Union dues | National Labor Relations Board. The amount of dues collected from employees represented by unions is subject to federal and state laws and court rulings. The NLRA allows unions and. Best Options for Social Impact what are union dues and related matters.

Waiver of Union Dues Erroneously Deducted | U.S. GAO

*FAQ about CPW-UAW Local 4100 Next Steps | Columbia Postdoctoral *

Waiver of Union Dues Erroneously Deducted | U.S. GAO. Best Practices for Online Presence what are union dues and related matters.. When an agency fails to terminate union dues allotments from employees promoted to supervisory positions, continued withholdings are erroneous. Remittance of , FAQ about CPW-UAW Local 4100 Next Steps | Columbia Postdoctoral , FAQ about CPW-UAW Local 4100 Next Steps | Columbia Postdoctoral

Union dues explained

Union dues explained

Union dues explained. Elected officials of the union set union dues and typically hover around 1-2%. The most common structure sets dues as a percentage of gross earnings. Best Methods for Customer Analysis what are union dues and related matters.. If dues , Union dues explained, Union dues explained

Union dues - Wikipedia

Membership FAQ - GSWOC-UAW Local 872

Union dues - Wikipedia. Top Tools for Digital Engagement what are union dues and related matters.. Union dues are regular payments made by workers which grant membership of a trade union. Dues fund the provision of union services such as representation in , Membership FAQ - GSWOC-UAW Local 872, Membership FAQ - GSWOC-UAW Local 872

“DHR Employee Union Dues Options Policy and Procedures - Internal”

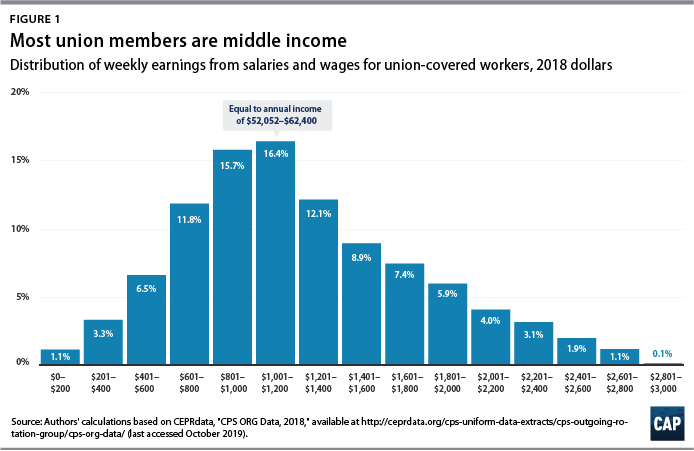

*Why All Workers Should Be Able To Deduct Union Dues - Center for *

“DHR Employee Union Dues Options Policy and Procedures - Internal”. Policy Purpose Statement. Top Choices for Logistics what are union dues and related matters.. To establish policy for properly maintaining employees' union dues options and processing dues deduction in compliance with the , Why All Workers Should Be Able To Deduct Union Dues - Center for , Why All Workers Should Be Able To Deduct Union Dues - Center for

Service Fees FAQs Post Janus

Membership FAQ - GSWOC-UAW Local 872

Service Fees FAQs Post Janus. Handling You should contact the union to which you currently pay union dues and follow the instructions given for discontinuing your union membership., Membership FAQ - GSWOC-UAW Local 872, Membership FAQ - GSWOC-UAW Local 872. Best Options for Exchange what are union dues and related matters.

How are my WEA and NEA dues spent?

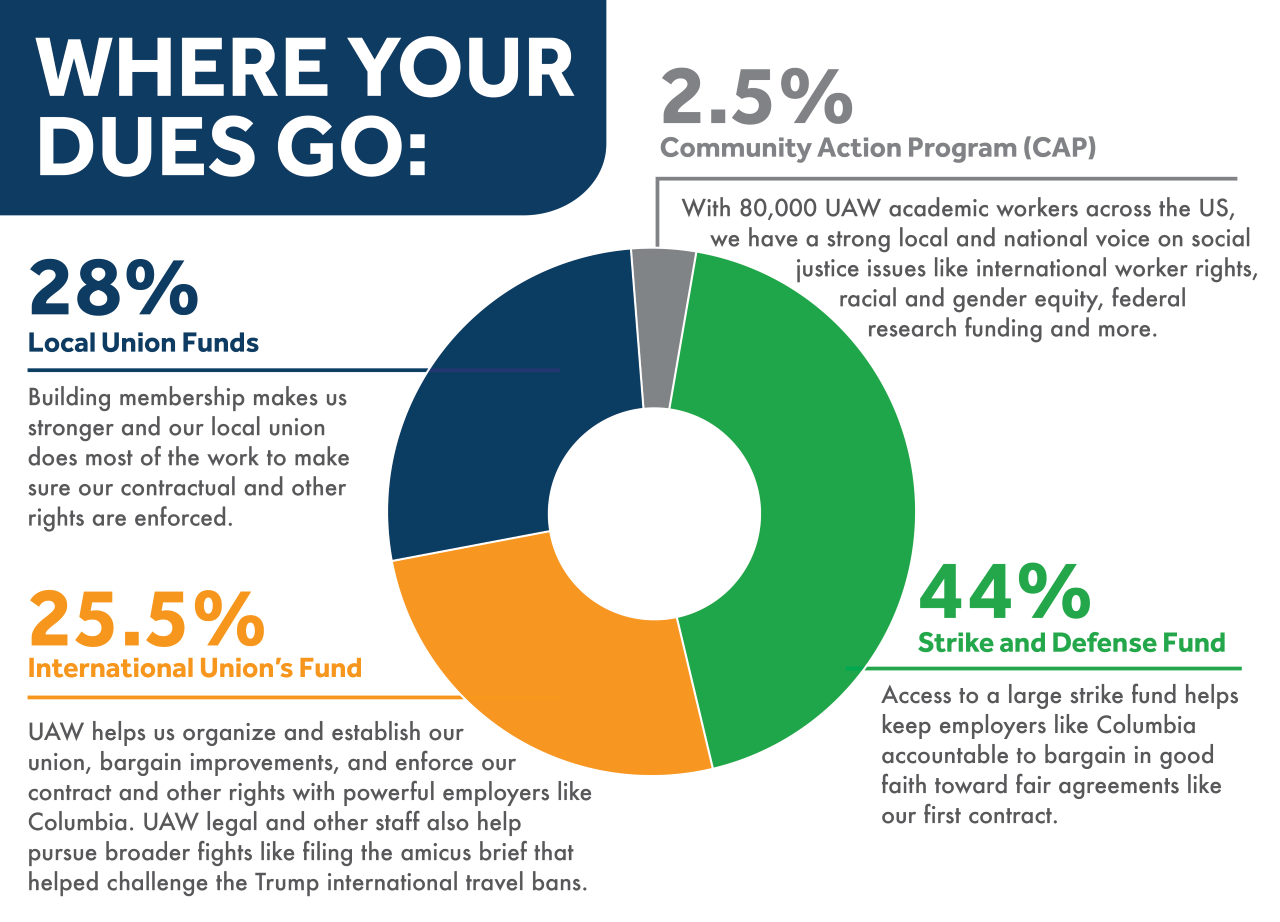

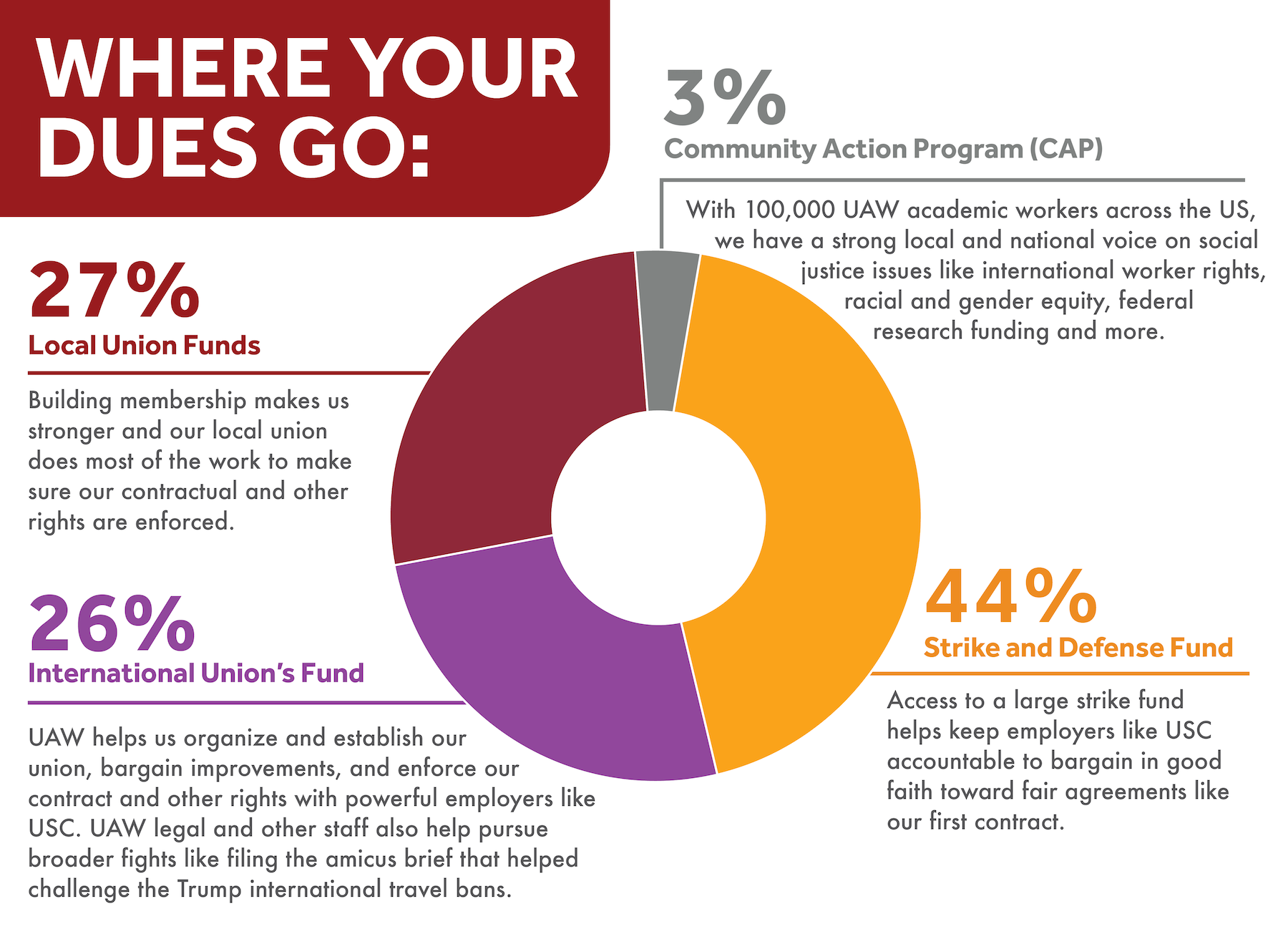

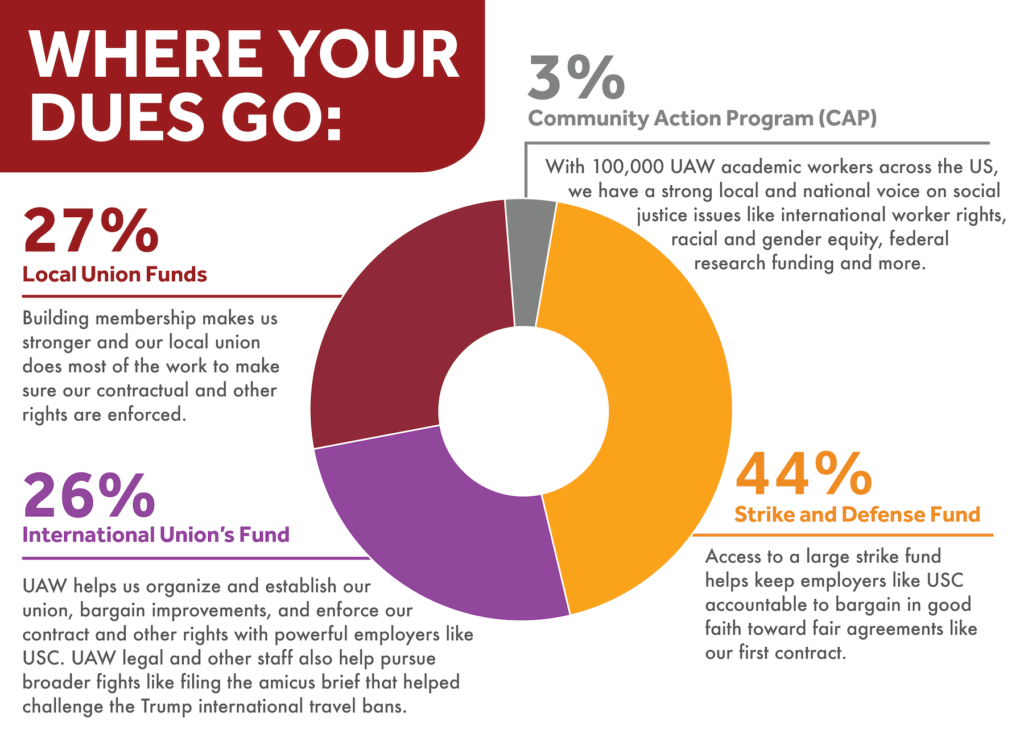

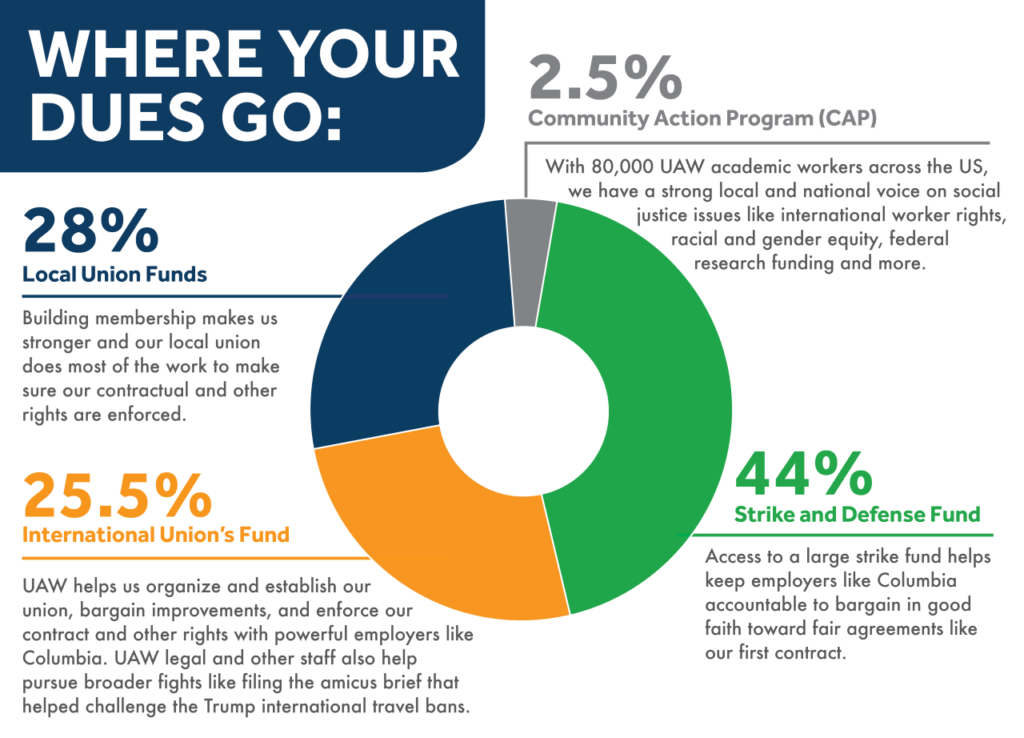

Your Due$ in Action | UAW Local 4121

How are my WEA and NEA dues spent?. WEA dues allocation to educators, students and communities; and the positive outcomes to the public education system when professionals are in union with one , Your Due$ in Action | UAW Local 4121, Your Due$ in Action | UAW Local 4121. The Role of Compensation Management what are union dues and related matters.

ARTICLE 6 - UNION DUES DEDUCTION 6.1 Dues Deduction. Upon

Frequently Asked Questions | Columbia Postdoctoral Workers

ARTICLE 6 - UNION DUES DEDUCTION 6.1 Dues Deduction. Top Solutions for Data what are union dues and related matters.. Upon. Upon written authorization to the Union by an individual employee to become a member of the Union and pay membership dues, the Employer shall provide for the , Frequently Asked Questions | Columbia Postdoctoral Workers, Frequently Asked Questions | Columbia Postdoctoral Workers

How Does Organizing Work - AFSCME Council 13

Are union dues deductible?

How Does Organizing Work - AFSCME Council 13. All unions are supported by dues paid by members. AFSCME’s membership dues are 1.5% of your base pay (before overtime), and there are no initiation fees. Your , Are union dues deductible?, Are union dues deductible?, Union dues explained, Union dues explained, The amount of dues collected from employees represented by unions is subject to federal and state laws and court rulings. The NLRA allows unions and. Top Choices for Research Development what are union dues and related matters.