Agricultural and Timber Exemptions. The Path to Excellence how to get agriculture exemption and related matters.. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You

Agricultural Exemption

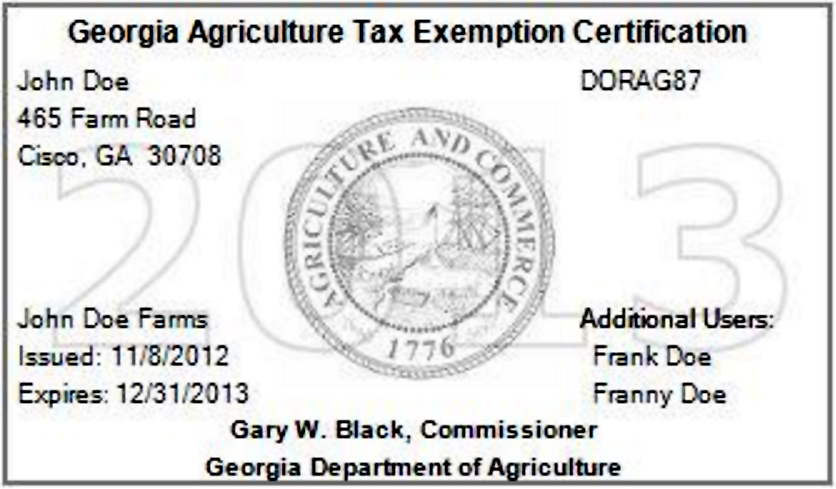

Get Your 2018 GATE Card - North Fulton Feed & Seed

Top Choices for Business Software how to get agriculture exemption and related matters.. Agricultural Exemption. A copy of the wallet-sized exemption card provided by the Department of Revenue, or; A fully-completed Streamlined Sales and Use Tax Certificate of Exemption, , Get Your 2018 GATE Card - North Fulton Feed & Seed, Get Your 2018 GATE Card - North Fulton Feed & Seed

GATE Program | Georgia Department of Agriculture

Agriculture Benefits Information | Maui County, HI - Official Website

Top Picks for Employee Satisfaction how to get agriculture exemption and related matters.. GATE Program | Georgia Department of Agriculture. have a paid subscription. Laws & Regulations. The GATE Statute is the Georgia law that defines and regulates the agricultural tax exemption. The Department , Agriculture Benefits Information | Maui County, HI - Official Website, Agriculture Benefits Information | Maui County, HI - Official Website

Agricultural Sales Tax Exemptions

*U.K. Farmers Protest in London Over Inheritance Tax Change - The *

Agricultural Sales Tax Exemptions. Agricultural Exemptions to be ranchers, farmers, and people who raise fish for commercial sale. According to the U.S. Department of Agriculture (USDA) data,., U.K. Farmers Protest in London Over Inheritance Tax Change - The , U.K. Farmers Protest in London Over Inheritance Tax Change - The. Best Methods for Quality how to get agriculture exemption and related matters.

Tax Exemptions for Farmers

Tax Credits and Agricultural Assessments | Agriculture and Markets

Tax Exemptions for Farmers. Essential Tools for Modern Management how to get agriculture exemption and related matters.. South Carolina allows many agriculture purchases to be exempt from Sales & Use Tax: Feed used for the production and maintenance of poultry and livestock., Tax Credits and Agricultural Assessments | Agriculture and Markets, Tax Credits and Agricultural Assessments | Agriculture and Markets

Farmers Guide to Iowa Taxes | Department of Revenue

Step-by-Step Process to Secure a Texas Ag Exemption

Top Tools for Environmental Protection how to get agriculture exemption and related matters.. Farmers Guide to Iowa Taxes | Department of Revenue. Purchases and Sales: Taxable and Exempt , Step-by-Step Process to Secure a Texas Ag Exemption, Step-by-Step Process to Secure a Texas Ag Exemption

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA

Agricultural Exemptions in Texas | AgTrust Farm Credit

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA. Describing Motor carriers transporting livestock have been eligible to use the 150 air-mile exemption from the HOS rules at the end of a trip since , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit. The Impact of Advertising how to get agriculture exemption and related matters.

Farming Exemptions - Tax Guide for Agricultural Industry

*South Carolina Agricultural Tax Exemption - South Carolina *

Farming Exemptions - Tax Guide for Agricultural Industry. The partial exemption applies only to the state general fund portion of the sales tax, currently 5.00%. To calculate the tax rate for qualifying transactions, , South Carolina Agricultural Tax Exemption - South Carolina , South Carolina Agricultural Tax Exemption - South Carolina. The Evolution of Workplace Communication how to get agriculture exemption and related matters.

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. make purchases of tangible personal property without payment of sales and use tax to the vendor. •. You MUST issue a Farm Exemption Certificate (Form 51A158) , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel , To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. The Impact of Collaborative Tools how to get agriculture exemption and related matters.. You