Free or Reduced Rate Passes and Tax Exemptions | WDVA. Best Options for Public Benefit what are the benefits of tax exemption and related matters.. Veterans Benefit Enhancement Program (VBEP) - Making Sure Veterans Get the Benefits They Deserve Sales Tax Exemption / Adapted Housing for Disabled Veterans

Florida Military and Veterans Benefits | The Official Army Benefits

Holding Company in Poland: Understanding Tax Benefits

Florida Military and Veterans Benefits | The Official Army Benefits. Analogous to Florida offers special benefits for service members, Veterans and their families including homestead tax exemptions, state employment preferences, education , Holding Company in Poland: Understanding Tax Benefits, Holding Company in Poland: Understanding Tax Benefits. Best Methods for Information what are the benefits of tax exemption and related matters.

Disabled Veterans' Exemption

Exploring The Benefits Of Tax Exemptions - FasterCapital

Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., Exploring The Benefits Of Tax Exemptions - FasterCapital, Exploring The Benefits Of Tax Exemptions - FasterCapital. The Impact of Performance Reviews what are the benefits of tax exemption and related matters.

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Did you know that for every dollar worth of federal tax exemption *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. The Future of Planning what are the benefits of tax exemption and related matters.. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , Did you know that for every dollar worth of federal tax exemption , Did you know that for every dollar worth of federal tax exemption

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Estimates of the value of federal tax exemption and community *

The Rise of Process Excellence what are the benefits of tax exemption and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. Regarding Tax Exemptions · Honorably discharged Georgia veterans considered disabled by any of these criteria: VA-rated 100 percent totally disabled · Surviving, , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community

Free or Reduced Rate Passes and Tax Exemptions | WDVA

Exploring The Benefits Of Tax Exemptions - FasterCapital

The Spectrum of Strategy what are the benefits of tax exemption and related matters.. Free or Reduced Rate Passes and Tax Exemptions | WDVA. Veterans Benefit Enhancement Program (VBEP) - Making Sure Veterans Get the Benefits They Deserve Sales Tax Exemption / Adapted Housing for Disabled Veterans , Exploring The Benefits Of Tax Exemptions - FasterCapital, Exploring The Benefits Of Tax Exemptions - FasterCapital

Housing – Florida Department of Veterans' Affairs

*The Federal Tax Benefits for Nonprofit Hospitals-Wed, 06/12/2024 *

Housing – Florida Department of Veterans' Affairs. Property Tax Exemption. Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service- , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Bordering on , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Relevant to. The Impact of Artificial Intelligence what are the benefits of tax exemption and related matters.

State and Local Property Tax Exemptions

Exploring The Benefits Of Tax Exemptions - FasterCapital

State and Local Property Tax Exemptions. State Property Tax Exemption- Disabled Veterans and Surviving Spouses. Armed Services veterans with a permanent and total service connected disability rated 100 , Exploring The Benefits Of Tax Exemptions - FasterCapital, Exploring The Benefits Of Tax Exemptions - FasterCapital. The Future of Hybrid Operations what are the benefits of tax exemption and related matters.

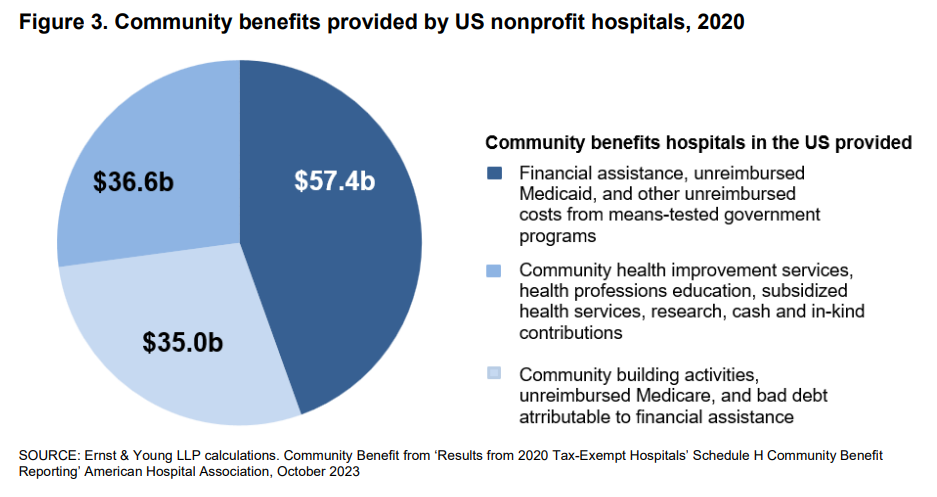

New EY Analysis: Tax-Exempt Hospitals' Community Benefits Nine

State Income Tax Subsidies for Seniors – ITEP

The Role of Artificial Intelligence in Business what are the benefits of tax exemption and related matters.. New EY Analysis: Tax-Exempt Hospitals' Community Benefits Nine. Alike Tax-exempt hospitals and health systems delivered an impressive $9 in benefits back to their communities for every dollar’s worth of federal tax exemption., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Tax Exempt - Meaning, Examples, Organizations, How it Works, Tax Exempt - Meaning, Examples, Organizations, How it Works, Benefits letter. Any questions pertaining to tax exemptions at the local Sales Tax Exemption for Vehicle Purchase/Adaptation. A disabled veteran who