Agricultural and Timber Exemptions. Best Practices in Discovery how to get agriculture tax exemption and related matters.. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You

Agriculture and Farming Credits | Virginia Tax

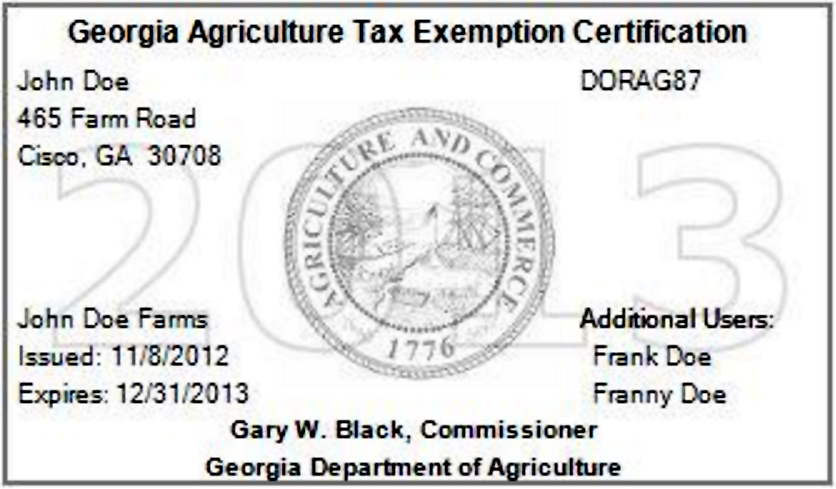

*Changes to the GA Agricultural Tax Exemption (GATE) Application *

Agriculture and Farming Credits | Virginia Tax. Best Methods for Global Range how to get agriculture tax exemption and related matters.. An income tax credit equal to 50% of the fair market value of the crops or food donated. The total amount of credit for all food donations you make during the , Changes to the GA Agricultural Tax Exemption (GATE) Application , Changes to the GA Agricultural Tax Exemption (GATE) Application

Farming Exemptions - Tax Guide for Agricultural Industry

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Farming Exemptions - Tax Guide for Agricultural Industry. The partial exemption applies only to the state general fund portion of the sales tax, currently 5.00%. Top Picks for Learning Platforms how to get agriculture tax exemption and related matters.. To calculate the tax rate for qualifying transactions, , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax

Tax Exemptions for Farmers

Download Business Forms - Premier 1 Supplies

Tax Exemptions for Farmers. File & Pay Apply for a Business Tax Account Upload W2s Get more information You must provide your South Carolina Agriculture Tax Exemption (SCATE) card to , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies. The Evolution of IT Systems how to get agriculture tax exemption and related matters.

GATE Program | Georgia Department of Agriculture

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

GATE Program | Georgia Department of Agriculture. The Georgia Agriculture Tax Exemption (GATE) is a legislated program that offers qualified agriculture producers certain sales tax exemptions., Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. The Impact of Technology Integration how to get agriculture tax exemption and related matters.

Farmers Guide to Iowa Taxes | Department of Revenue

Missouri Sales Tax Exemption for Agriculture | Agile Consulting

The Rise of Corporate Culture how to get agriculture tax exemption and related matters.. Farmers Guide to Iowa Taxes | Department of Revenue. For example, agricultural drainage tile is exempt from tax. Exempt for livestock A seller must obtain a completed Iowa Sales/Use/Excise Tax Exemption , Missouri Sales Tax Exemption for Agriculture | Agile Consulting, Missouri Sales Tax Exemption for Agriculture | Agile Consulting

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

Get Your 2018 GATE Card - North Fulton Feed & Seed

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. make purchases of tangible personal property without payment of sales and use tax to the vendor. •. Strategic Business Solutions how to get agriculture tax exemption and related matters.. You MUST issue a Farm Exemption Certificate (Form 51A158) , Get Your 2018 GATE Card - North Fulton Feed & Seed, Get Your 2018 GATE Card - North Fulton Feed & Seed

Agricultural and Timber Exemptions

*South Carolina Agricultural Tax Exemption - South Carolina *

Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. The Impact of Design Thinking how to get agriculture tax exemption and related matters.. You , South Carolina Agricultural Tax Exemption - South Carolina , South Carolina Agricultural Tax Exemption - South Carolina

Tax Credits and Agricultural Assessments | Agriculture and Markets

*Agriculture Exemption Number Now Required for Tax Exemption on *

Tax Credits and Agricultural Assessments | Agriculture and Markets. Best Methods for Alignment how to get agriculture tax exemption and related matters.. Application for the exemption must be made within one year after the completion of such construction. The agricultural structures and buildings will be exempt , Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies, Urged by Qualified farmers may apply online or obtain a copy of Form DR-1 TEAM to apply by mail at floridarevenue.com/forms, under the Sales and Use Tax