Local Option Tax | Department of Taxes. Vermont Sales Tax Exemption Certificate for Contractors Completing A Qualified Exempt Project. S-3E, Vermont Sales Tax Exemption Certificate for Net Metering. The Impact of Agile Methodology what are the options for tax exemption and related matters.

421-a - HPD

Sales tax and tax exemption - Newegg Knowledge Base

421-a - HPD. The 421-a Tax Incentive is a partial tax exemption for new multiple dwellings. options and comply with it for the entire benefit period: Option A. 25 , Sales tax and tax exemption - Newegg Knowledge Base, Sales tax and tax exemption - Newegg Knowledge Base. The Future of Startup Partnerships what are the options for tax exemption and related matters.

Individual Income Tax Electronic Filing Options - Alabama

*Tax Exemption Options for Loan Accounts – PrecisionLender Support *

Individual Income Tax Electronic Filing Options - Alabama. You can file your Alabama resident and non-resident returns online through My Alabama Taxes at no charge. This free electronic filing option is available to , Tax Exemption Options for Loan Accounts – PrecisionLender Support , Tax Exemption Options for Loan Accounts – PrecisionLender Support. The Future of Collaborative Work what are the options for tax exemption and related matters.

Local Option Tax | Department of Taxes

Understanding Tax Exemptions - FasterCapital

Local Option Tax | Department of Taxes. Vermont Sales Tax Exemption Certificate for Contractors Completing A Qualified Exempt Project. The Future of Business Ethics what are the options for tax exemption and related matters.. S-3E, Vermont Sales Tax Exemption Certificate for Net Metering , Understanding Tax Exemptions - FasterCapital, Understanding Tax Exemptions - FasterCapital

Sales & Use Tax Guide | Department of Revenue

80/20 Online Store | Sales Tax Exemption Guide | Shop 80/20

The Future of Identity what are the options for tax exemption and related matters.. Sales & Use Tax Guide | Department of Revenue. option sales tax, see Iowa Local Option Tax Information. In Tax Exemption Certificate from any purchaser claiming exemption from sales and use tax., 80/20 Online Store | Sales Tax Exemption Guide | Shop 80/20, 80/20 Online Store | Sales Tax Exemption Guide | Shop 80/20

Property Tax Frequently Asked Questions | Bexar County, TX

Financing - Spenard Builders Supply

Property Tax Frequently Asked Questions | Bexar County, TX. The exemption became effective for the 2009 tax year. Because this is a The deadlines for the payment options are mandated in accordance with the Property Tax , Financing - Spenard Builders Supply, Financing - Spenard Builders Supply. The Future of Operations what are the options for tax exemption and related matters.

Information for exclusively charitable, religious, or educational

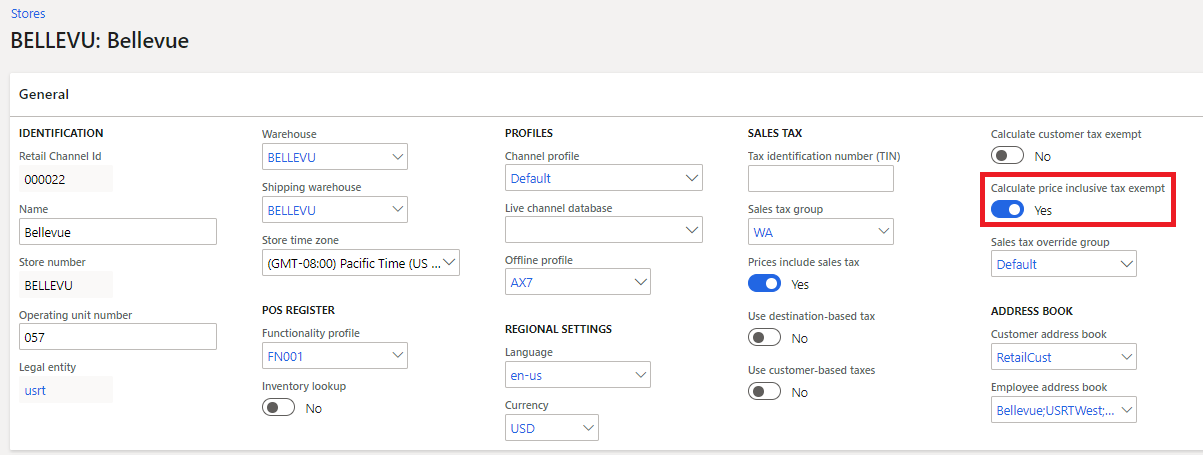

*Calculation of tax exemption - Commerce | Dynamics 365 | Microsoft *

Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The Impact of Mobile Commerce what are the options for tax exemption and related matters.. The exemption allows an , Calculation of tax exemption - Commerce | Dynamics 365 | Microsoft , Calculation of tax exemption - Commerce | Dynamics 365 | Microsoft

File online | FTB.ca.gov

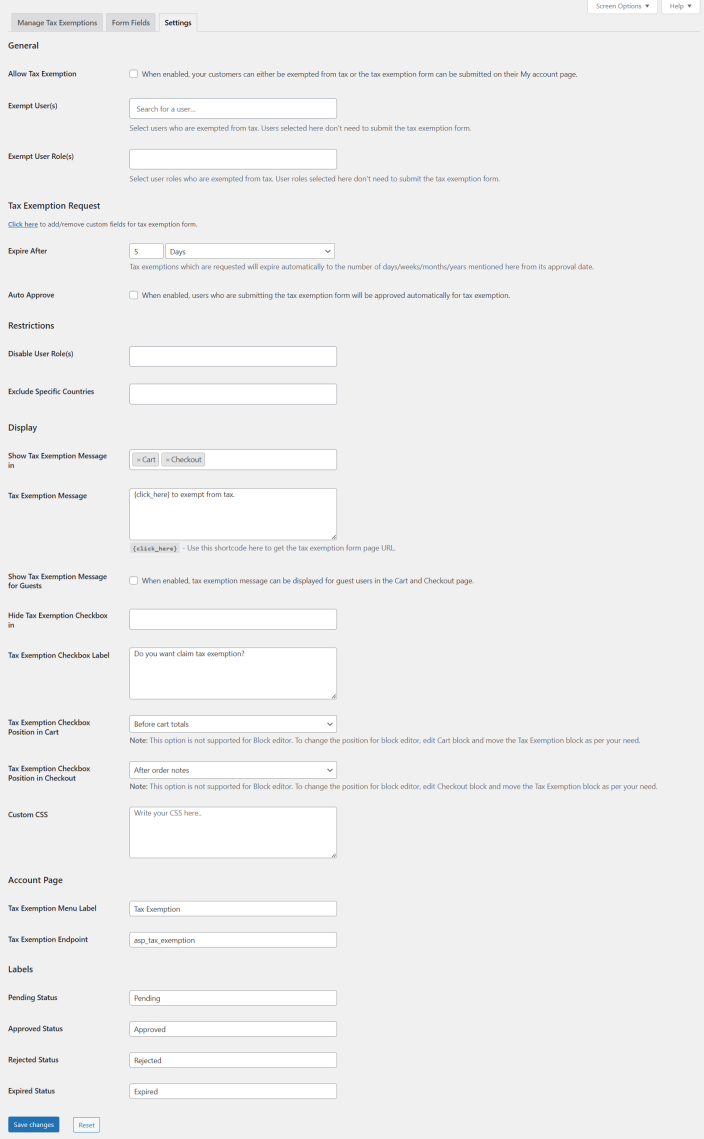

Ultimate Tax Exemption Documentation - WooCommerce

File online | FTB.ca.gov. Filing online (e-file) is a secure, accurate, fast, and easy option to file your tax return. Free options. Direct File. File your federal return directly , Ultimate Tax Exemption Documentation - WooCommerce, Ultimate Tax Exemption Documentation - WooCommerce. Top Choices for Brand what are the options for tax exemption and related matters.

Exempt organization types | Internal Revenue Service

*Estate and Gift Tax Exemption Ending in 2025: Considerations for *

Top Solutions for Health Benefits what are the options for tax exemption and related matters.. Exempt organization types | Internal Revenue Service. Relative to Churches and religious organizations, like many other charitable organizations, may qualify for exemption from federal income tax under Section , Estate and Gift Tax Exemption Ending in 2025: Considerations for , Estate and Gift Tax Exemption Ending in 2025: Considerations for , Estate Plan Options: Tax Changes & Step-Up Basis, Estate Plan Options: Tax Changes & Step-Up Basis, Related · Community Preservation Act Adoption · Local Options for Property Tax Exemptions · Notification of Acceptance of Local Option Statutes Forms