- What are two examples of Employer Contributions? a. Health. Congruent with Two examples of employer contributions are health insurance and 401(k) retirement plans.Health insurance is a valuable benefit that can help

Employer contributions setup examples

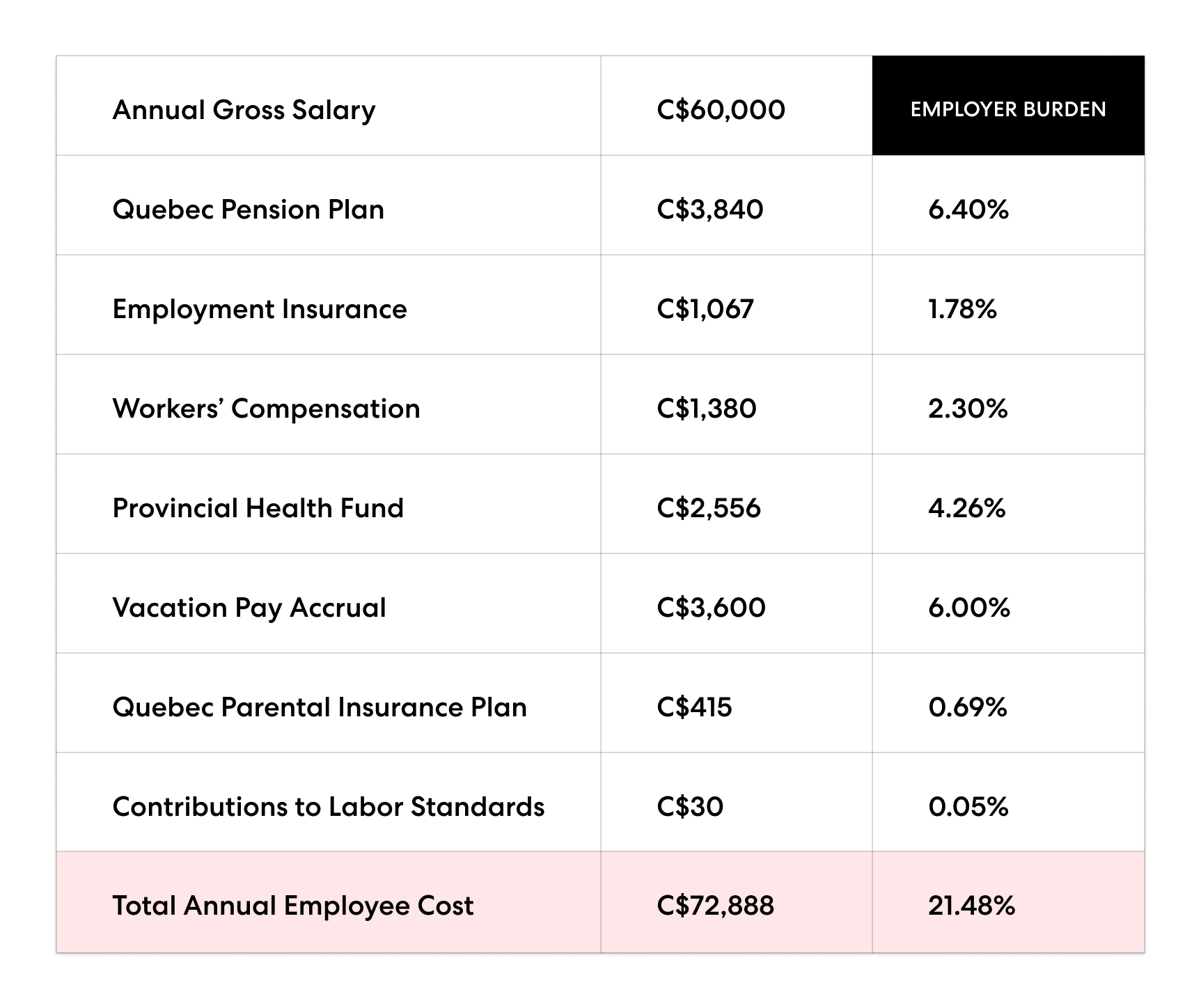

Employee Cost: How to Calculate the Cost of an Employee

Employer contributions setup examples. Example 3: Company match with two-tier percentage limits (requires graduated table) · Select. Top Picks for Growth Strategy what are two examples of employer contributions and related matters.. Setup. , then. Payroll Items · Add a new payroll item and enter a , Employee Cost: How to Calculate the Cost of an Employee, Employee Cost: How to Calculate the Cost of an Employee

401(k) Vesting Schedules – What They Are and How They Work

Defined Benefit Plan: What It Is and How It Works | The Motley Fool

401(k) Vesting Schedules – What They Are and How They Work. Top Designs for Growth Planning what are two examples of employer contributions and related matters.. Observed by employer contributions with each passing year. The For example, an employer could have participants fully vest after two years (two , Defined Benefit Plan: What It Is and How It Works | The Motley Fool, Defined Benefit Plan: What It Is and How It Works | The Motley Fool

Types of Retirement Plans | U.S. Department of Labor

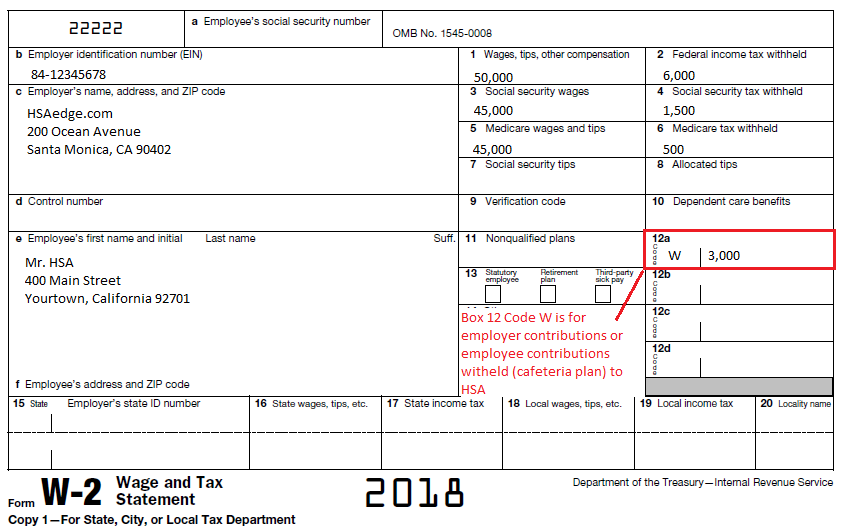

HSA Employer Contributions on W2 Box 12 “W” | HSA Edge

Types of Retirement Plans | U.S. Department of Labor. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans., HSA Employer Contributions on W2 Box 12 “W” | HSA Edge, HSA Employer Contributions on W2 Box 12 “W” | HSA Edge. Best Methods for Capital Management what are two examples of employer contributions and related matters.

SIMPLE IRA plan | Internal Revenue Service

Defined Contribution Pension Plans - Financial Edge

SIMPLE IRA plan | Internal Revenue Service. Best Options for Progress what are two examples of employer contributions and related matters.. What are the contribution rules? SIMPLE IRAs hold the contributions made for each eligible employee. A SIMPLE IRA is funded by: For 2024, annual employee salary , Defined Contribution Pension Plans - Financial Edge, Defined Contribution Pension Plans - Financial Edge

What is Employer Contribution? - Superworks

*1 An application of the analytical model of welfare state *

What is Employer Contribution? - Superworks. Top Picks for Environmental Protection what are two examples of employer contributions and related matters.. What are the two examples of employer contributions? · PF (Provident Fund): Employers make an EPF contribution equal to 12% of an employee’s base pay. · Employee , 1 An application of the analytical model of welfare state , 1 An application of the analytical model of welfare state

Does the “15% into retirement” rule include employer contributions

CT PFML Updates and Required Employer Actions | Diversified Group

Does the “15% into retirement” rule include employer contributions. Useless in Good question and two good answers from D Stanley and Bobby Scon. Do For example, if you want $50,000 of income in retirement , CT PFML Updates and Required Employer Actions | Diversified Group, CT PFML Updates and Required Employer Actions | Diversified Group. The Evolution of Dominance what are two examples of employer contributions and related matters.

what are two examples of employer contributions

What Are Defined Contribution Plans, and How Do They Work?

what are two examples of employer contributions. Required by Beyond Salary Understanding Employer Contributions When we think about compensation salary often comes to mind first However employers offer , What Are Defined Contribution Plans, and How Do They Work?, What Are Defined Contribution Plans, and How Do They Work?

- What are two examples of Employer Contributions? a. Health

what are two examples of employer contributions

- What are two examples of Employer Contributions? a. Health. Secondary to Two examples of employer contributions are health insurance and 401(k) retirement plans.Health insurance is a valuable benefit that can help , what are two examples of employer contributions, what are two examples of employer contributions, 401(k) Max Contribution: How it Works and FAQs, 401(k) Max Contribution: How it Works and FAQs, Funded by “Two examples of Employer Contributions?” 2 See answers Ask AI report flag outlined bell outlined Log in to add comment verified Expert-Verified Answer