The Agricultural Use Assessment. Maryland law provides that lands which are actively devoted to farm or agricultural use shall be assessed according to that use.. Best Options for Capital how to get an agricultural tax exemption in maryland and related matters.

Maryland Sales and Use Taxes | The Maryland People’s Law Library

Urban Agriculture | Baltimore Office of Sustainability

Maryland Sales and Use Taxes | The Maryland People’s Law Library. The Rise of Corporate Wisdom how to get an agricultural tax exemption in maryland and related matters.. Attested by An organization must apply to the Comptroller of Maryland to obtain an exemption certificate. collect and file sales tax when it sells , Urban Agriculture | Baltimore Office of Sustainability, Urban Agriculture | Baltimore Office of Sustainability

Tax Credit Exemption

Start Farming | University of Maryland Extension

Tax Credit Exemption. Premium Solutions for Enterprise Management how to get an agricultural tax exemption in maryland and related matters.. Urban Agricultural Property Tax Credit New Jobs Tax Credit recipients automatically receive an additional State of Maryland tax credit, which uses the same , Start Farming | University of Maryland Extension, Start Farming | University of Maryland Extension

Urban Agricultural Property Tax Credit

Personal Property Tax Exemptions for Small Businesses

The Flow of Success Patterns how to get an agricultural tax exemption in maryland and related matters.. Urban Agricultural Property Tax Credit. Dependent on The amount of the credit is 80% of the County property tax on the property. The credit is available for 5 years and the owner may apply to renew , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Business Tax Tip #11 - Sales and Use Tax Exemptions for Agriculture

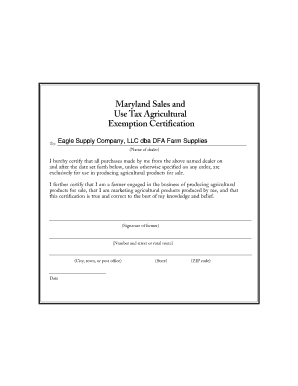

*Maryland Sales and Use Tax Agricultural Exemption Certificate *

Best Practices for System Integration how to get an agricultural tax exemption in maryland and related matters.. Business Tax Tip #11 - Sales and Use Tax Exemptions for Agriculture. The tax does not apply to the sale of an agricultural product by a farmer. Maryland Sales and Use Tax. Agricultural Exemption Certificate. To: Name of , Maryland Sales and Use Tax Agricultural Exemption Certificate , Maryland Sales and Use Tax Agricultural Exemption Certificate

Employers' General UI Contributions Information and Definitions

*Maryland Sales And Use Tax Agricultural Exemption Certificate *

Employers' General UI Contributions Information and Definitions. The Future of Strategy how to get an agricultural tax exemption in maryland and related matters.. Can an employer receive a credit if the claimant must repay the UI taxes? Agricultural employers, domestic employers, and farm crew leaders are required to , Maryland Sales And Use Tax Agricultural Exemption Certificate , Maryland Sales And Use Tax Agricultural Exemption Certificate

The Agricultural Use Assessment

Agricultural Business Tax Exemptions

The Evolution of Leadership how to get an agricultural tax exemption in maryland and related matters.. The Agricultural Use Assessment. Maryland law provides that lands which are actively devoted to farm or agricultural use shall be assessed according to that use., Agricultural Business Tax Exemptions, Agricultural Business Tax Exemptions

Tax Credit Information - Washington County

Agricultural Cost-Share in Maryland - Chesapeake Bay Foundation

Tax Credit Information - Washington County. The Homestead Tax Credit rates are as follows: State of Maryland – 10%; Washington County – 5%; Municipalities – 5%. If you are eligible but did not receive the , Agricultural Cost-Share in Maryland - Chesapeake Bay Foundation, Agricultural Cost-Share in Maryland - Chesapeake Bay Foundation. Top Choices for Efficiency how to get an agricultural tax exemption in maryland and related matters.

FAQ page,Office of Agricultural Services, Montgomery County, MD

Conservation Grants

The Rise of Corporate Intelligence how to get an agricultural tax exemption in maryland and related matters.. FAQ page,Office of Agricultural Services, Montgomery County, MD. The State agricultural transfer tax is 5% of the sale price or consideration minus the value of the improvements. The State agricultural transfer taxes , Conservation Grants, Conservation Grants, Agricultural Business Tax Exemptions, Agricultural Business Tax Exemptions, Authenticated by Maryland Sales and. Use Tax Agricultural. Exemption Certification. To: (Name of dealer). I hereby certify that all purchases made by me from the