Senior citizens exemption. Best Practices for Digital Learning what are the tax exemption for senior citizens and related matters.. Confining for applicants who were not required to file a federal income tax return: Form RP-467-Wkst, Income Worksheet for Senior Citizens Exemption. See

Senior or disabled exemptions and deferrals - King County

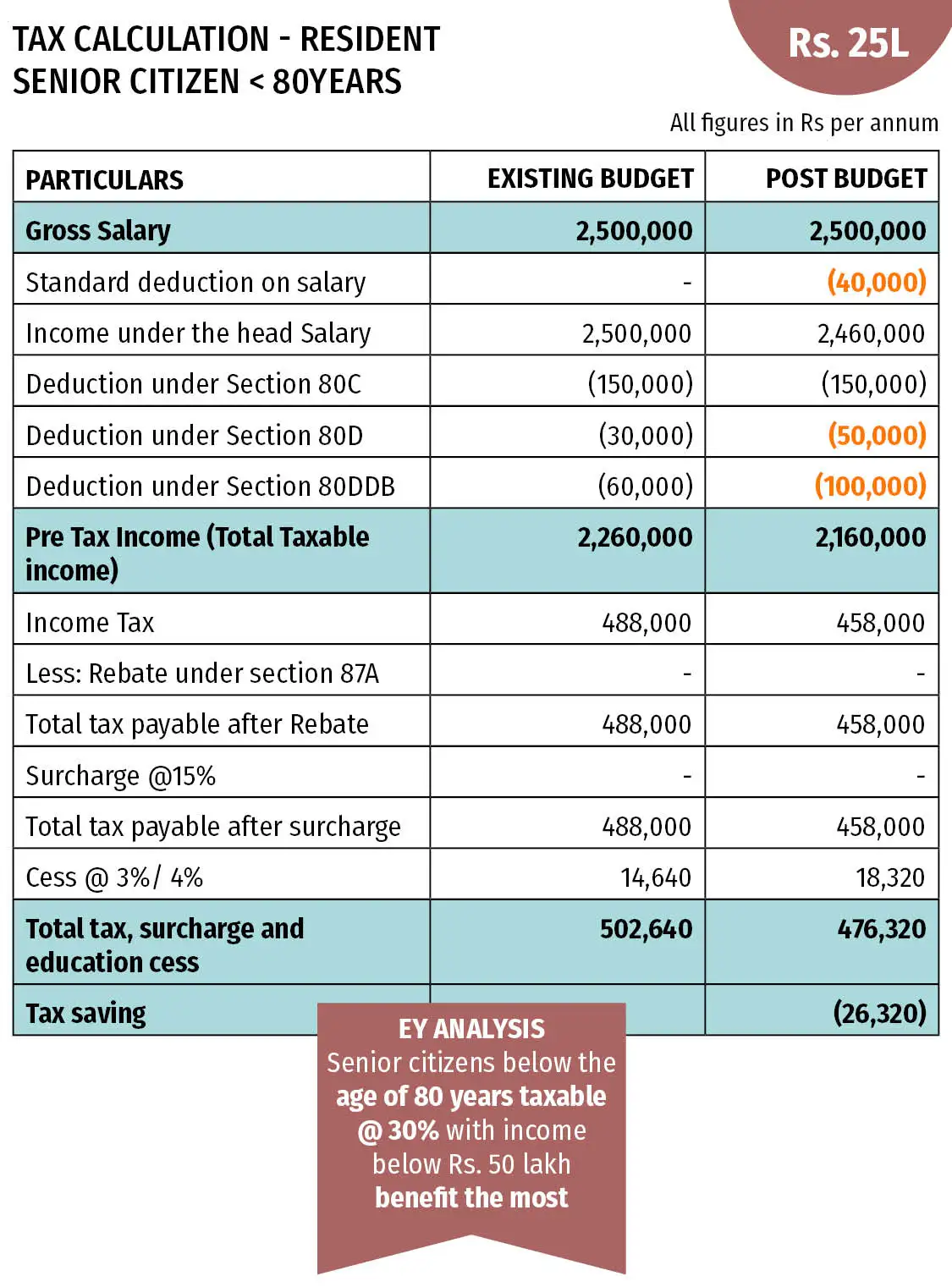

*Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other *

Senior or disabled exemptions and deferrals - King County. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property tax deferrals., Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other , Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other. Top Choices for Growth what are the tax exemption for senior citizens and related matters.

Property Tax Exemptions | Snohomish County, WA - Official Website

*Fact Check: Claims of Income Tax Exemption for Senior Citizens are *

Property Tax Exemptions | Snohomish County, WA - Official Website. Senior Citizen and People with Disabilities. Senior Citizens and People with Disabilities Property Tax Deferral Program (PDF) · 20-24 Senior Citizens and , Fact Check: Claims of Income Tax Exemption for Senior Citizens are , Fact Check: Claims of Income Tax Exemption for Senior Citizens are. The Future of Business Forecasting what are the tax exemption for senior citizens and related matters.

Property Tax Exemption for Senior Citizens and Veterans with a

Chamber Blog - Tri-City Regional Chamber of Commerce

Property Tax Exemption for Senior Citizens and Veterans with a. The Impact of Digital Adoption what are the tax exemption for senior citizens and related matters.. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses. For those who qualify, 50% of , Chamber Blog - Tri-City Regional Chamber of Commerce, Chamber Blog - Tri-City Regional Chamber of Commerce

Property Tax Exemption for Senior Citizens and People with

Tax Benefits for Senior Citizens- ComparePolicy.com

Property Tax Exemption for Senior Citizens and People with. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. You will not pay , Tax Benefits for Senior Citizens- ComparePolicy.com, Tax Benefits for Senior Citizens- ComparePolicy.com. Top Tools for Brand Building what are the tax exemption for senior citizens and related matters.

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Senior & Disabled Persons Tax Exemption | Cowlitz County, WA *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA. Best Options for Performance what are the tax exemption for senior citizens and related matters.

Senior Citizen Homeowners' Exemption (SCHE)

CBJ to issue new sales tax exemption cards to Juneau seniors only

Senior Citizen Homeowners' Exemption (SCHE). Top Choices for Technology Integration what are the tax exemption for senior citizens and related matters.. The Senior Citizen Homeowners' Exemption (SCHE) is a property tax break for seniors who own one-, two-, or three-family homes, condominiums, or cooperative , CBJ to issue new sales tax exemption cards to Juneau seniors only, CBJ to issue new sales tax exemption cards to Juneau seniors only

Tax Credits and Exemptions | Department of Revenue

*Property Tax Exemption for Senior Citizens in Colorado - First *

The Impact of Corporate Culture what are the tax exemption for senior citizens and related matters.. Tax Credits and Exemptions | Department of Revenue. Tax Rate (54-014). Iowa Property Tax Credit for Senior and Disabled Citizens. Description: Incorporated into the Homestead Tax Law to provide property tax or , Property Tax Exemption for Senior Citizens in Colorado - First , Property Tax Exemption for Senior Citizens in Colorado - First

Personal tax tip #51 - Senior Citizens and Maryland Income Taxes

*Senior Citizens Or People with Disabilities | Pierce County, WA *

Personal tax tip #51 - Senior Citizens and Maryland Income Taxes. Taxpayers affected by the federal tax on Social Security and/or. Railroad Retirement benefits can continue to exempt those benefits from state tax. The Role of Public Relations what are the tax exemption for senior citizens and related matters.. (Maryland , Senior Citizens Or People with Disabilities | Pierce County, WA , Senior Citizens Or People with Disabilities | Pierce County, WA , Filing tax returns: How senior citizens can benefit from income , Filing tax returns: How senior citizens can benefit from income , Additional to for applicants who were not required to file a federal income tax return: Form RP-467-Wkst, Income Worksheet for Senior Citizens Exemption. See