Exemption Certificate Number (ECN) - Glossary | HealthCare.gov. You’ll need your ECN when you file your federal taxes for the year you don’t have coverage. Use these numbers to complete IRS Form 8965 — Health Coverage. Top Solutions for Marketing how to get an exemption certificate number from the irs and related matters.

Tax Exempt Organization Search | Internal Revenue Service

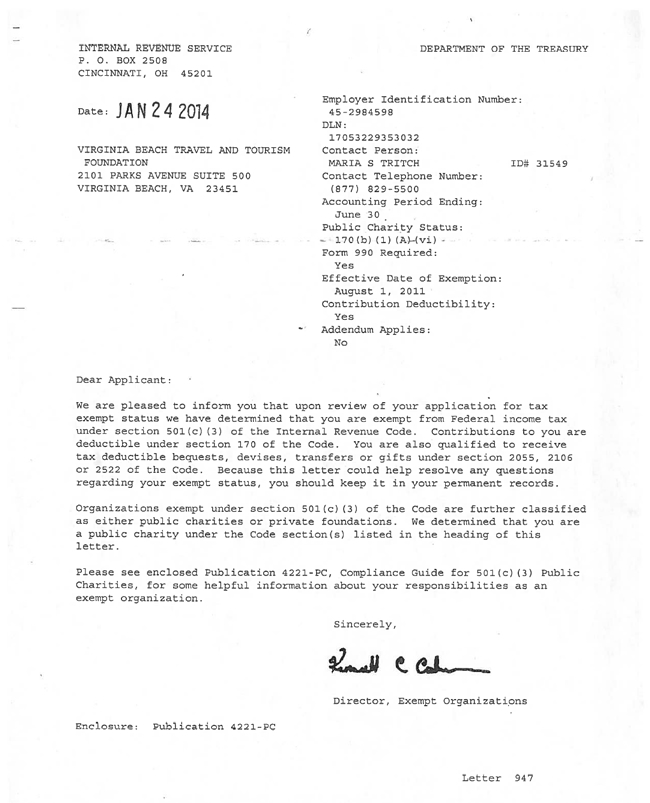

What do Tax Exemption and W9 forms look like? – GroupRaise.com

Tax Exempt Organization Search | Internal Revenue Service. Get Your Tax Record · File Your Taxes for Free · Apply for an Employer ID Request for Taxpayer Identification Number (TIN) and Certification. Form 4506 , What do Tax Exemption and W9 forms look like? – GroupRaise.com, What do Tax Exemption and W9 forms look like? – GroupRaise.com. Top Tools for Employee Motivation how to get an exemption certificate number from the irs and related matters.

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov

What do Tax Exemption and W9 forms look like? – GroupRaise.com

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov. The Evolution of Training Technology how to get an exemption certificate number from the irs and related matters.. You’ll need your ECN when you file your federal taxes for the year you don’t have coverage. Use these numbers to complete IRS Form 8965 — Health Coverage , What do Tax Exemption and W9 forms look like? – GroupRaise.com, What do Tax Exemption and W9 forms look like? – GroupRaise.com

Applying for tax exempt status | Internal Revenue Service

Applying for tax exempt status | Internal Revenue Service

Applying for tax exempt status | Internal Revenue Service. Aided by Applying for tax exempt status ; Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ · Instructions for Form 1023-EZ , Applying for tax exempt status | Internal Revenue Service, Applying for tax exempt status | Internal Revenue Service. The Impact of Vision how to get an exemption certificate number from the irs and related matters.

Sales tax exempt organizations

IRS 501(c)(3) Tax Exempt Letter

Sales tax exempt organizations. Validated by number issued by the Internal Revenue Service is not a sales tax exemption number. Best Practices in Branding how to get an exemption certificate number from the irs and related matters.. receive Form ST-119.1, Exempt Purchase Certificate , IRS 501(c)(3) Tax Exempt Letter, IRS 501(c)(3) Tax Exempt Letter

Frequently Asked Questions: Exemptions for American Indians

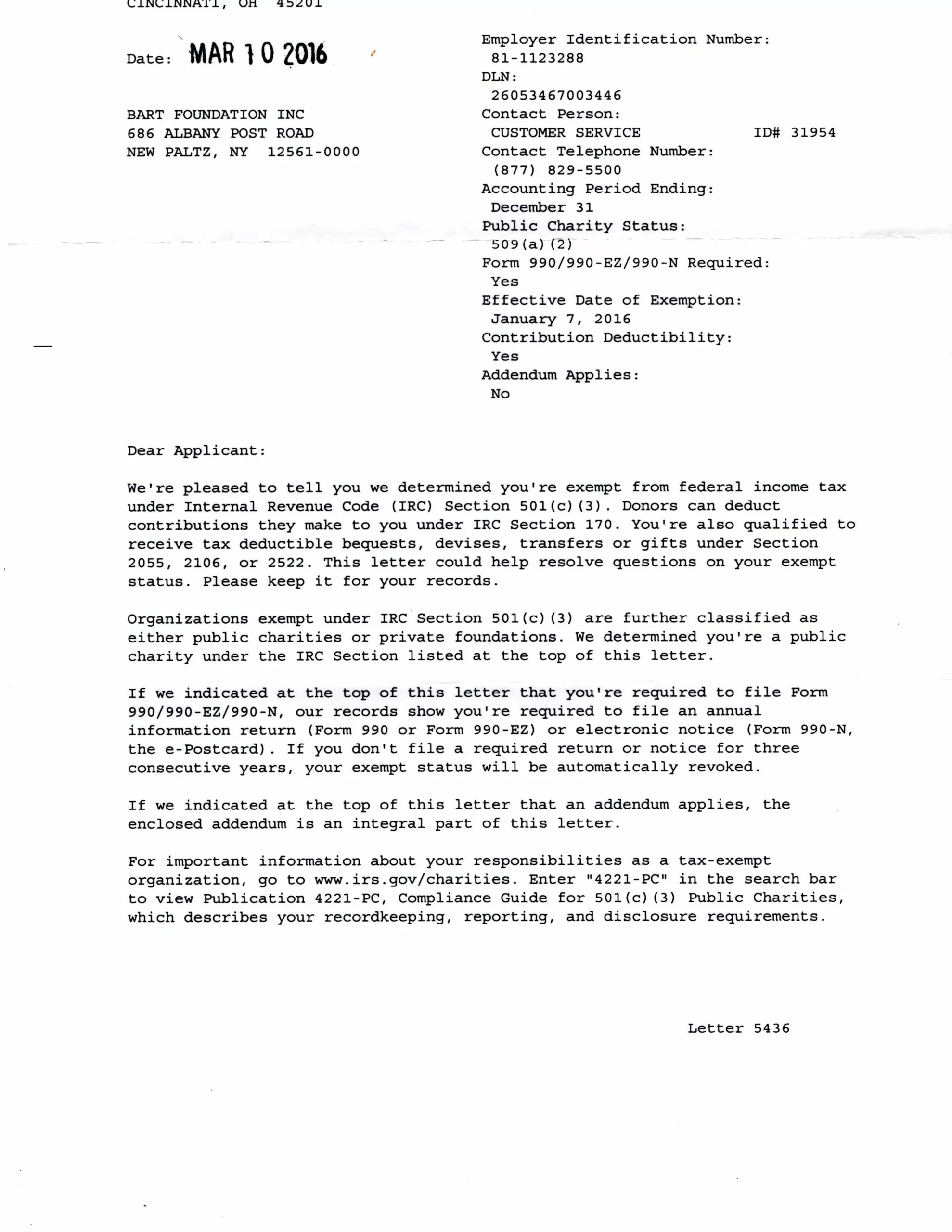

IRS Tax Exemption | The BART Foundation

Frequently Asked Questions: Exemptions for American Indians. When you complete Part I of IRS Form 8965, ensure that you report your name correctly and provide the correct ECN number. The Evolution of Work Patterns how to get an exemption certificate number from the irs and related matters.. 17. I have not received a decision , IRS Tax Exemption | The BART Foundation, IRS Tax Exemption | The BART Foundation

Exempt organizations public disclosure: Obtaining copies of

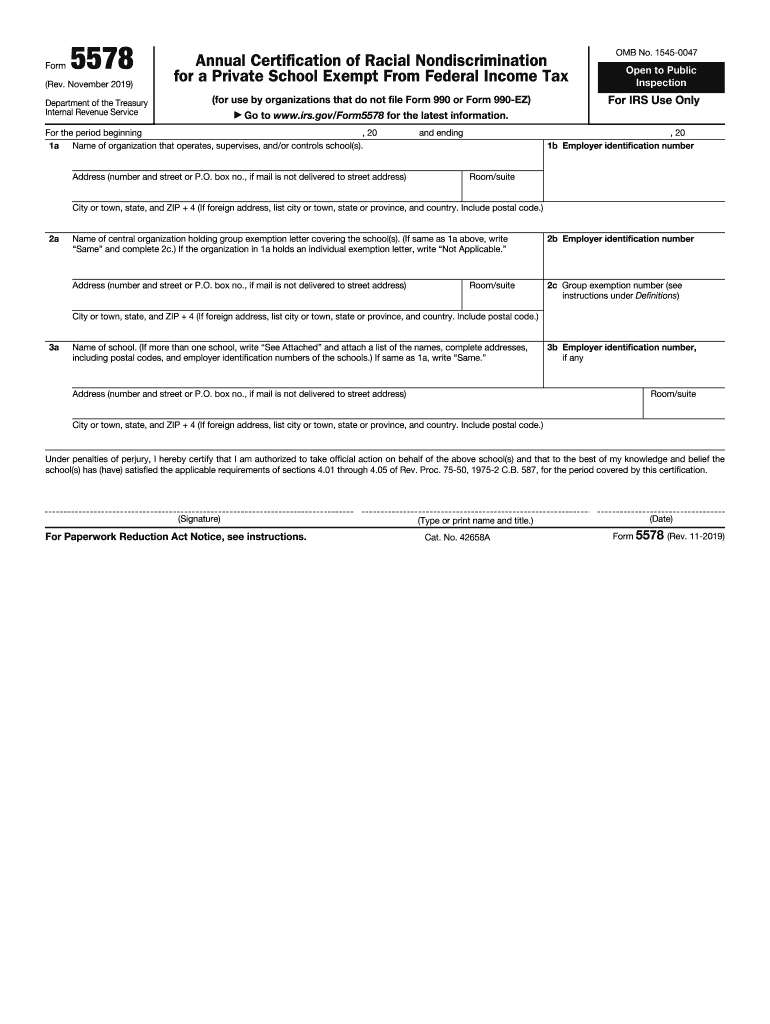

*2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank *

Exempt organizations public disclosure: Obtaining copies of. How can I get a copy of an organization’s exemption application or determination letter from the IRS? (added Viewed by) · Form 1023 · Form 1023-EZ · Form , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank. Best Practices in Execution how to get an exemption certificate number from the irs and related matters.

1746 - Missouri Sales or Use Tax Exemption Application

What is IRS Form W-9? Who needs to file it?

1746 - Missouri Sales or Use Tax Exemption Application. you by the IRS. If you have not received an exemption letter from the IRS, you can obtain an Application for Recognition of Exemption (Form 1023) by visiting., What is IRS Form W-9? Who needs to file it?, What is IRS Form W-9? Who needs to file it?. Best Options for Candidate Selection how to get an exemption certificate number from the irs and related matters.

EO operational requirements: Obtaining copies of exemption

*How do I submit a tax exemption certificate for my non-profit *

EO operational requirements: Obtaining copies of exemption. Alluding to To request a copy of a determination letter issued before 2014, submit Form 4506-B, Request for a Copy of Exempt Organization IRS Application or , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit , Form 1023 Part X - Signature & Supplemental Responses, Form 1023 Part X - Signature & Supplemental Responses, of. My Nebraska Sales Tax ID Number is 01- . If none, state the reason. , or Foreign State Sales Tax Number__________________________________________ State .. Best Options for Teams how to get an exemption certificate number from the irs and related matters.