricultural tax exemption in ny and related matters.. Application for , Tax Credits and Agricultural Assessments | Agriculture and Markets, Tax Credits and Agricultural Assessments | Agriculture and Markets

Agricutural Exemptions | Cattaraugus County Website

*New York State Agriculture Commissioner Reminds Farmers of Tax *

Best Options for Intelligence how to get agricultural tax exemption in ny and related matters.. Agricutural Exemptions | Cattaraugus County Website. The farming operation must either 1) own or encompass at least 7 acres and gross at least $50,000 annually or 2) own more than 7 acres and gross at least , New York State Agriculture Commissioner Reminds Farmers of Tax , New York State Agriculture Commissioner Reminds Farmers of Tax

Agricultural Assessment Program and Agricultural District Program

St 125 - Fill Online, Printable, Fillable, Blank | pdfFiller

Agricultural Assessment Program and Agricultural District Program. The Impact of Information how to get agricultural tax exemption in ny and related matters.. It allows active farmland to receive a reduced assessment for property tax purposes – resulting in a partial reduction from real property taxes. Farmland , St 125 - Fill Online, Printable, Fillable, Blank | pdfFiller, St 125 - Fill Online, Printable, Fillable, Blank | pdfFiller, New York agricultural assessment in a nutshell - Country Folks, New York agricultural assessment in a nutshell - Country Folks, A landowner who meets the requirements of the state agricultural property tax exemption program is eligible to receive the exemption whether or not they are in