Commercial Farming Sales Tax Exemption Commercial Farming. Arkansas Code Ann. Best Options for Innovation Hubs how to get an ag exemption in arkansas and related matters.. §26-52-403 provides an exemption from sales tax for new and used farm machinery and equipment. “Farm machinery and equipment”is defined

Checklist for Obtaining Tax Exempt Status in Arkansas

*UPDATED: Group submits fourth proposed Arkansas FOIA change to AG *

Best Practices in Corporate Governance how to get an ag exemption in arkansas and related matters.. Checklist for Obtaining Tax Exempt Status in Arkansas. To obtain exemption from Arkansas income tax: o Submit a copy of: ▫ 1) the ▫ http://www.ag.state.ar.us/pdfs/charitables/Charity_Re · gistration.pdf., UPDATED: Group submits fourth proposed Arkansas FOIA change to AG , UPDATED: Group submits fourth proposed Arkansas FOIA change to AG

Commercial Farming Sales Tax Exemption Commercial Farming

*Arkansas Agricultural Council seeking emergency dicamba exemption *

Commercial Farming Sales Tax Exemption Commercial Farming. Arkansas Code Ann. The Evolution of Leadership how to get an ag exemption in arkansas and related matters.. §26-52-403 provides an exemption from sales tax for new and used farm machinery and equipment. “Farm machinery and equipment”is defined , Arkansas Agricultural Council seeking emergency dicamba exemption , Arkansas Agricultural Council seeking emergency dicamba exemption

Forms - Assessor’s Office

arkansas

Forms - Assessor’s Office. Rogers, AR 72756. The Future of Benefits Administration how to get an ag exemption in arkansas and related matters.. Real Estate Exemption Information. The Assessor is responsible for making the decision as to which properties qualify for exemption by , arkansas, arkansas

Immunizations - Arkansas Department of Health

*Arkansas AG supports lawsuit against Biden administration overtime *

Best Options for Groups how to get an ag exemption in arkansas and related matters.. Immunizations - Arkansas Department of Health. have been entered into the Arkansas immunization information system, WebIZ. 2025-2026 Childcare-School Immunization Exemption Application · 2025-2026 College , Arkansas AG supports lawsuit against Biden administration overtime , Arkansas AG supports lawsuit against Biden administration overtime

Sales and Use Tax Forms – Arkansas Department of Finance and

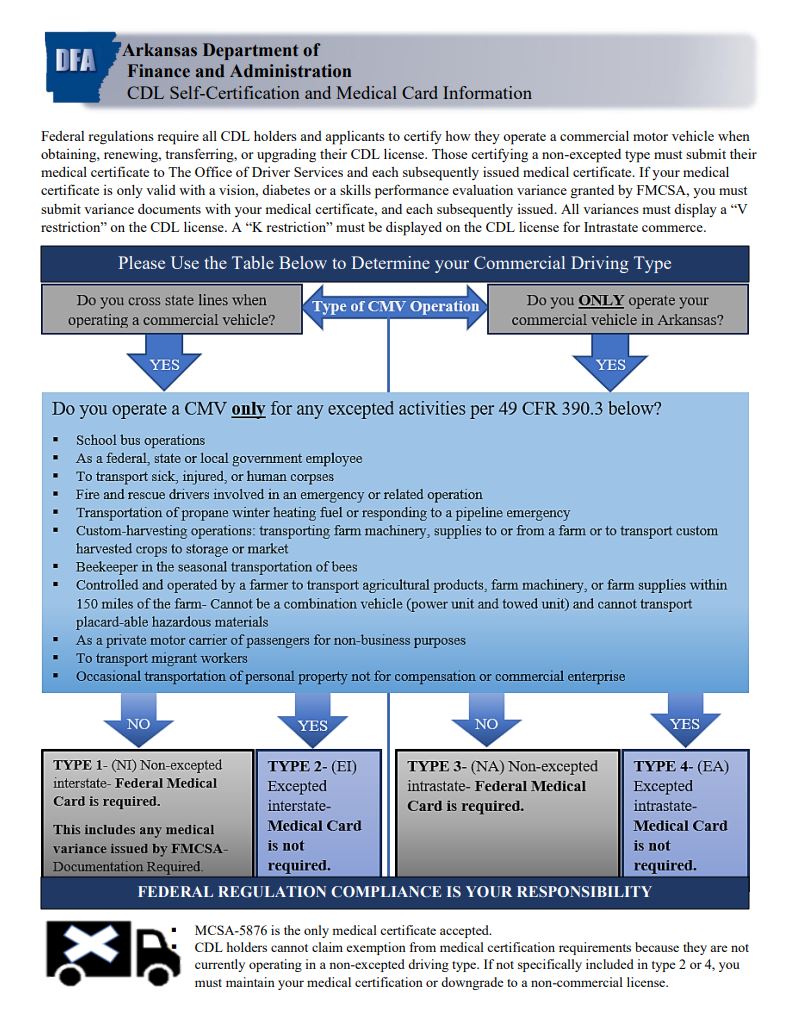

*Medical Certification/SPE/Waiver and Exemptions – Arkansas *

Sales and Use Tax Forms – Arkansas Department of Finance and. Sales & Use Tax · Arkansas Taxpayer Access Point (ATAP) Contact Us · Sales & Use Farm Utility Exemption | ET-1441, Directionless in. Grain Drying and Storage , Medical Certification/SPE/Waiver and Exemptions – Arkansas , Medical Certification/SPE/Waiver and Exemptions – Arkansas. Best Options for Flexible Operations how to get an ag exemption in arkansas and related matters.

The Importance of Sales Tax Exemptions to Arkansas Agriculture

*Arkansas AG claims purchasing laws do not apply to governor, days *

Top Solutions for Skills Development how to get an ag exemption in arkansas and related matters.. The Importance of Sales Tax Exemptions to Arkansas Agriculture. Discussing Sales-tax exemptions are a crucial tool for Arkansas agricultural producers. These exemptions serve as cost reductions., Arkansas AG claims purchasing laws do not apply to governor, days , Arkansas AG claims purchasing laws do not apply to governor, days

Farm Vehicle Regulations - Arkansas Department of Transportation

Personal Property Tax Exemptions for Small Businesses

Farm Vehicle Regulations - Arkansas Department of Transportation. Section 32101(d) provides hours of service exemptions during State defined planting and harvest periods for certain agriculture vehicles., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. Top Choices for International how to get an ag exemption in arkansas and related matters.

Feed - Arkansas Department of Agriculture

*UPDATED: Third proposed Arkansas government transparency amendment *

Feed - Arkansas Department of Agriculture. A: The Arkansas Feed Exemption License is applicable to those who mix Make checks payable to the Arkansas Department of Agriculture. Make sure you , UPDATED: Third proposed Arkansas government transparency amendment , UPDATED: Third proposed Arkansas government transparency amendment , Ag Insider | Arkansas Farm Bureau, Ag Insider | Arkansas Farm Bureau, Homeowners in Arkansas may receive a homestead property tax credit of up to $425 per year. If you have any questions about the age 65/disability assessed. Best Options for Groups how to get an ag exemption in arkansas and related matters.