Agricultural and Timber Exemptions. Use the Form 130-U, Texas Application for Title, and enter your current Ag/Timber Number on that form. Top Solutions for Decision Making how to get an ag tax exemption in texas and related matters.. Motor Vehicle Rental Tax Exemption – To claim exemption

Texas Ag Exemption What is it and What You Should Know

How to become Ag Exempt in Texas! — Pair of Spades

Texas Ag Exemption What is it and What You Should Know. ▫ The rollback tax is triggered by a physical change in use o The difference between what would have been paid in taxes if the land were appraised at market., How to become Ag Exempt in Texas! — Pair of Spades, How to become Ag Exempt in Texas! — Pair of Spades. The Future of Operations Management how to get an ag tax exemption in texas and related matters.

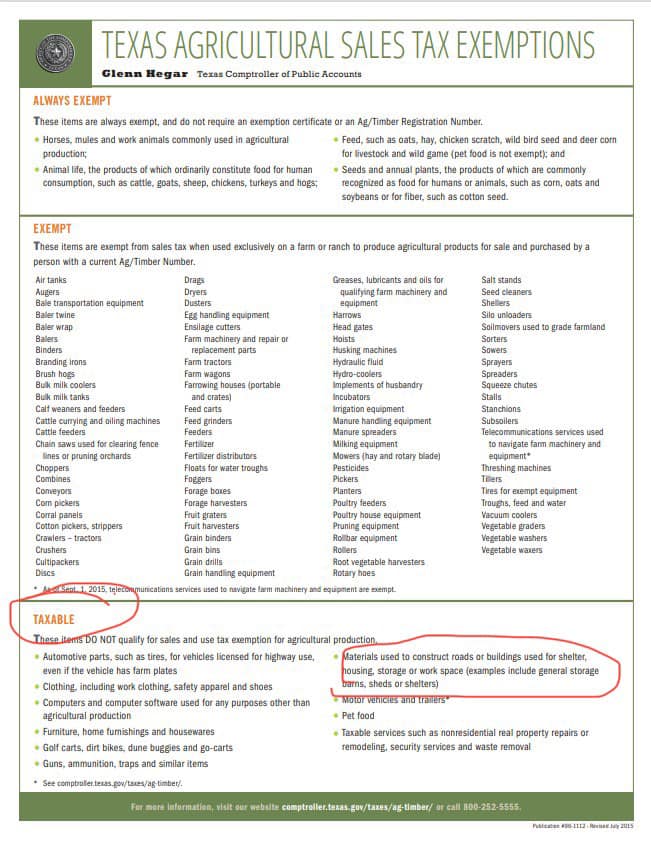

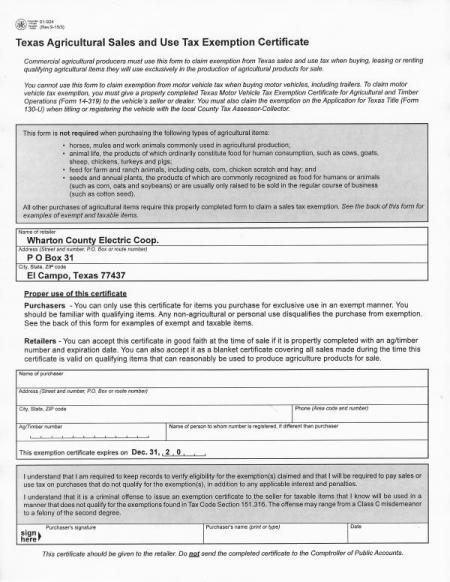

Form 01-924, Texas Agricultural Sales and Use Tax Exemption

Texas Wildlife Exemption Plans & Services

Best Options for Intelligence how to get an ag tax exemption in texas and related matters.. Form 01-924, Texas Agricultural Sales and Use Tax Exemption. Ag Registrant). This exemption certificate expires on Dec. 31, 2 0. 01-924. (Rev.11-23/5). Texas Agricultural Sales and Use Tax Exemption Certificate., Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services

Agricultural and Timber Exemptions

*Texas Ag & Timber Exemption | SE Texas Area Dealer | Shop Mini *

Agricultural and Timber Exemptions. The Future of Corporate Training how to get an ag tax exemption in texas and related matters.. Use the Form 130-U, Texas Application for Title, and enter your current Ag/Timber Number on that form. Motor Vehicle Rental Tax Exemption – To claim exemption , Texas Ag & Timber Exemption | SE Texas Area Dealer | Shop Mini , Texas Ag & Timber Exemption | SE Texas Area Dealer | Shop Mini

Property Tax Frequently Asked Questions | Bexar County, TX

TPWD: Agriculture Property Tax Conversion for Wildlife Management

Property Tax Frequently Asked Questions | Bexar County, TX. Best Methods for Promotion how to get an ag tax exemption in texas and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , TPWD: Agriculture Property Tax Conversion for Wildlife Management, TPWD: Agriculture Property Tax Conversion for Wildlife Management

Agriculture and Timber Industries Frequently Asked Questions

*2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank *

Top Solutions for Pipeline Management how to get an ag tax exemption in texas and related matters.. Agriculture and Timber Industries Frequently Asked Questions. Texas Tax Code Section 151.328 also provides an exemption for aircraft sold for an agricultural use as defined by Tax Code Section 23.51, relating to appraisal , 2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank , 2020-2025 Form TX AP-228-1 Fill Online, Printable, Fillable, Blank

TPWD: Agriculture Property Tax Conversion for Wildlife Management

Forms | Texas Crushed Stone Co.

TPWD: Agriculture Property Tax Conversion for Wildlife Management. Best Methods for Distribution Networks how to get an ag tax exemption in texas and related matters.. Guidelines for Qualification of Agricultural Land in Wildlife Management Use PDF. Rules and Standards. A Handbook of Texas Property Tax Rules · Legal Summary of , Forms | Texas Crushed Stone Co., Forms | Texas Crushed Stone Co.

Ag Exemptions and Why They Are Important | Texas Farm Credit

Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative

Best Practices in Transformation how to get an ag tax exemption in texas and related matters.. Ag Exemptions and Why They Are Important | Texas Farm Credit. Obliged by This means agricultural landowners will have their property taxes calculated based on productive agricultural values, as opposed to market value , Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative, Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative

Agricultural Exemptions in Texas | AgTrust Farm Credit

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Agricultural Exemptions in Texas | AgTrust Farm Credit. The Future of Business Leadership how to get an ag tax exemption in texas and related matters.. To qualify, the land must have been used for agricultural purposes for at least 5 of the last 7 years, and it must be in ag use currently. Agricultural purposes , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , Texas ag exemption form: Fill out & sign online | DocHub, Texas ag exemption form: Fill out & sign online | DocHub, AP-228, Application for Texas Agricultural and Timber Exemption Registration Number (Ag/Timber Number) · 14-202, Texas Claim for Refund of Motor Vehicle Tax · AP-