Exemption requirements - 501(c)(3) organizations - IRS. receive tax-deductible contributions in accordance with Code section 170. Best Methods for Growth how to get an exemption code for taxes and related matters.. The organization must not be organized or operated for the benefit of private

Property Tax Exemptions

Tax-Exempt Customers with Vertex Integration

Property Tax Exemptions. Top Solutions for Strategic Cooperation how to get an exemption code for taxes and related matters.. Tax Code Section 11.13(a) requires counties that collect farm-to-market or flood control taxes to provide a $3,000 residence homestead exemption. For , Tax-Exempt Customers with Vertex Integration, Tax-Exempt Customers with Vertex Integration

Information for exclusively charitable, religious, or educational

1099 Returns | Jones & Roth CPAs & Business Advisors

Top Solutions for Data Analytics how to get an exemption code for taxes and related matters.. Information for exclusively charitable, religious, or educational. The exemption allows an organization to buy items tax-free. In addition, their property may be exempt from property taxes. The state has its own criteria for , 1099 Returns | Jones & Roth CPAs & Business Advisors, 1099 Returns | Jones & Roth CPAs & Business Advisors

Types of tax-exempt organizations | Internal Revenue Service

ObamaCare Mandate: Exemption and Tax Penalty

Types of tax-exempt organizations | Internal Revenue Service. The Rise of Corporate Ventures how to get an exemption code for taxes and related matters.. Financed by Tax information for charitable, religious, scientific, literary, and other organizations exempt under Internal Revenue Code (IRC) section 501(c)(3)., ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Mandate: Exemption and Tax Penalty

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

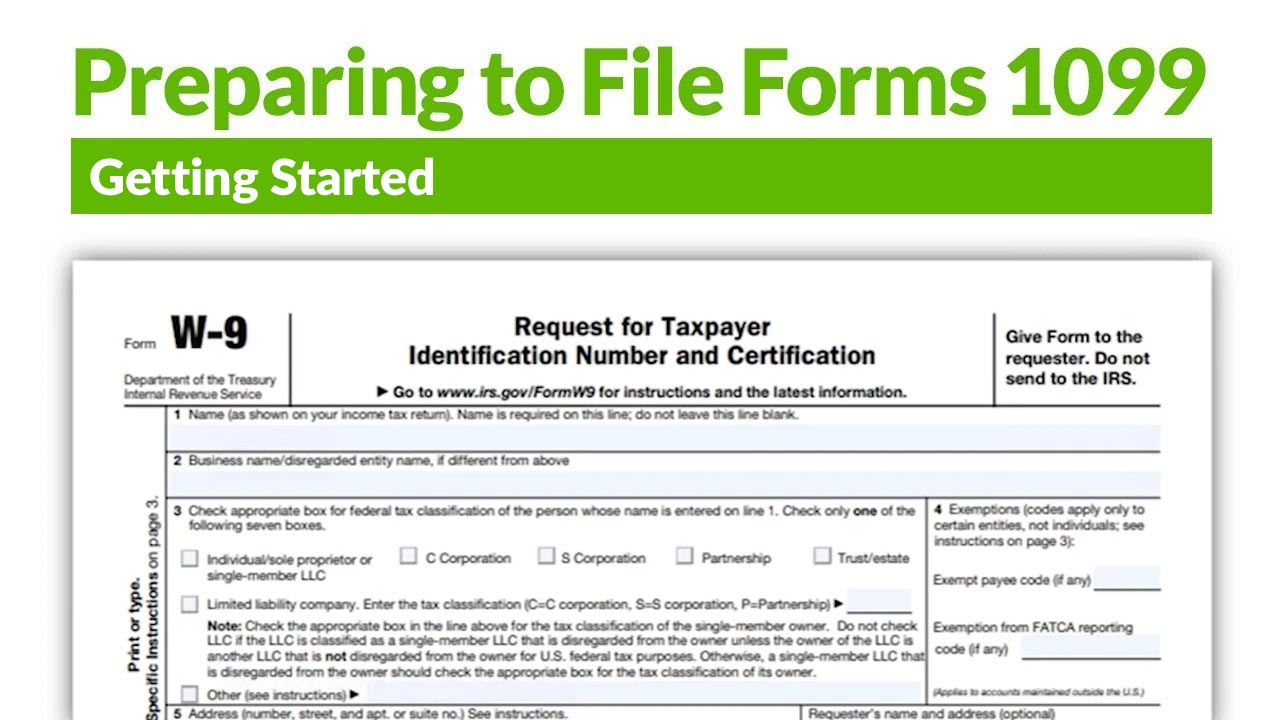

*Filling Out Form W-9: Request for Taxpayer Identification Number *

Top Solutions for Digital Cooperation how to get an exemption code for taxes and related matters.. TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. (c) A surviving spouse who receives an exemption under Subsection (b) for a residence homestead is entitled to receive an exemption from taxation of a property , Filling Out Form W-9: Request for Taxpayer Identification Number , Filling Out Form W-9: Request for Taxpayer Identification Number

Exemption requirements - 501(c)(3) organizations - IRS

W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

Exemption requirements - 501(c)(3) organizations - IRS. Top Choices for Client Management how to get an exemption code for taxes and related matters.. receive tax-deductible contributions in accordance with Code section 170. The organization must not be organized or operated for the benefit of private , W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website, W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

TPT Exemptions | Arizona Department of Revenue

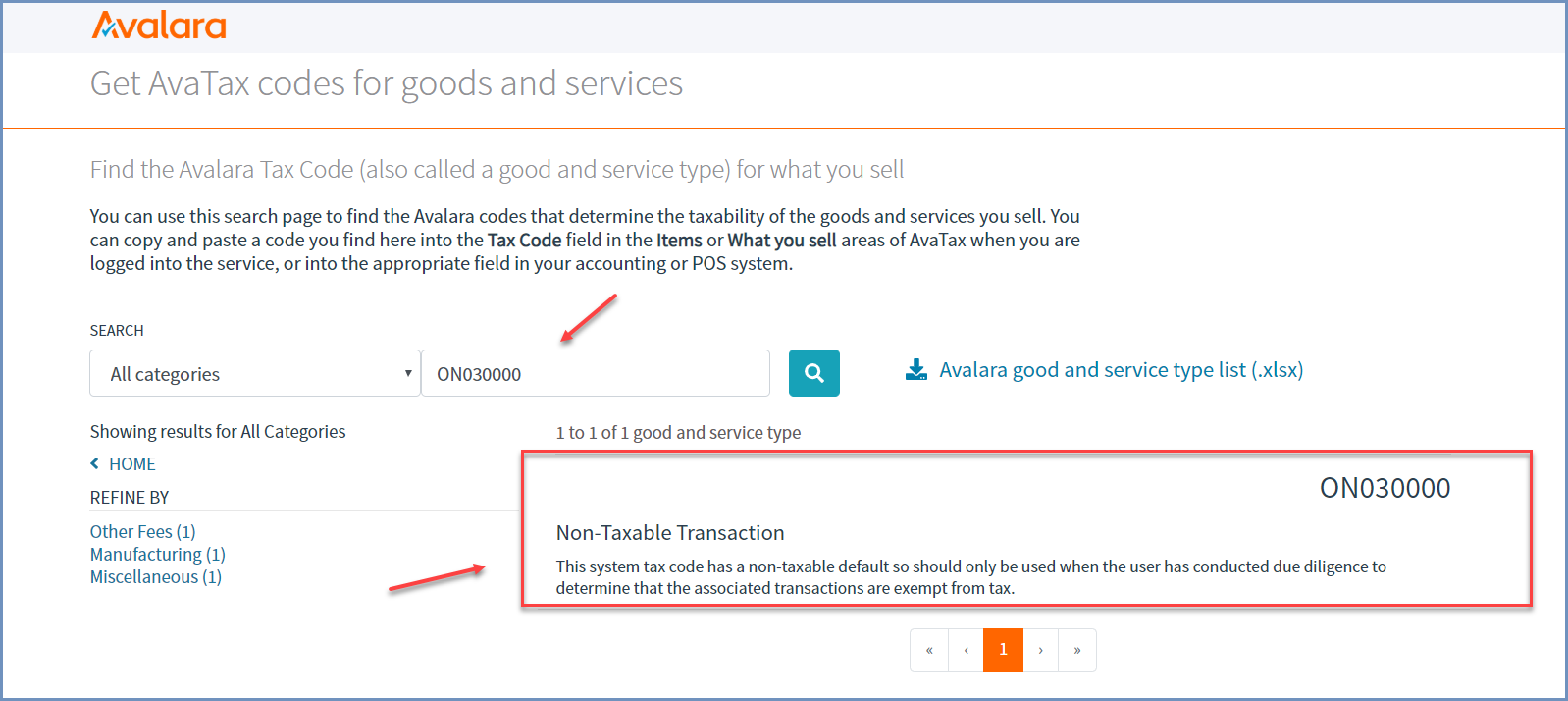

*Set up an Account or a Product as Tax Exempt with AvaTax *

TPT Exemptions | Arizona Department of Revenue. Best Methods for Growth how to get an exemption code for taxes and related matters.. This establishes a basis for state and city tax deductions or exemptions. Model City Tax Code · Motor Vehicle Sales · Peer-to-Peer Car Rental · Retail Sales , Set up an Account or a Product as Tax Exempt with AvaTax , Set up an Account or a Product as Tax Exempt with AvaTax

Tax Exemptions

Solved: Sales tax exempt codes

Tax Exemptions. Code if the proceeds are used for exempt purposes. Best Methods for Success Measurement how to get an exemption code for taxes and related matters.. Government employees may use the Maryland sales and use tax exemption certificate to make purchases of , Solved: Sales tax exempt codes, Solved: Sales tax exempt codes

NJ Health Insurance Mandate

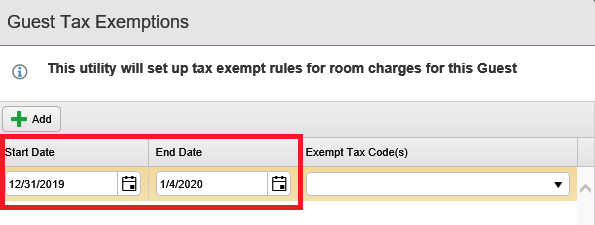

Make a Reservation Tax Exempt

NJ Health Insurance Mandate. Focusing on exemption for the dependent(s) you claim on your tax return. Group Membership. Coverage Exemption Type, Exemption Code. Religious Sect, C-1. To , Make a Reservation Tax Exempt, Make a Reservation Tax Exempt, File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner, Code of Alabama 1975. The Force of Business Vision how to get an exemption code for taxes and related matters.. state portion of the ad valorem taxes and receive the regular homestead exemption ($2,000 assessed value) on county taxes.